Market Still Poised To Move Higher

Another earnings season starts today as JP Morgan and Wells Fargo are out of the gate first. We have owned the former in our Unloved Gems strategy since inception in 2018 and I don’t think we’ve ever owned the latter. As I wrote the other day, stocks still seem poised to move higher. Both inflation gauges released this week were cool and that should help a breakout to the upside.

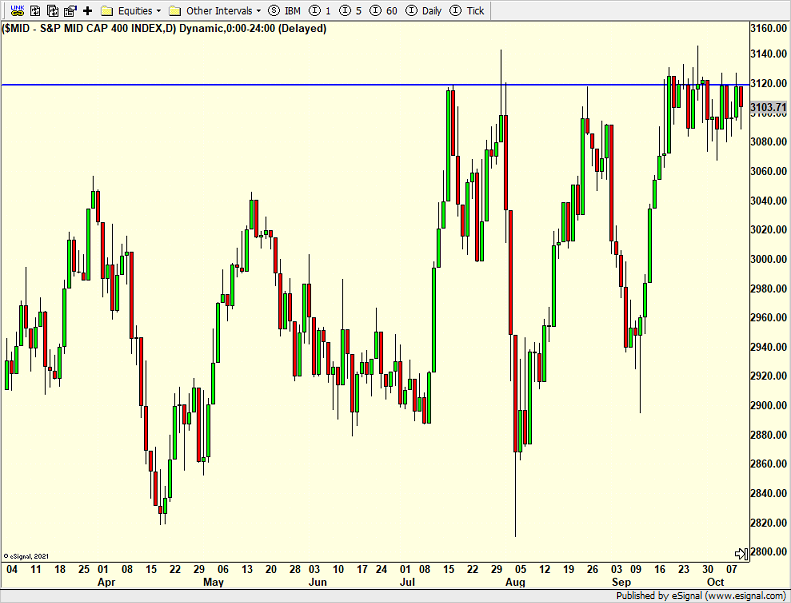

I think small and mid caps stock look the most compelling as they are wound up and ready for a big move. Those two indices are below.

Although we do have large positions in the NASDAQ 100 because that’s what some strategies trade, I am not enamored with it from a leadership perspective, at least not now or yet.

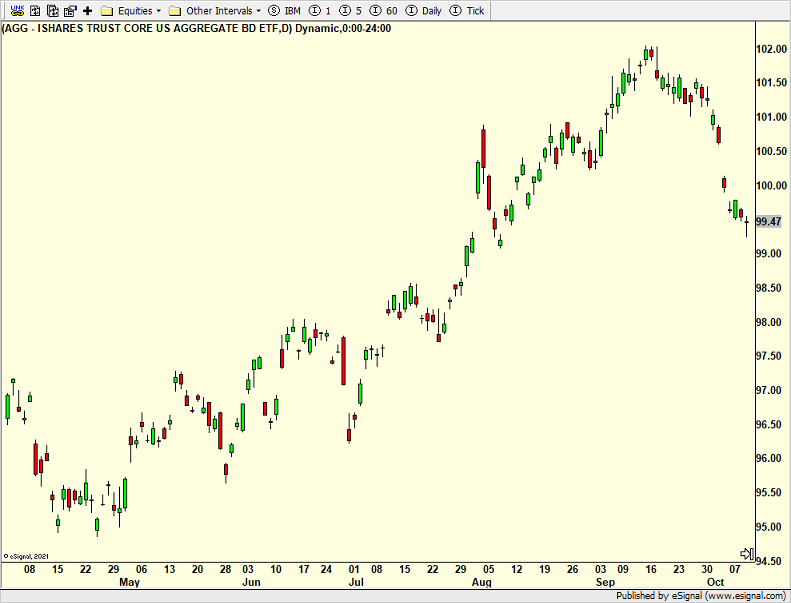

I do like bonds here. In the short-term they are oversold. I think at least a bounce is coming.

Looking out further, I think there is solid risk/reward. I don’t think you have to give them more than 1% to prove you wrong.

And if I like bonds I have to be sanguine on bond proxies like utilities, REITs and staples.

A beautiful fall weekend is ahead although a full day in synagogue awaits on Saturday for me to atone for my sins. Sunday looks like the little guy’s baseball tournament along with lots of NFL games and maybe a tiny bit of golf.

On Wednesday we bought XLRE. We sold some FCOM and some QQQW. On Thursday we bought GDX, PMPIX, TLT, SPYB and more PDBC. We sold QQQW and DXHYX.