Low Volatility Is Bullish – Ignore The Lazy

This past Friday was your typical options expiration which used to be a somewhat important affair. Over the years, it has almost become a non-event with all the more frequent options being traded weekly and now daily. A tried and true trend about strength into last Friday and weakness the following week kicks off today. I don’t think it’s anything big to the downside, just maybe a modest pullback.

As I thought about that old study I just mentioned, I realized that so many other trends still point to higher prices over the next 6-12 months. Now, they are not the same 20+% returns that I frequently quoted in late 2022 and early 2023, but they still indicate another 7-10% is coming on the upside which is nothing to sneeze at after the last 18 months. That also continues to fit in nicely with my thesis of higher prices into 2025.

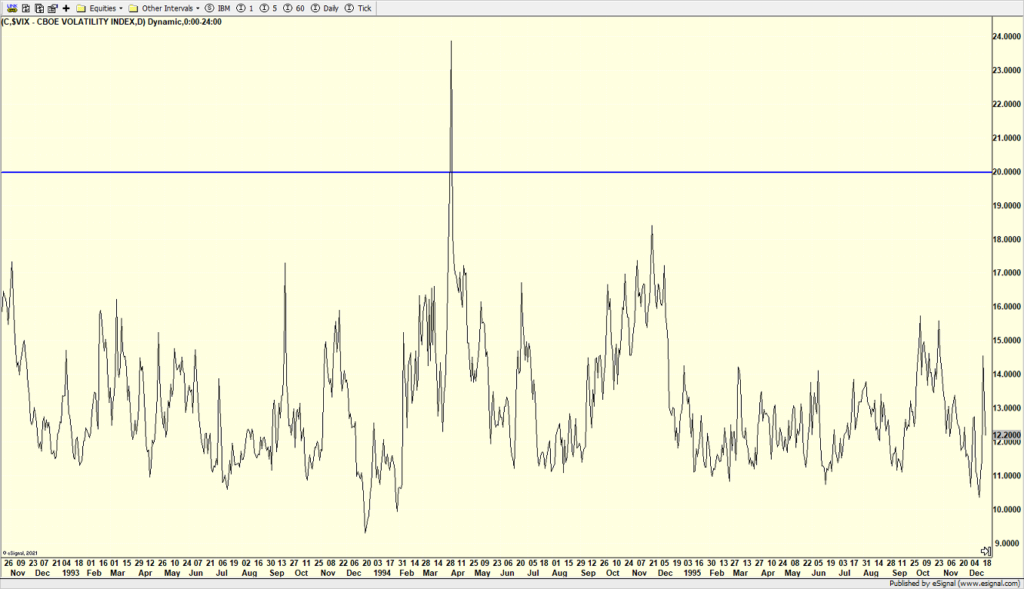

Take a look at the Volatility Index (VIX) which I discussed last week. It looks like it made a new two-year closing low on Friday. The lazy and uninformed will spin this as something negative. They will tell you that people are complacent. Well folks, while low volatility eventually leads to higher vol, new low vol is definitely not bearish until vol rises as stocks make new highs. That is not happening today or tomorrow or even this week. It is going to take time.

In the early 1990s when I worked on Wall Street, the VIX was even below 10 as you can see below. And stocks didn’t even decline 10% for another two years.

On Friday we bought more levered NDX.