Lots of Negativity But Stocks Close to Blue Skies

Stocks begin the new week with the Dow Industrials masking the overall strength of the S&P 500 and NASDAQ 100. Remember, the Dow only has 30 stocks and they are weighted by price. So, high prices stocks move the index a lot more than mid or lower priced ones. Boeing has been hit with the ugly stick for 40+ points over the past two days which equates to roughly 280 Dow points.

While the Dow has stalled out with a few stocks lagging, the S&P 500 and NASDAQ 100 are but one solid day from all-time highs. Most people find that hard to believe as there seems to be a sea of negativity these days. I was shocked to see option traders flood into negative put options last Friday, however, there may some undue influence from monthly expiration. Both the S&P 400 and Russell are still lagging, but they look like they want to play some catch up sooner than later.

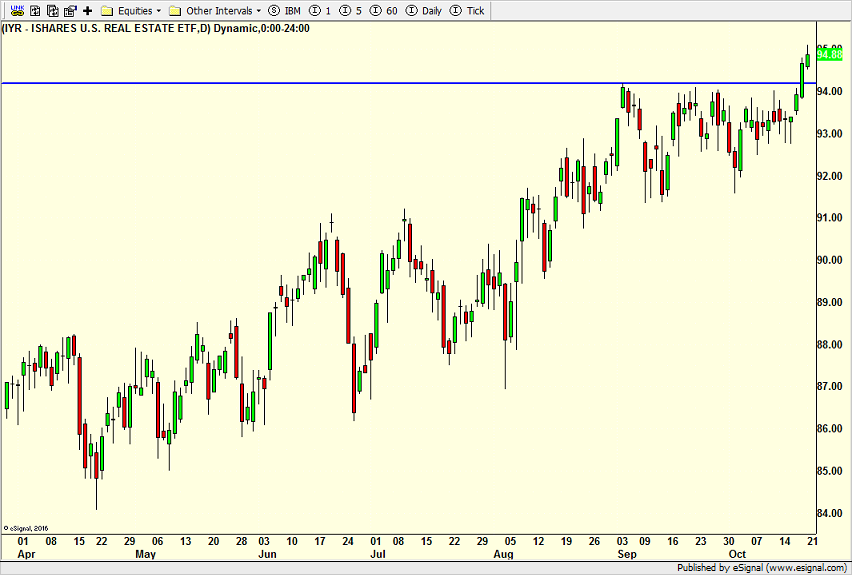

My long favored semis are very close to new highs with the financials and transports really getting into high gear. Any one of these sectors could provide fuel for another leg higher, but if we get all four key sectors going at once, we could see a relatively fast 10% spurt over into January. Last week, I followed up on recent positive comments about REITs and right on cue, they broke out to fresh, all-time highs. Next up is to watch utilities and staples for signs that all defensive sectors are running again.