Markets Cranky To Start New Week

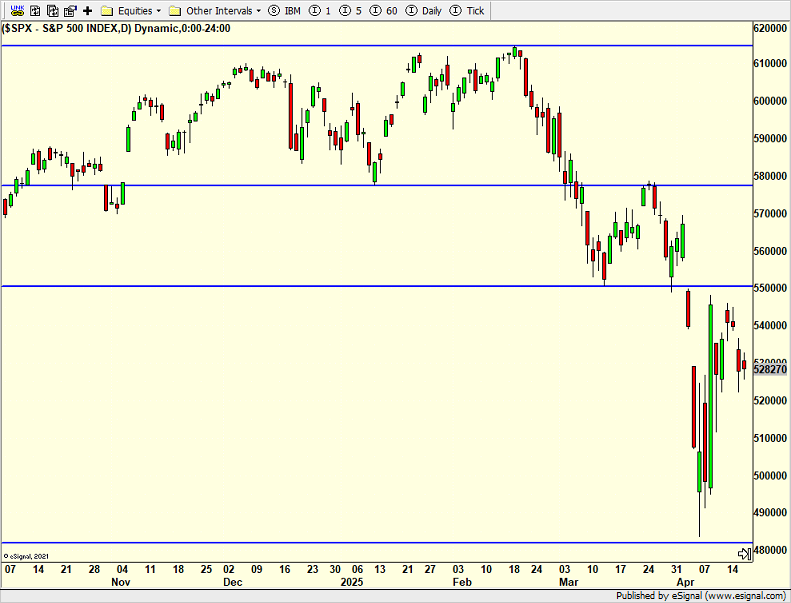

I hope those who observe Easter and Passover had a good holiday. The markets return from the long weekend on the cranky side with pre-market indicating a 1%+ loss at the open. Last week, I wrote about a pullback coming and this certainly looks like it. Unless I am totally misreading the market, there should be another rally coming later this week or next. Stocks basically remain in the range from that wild up 10% day from two Wednesdays ago. I sense a lot more days will remain inside that range.

The bottoming process continues. And yes, this is a process. Last week, I showed other similar crashes and how they played out going forward. Unless the Fed dramatically pivots, this bottom will evolve over the next 4-7 weeks with high volatility and lots of ups and downs. Absolutely do not be surprised if the April lows are breached in May.

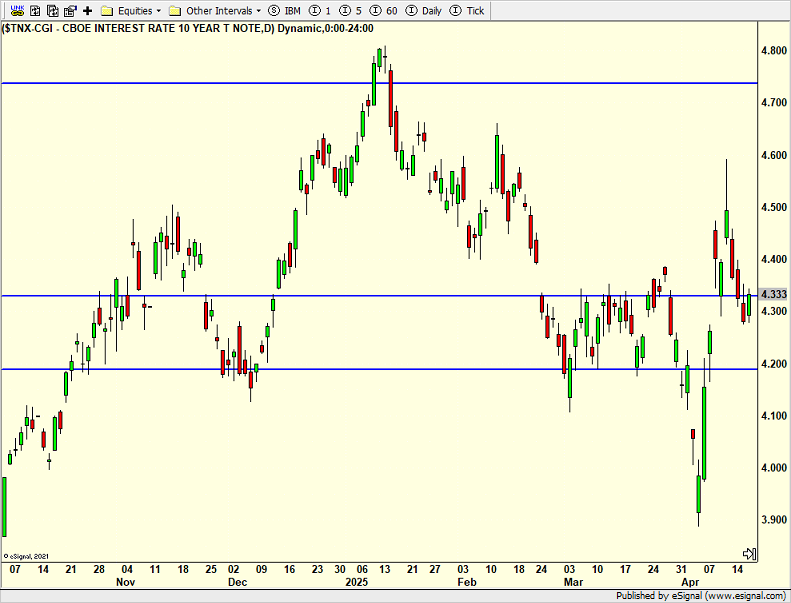

There continues to be much chatter about the long-term bond market. The 10-Year yield is below. You can see some pretty good swings, but let’s face it, yields are in the same area they were in late February and early December. When yields rally in this environment it is mostly because of stress in the treasury system and not runaway inflation. There is a real problem with foreign money not buying or buying less at weekly auctions as well as outright sales in the secondary market. This is likely due to potential tariffs.

The bears begin the week in control and more downside likely lies ahead this week and by the end of May.

On Wednesday we bought UWM, QLD and BAPR. We sold PCY and some QID. On Thursday we bought PCY, SDS, more VGK and more QLD. We sold EMB and QID.