Markets Looking Bullish Post-Election

Super excited to join my friend, Tim Lammers, on FOX61’s morning show at 10:15am discussing our presidential election model, what the markets are pricing in and which groups will benefit each candidate’s victory.

T minus one day until the election. I can’t tell you how happy I will be when it’s over. Goodbye TV ads. Adios SPAM texts and emails. This is probably naive, but I hope kindness and respect return.

Last week began the strongest seasonal period of the year, November through January. November in an election year averages +0.70% with December doubling that return. Remember, I posted a study that indicated Q4 averages +5%. With October coming in down a bit that means that November through December should be strongly bullish.

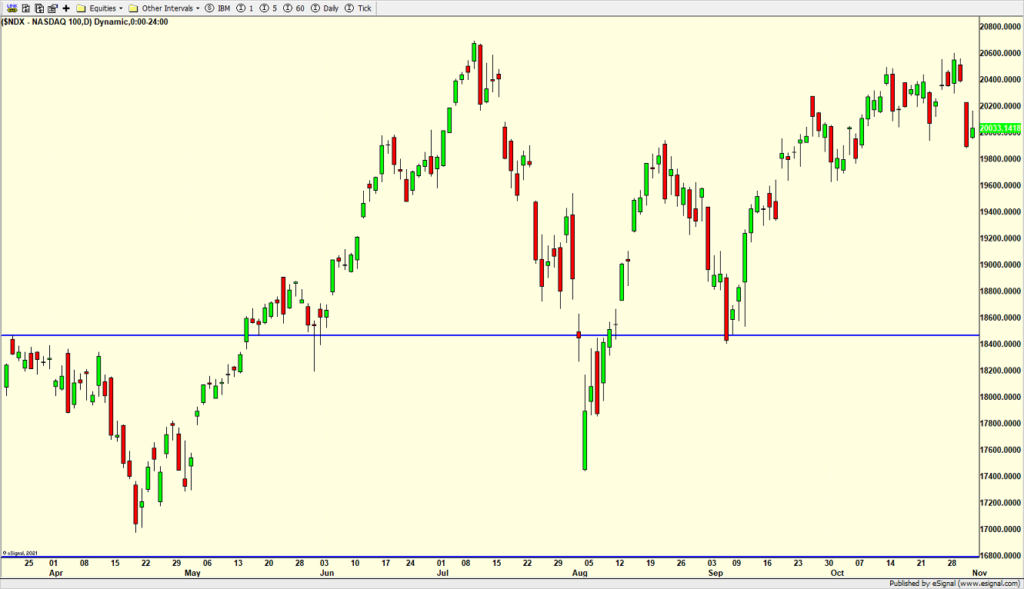

When I look at the five major stock market indices, none of them look like they are ready to blast off to new highs. Rather, they look like they want to finish the pullback with one more decline below last week’s low. It doesn’t mean they have to, just that is how they are set up right now.

I have been sharing the S&P 500 for a while so let’s turn to the sexier, AI-dominated NASDAQ 100. Weakness from here or a quick bounce and then a move below last week’s low should set up a strong move to fresh all-time highs by January.

Several times this quarter I have written about the Volatility Index (VIX) being higher than expected. At this point with the big day here, we should see volatility come down after whatever market reaction we get from the election results whenever those results are confirmed.

In a perfect world for the bullish market case, the election results take a few days to come out. Markets get uneasy and selloff a few percent. Then the bulls come back to work in a big way the week of November 11. The rally catches many off guard and runs into 2025.

On Friday we sold OIH, EMB, RYVIX some TAN and some SPYB.