Lower End of Range Hit – Can Bulls Make a Stand?

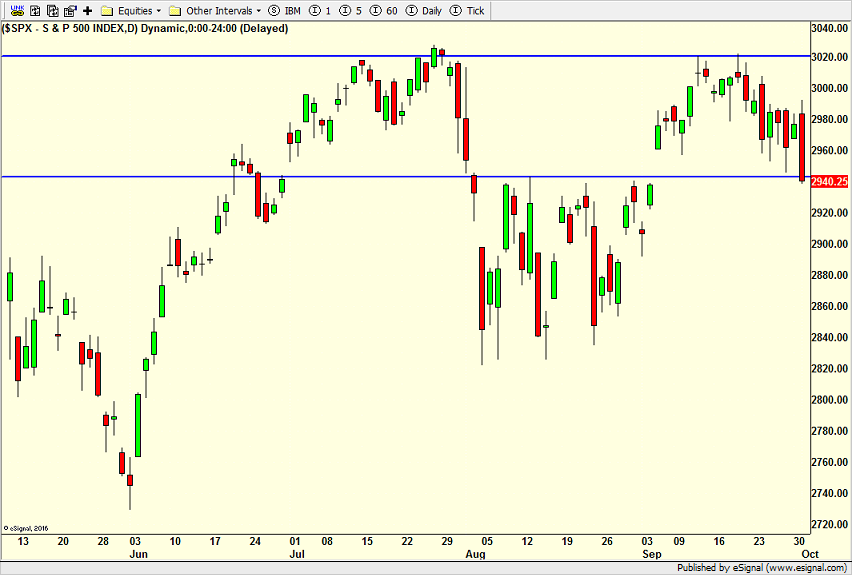

Last week was the single worst week of the year based on seasonal patterns and it certainly lived up to the billing I gave it several times here. Weak seasonality didn’t end last Friday. It extends to the first part of October. For the past few weeks I have been in the trading range / mild pullback camp with an eye on the upper and lower ends of recent range. After stocks failed to exceed the top of the range last month, I offered that a visit to the lower end of the range would probably be in line.

After a feeble bounce to close the month and quarter on Monday, the bears made a lot of noise on Tuesday after the ISM economic report came in much weaker than expected with a chorus of recession calls following. While I continue to expect a mild recession beginning in the next year, I don’t think it’s right here and now. And certainly, the markets are not forecasting recession just yet.

Tuesday was an ugly day for the bulls. Looking at an updated chart of the trading range below, you can see that the lower horizontal blue line is where stocks closed. Wednesday will be a key day for the very short-term in determining if the bulls have enough ammunition to make a meaningful stand here or will they need to stand back and wait for lower prices to circle the wagons. If the uptrend is still strong, I would expect early morning weakness to be bought with the bulls coming in stronger after lunch. If not, then early morning weakness should lead to a mid-morning rally that is sold with lower prices after lunch and into the close.