Markets Giving Back Post-Election Boom

I have been saying that 2024 is not 2016 and people should not be expecting the same response. It isn’t a knock on the markets. It’s just how the markets came into the 2016 and 2024 elections. The landscape was very different. 2024 was all about the “haves” and the “have nots”, very similar to how our economy has been since the emergency COVID measures ended. On Friday, almost everything was a “have not” in the stock market.

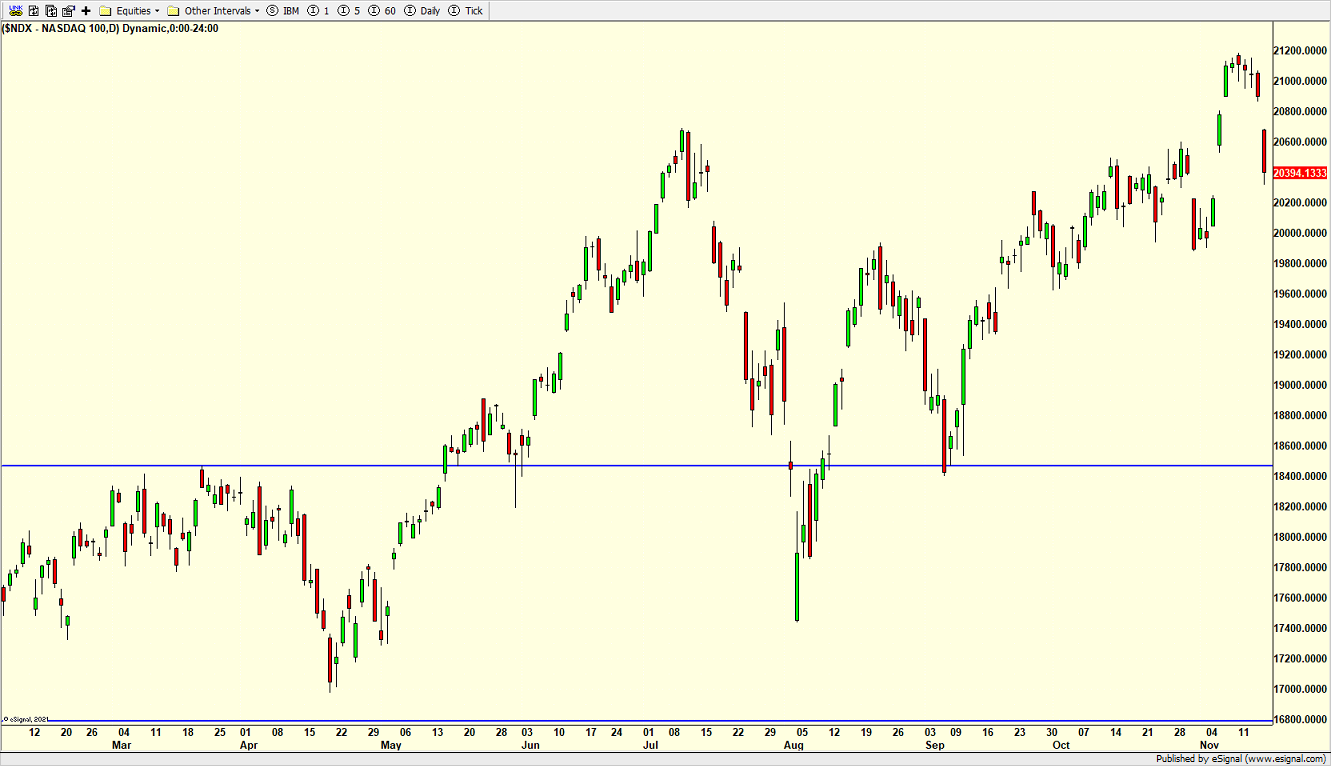

After the initial “risk on” market surge the day after the election, not much has happened. In fact, some indices are lower. Let’s take a look. So I am not accused of cherry picking, here is the S&P 500, NASDAQ 100 and Russell 2000 which is certainly a good cross section.

None are exactly the pillar of strength and economic rejuvenation. Markets saw a surge with some follow through. Now, all but the initial surge has been given back. And don’t be surprised if the initial surge goes away before Thanksgiving. That would not necessarily be a bad thing. In fact, I think it would set the stage for a solid year-end rally lasting into January.

Here is an example of something we don’t own but I am watching. It had a big surge, is now pulling back and is stronger than the market.

Here is an example of something I am not keenly watching as it is weaker than the stock market and lagging.

The recent pullback isn’t a major, belling ringing buy. But it is a tidy little pullback in an ongoing and strong bull market. At a minimum I expect a bounce on Monday or Tuesday. And I remain in the “buy weakness” mode until proven otherwise.

On Friday we bought FNOV and more TQQQ and more SPYB.