Low Stress in Markets But Inflation Report Coming Up

On Friday we had the Dow Industrials, S&P 500 and NASDAQ 100 all at new highs. The S&P 400 and Russell 2000 were absent. It just didn’t seem like a celebratory day. Perhaps, it was because the rising tide is not lifting all ships as I mentioned on Thursday. But the market is also not showing stress on the credit side either.

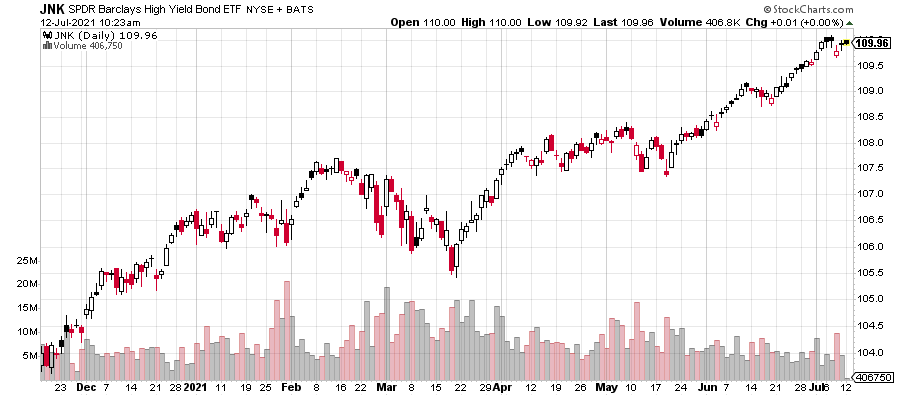

Looking below at the high yield bond ETF, you can see that it is just a few pennies from all-time highs. That is not the behavior you typically see at the end of bull markets or even before a significant decline. If the junk bond market is sanguine and that is where we see the first sign of trouble in liquidity, it does not stand to reason that problems will pop up elsewhere first.

Now, some of you may push back that the mid and small caps are not at new highs. And you would be correct. However, they are also not trending lower. It’s more like they are going sideways with the potential for an upside resolution. You can see that below in the Russell 2000. For now, I will give the bulls the benefit of the doubt as long as we do not see the other indices continue to make new and the Russell trend lower.

Lots of folks are focused on the inflation numbers for June which are due out this week. Everyone and my mother knows that we have inflation at the pump, at the store and on rents. However, the bond market seems to be looking past this with falling interest rates over the last few months. It is going to be very telling to watch its reaction,m especially since the most recent peak in May coincided with the white hot inflation report.

Remember, it’s more important to watch the reaction in the markets than analyze the actual news.