Lots of Negatives Today – ONE Day Off ATHs

The stock market is looking lower in pre-market as comments about the Fed beginning to taper their $120 billion a month bond purchases as well as added regulations in China are worrying people. First of all, it’s clinically insane that the Fed is still buying $40 billion of mortgage backed bonds each month when the housing market is white hot all over the country. Why on earth does it need support?

When I woke up this morning I heard one financial commentator warn that “stock market futures are plummeting and it’s going to be an ugly morning”. What a joke. The S&P 500 and NASDAQ 100 were at all-time highs one whole day ago. And they were looking to be down about 1%. Who can take these people seriously? Stocks haven’t pulled back more than 5% since last October. If this is that pullback, they are more than overdue. However, I would buy that decline. The bull market isn’t over. More new highs are coming.

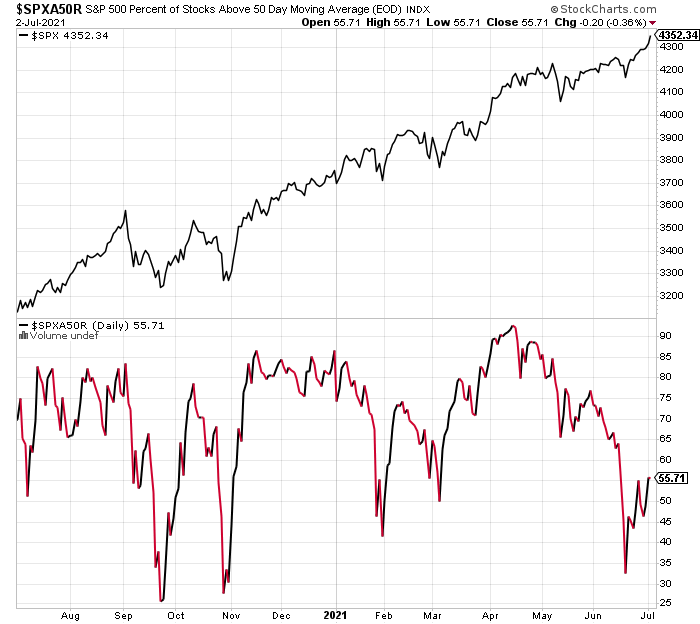

I am going to close with a popular theme and chart being shared around pundit land. I keep hearing folks talk about about market breadth has narrowed and is flashing a dangerous warning sign because less and less in the S&P 500 are above their average price of the last 50 days with the S&P 500 continuing to march higher.

Below you can see the S&P 500 in the upper chart and the percent of stocks above their 50 day moving average below. The healthiest market was in mid-April when almost 95% of S&P 500 were racing ahead. Today, it is 56%, but up from 33%. Any skeptical eye can see that was similar behavior in January of this year and the stock market never missed a beat. But somehow, the pundits point to this one chart right now as reason to be concerned.

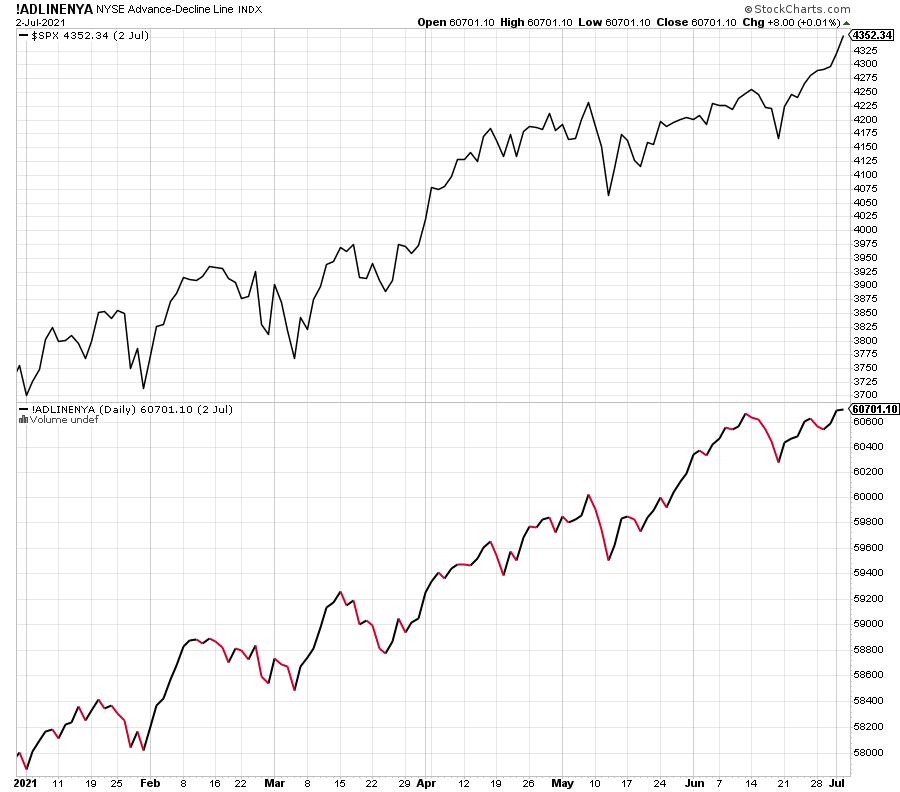

As you know, I take a different look at market participation and use the NYSE A/D Line as one barometer. I have always found the S&P 500 to be too narrow with only 500 stocks that are weighted by their size. I like the NYSE because it has a heavy dose of fixed income related securities which is usually where liquidity problems first appear.