Markets Stronger Than Even I Expected

I gotta say that this market is even stronger than I thought in my most bullish scenario. For five months I have been writing about how the tariff tantrum reportedly saw the single greatest mass liquidation by institutions of all-time in dollar terms. And then the masses hated and disavowed the rally right through June before accepting it. I guess I was wrong there.

With stocks continuing to grind and creep higher week after week after week, there must an awful lot of big money players who have been on the outside wishing, praying and hoping they were in. And once we get past September, there is often the great performance chase into year-end for all those with excess cash positions or who made career-jeopardizing mistakes during the year.

Even today, I hear too many people telling me about the next inflation spike coming. On Facebook, people chirped me about the weak dollar, comparing it to Turkey and the UK. Ahhh. Yes. The macro morons in full swing. My old neighbor posted this nonsensical piece about soaring inflation and a collapsing economy. When the dollar was historically strong, she said it was ruining the economy. Now that it has fallen back to its long-term average, she told me that it’s weak and was going to, wait for it, ruin the economy.

Listen, I make mistakes every single day. I just learned (although I already knew) that you can’t make a quad bogey in a golf tournament and expect to win even though you made 12 pars. And at 59 years old, I hope I learn from mistakes. We don’t invest on spins. We don’t invest on narratives. We invest on emotionless data. I think it has served our clients well.

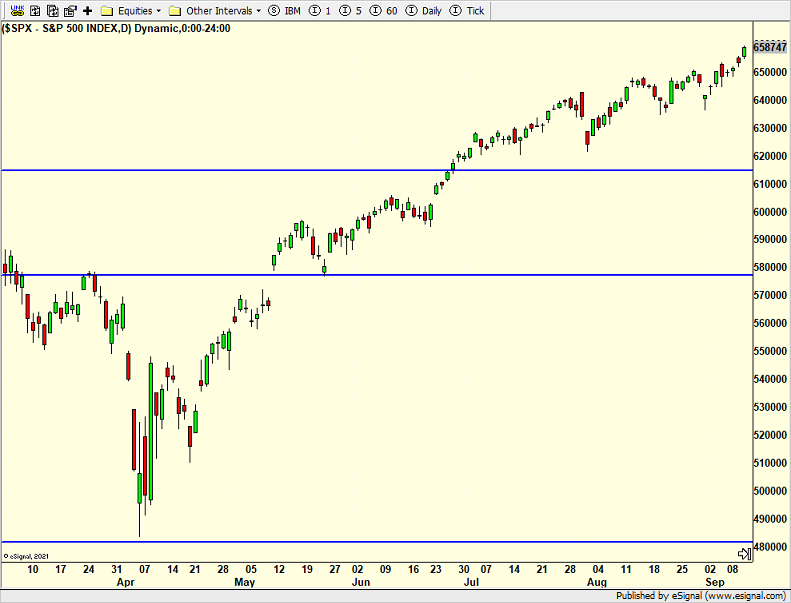

The S&P 500 is seeing just blue skies above at fresh, all-time highs.

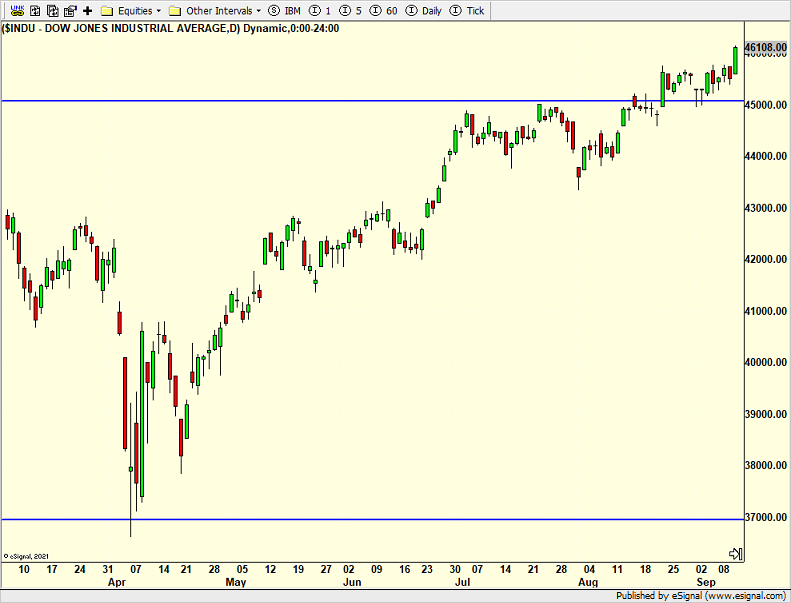

So is the Dow in the way to 50,000 and above.

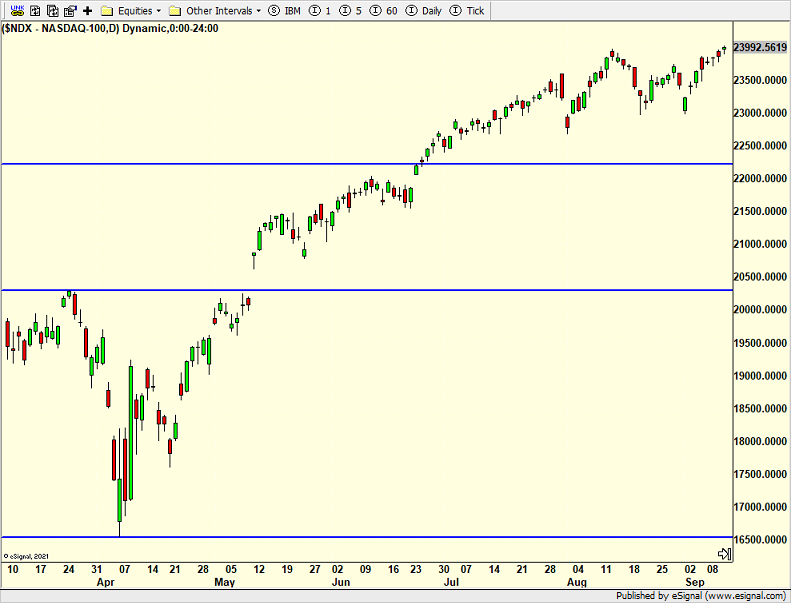

The NASDAQ 100 you ask? Where all of the AI stocks are? While it’s at all-time highs, it’s no longer charging ahead unabated. It has settled down as the rest of the market has broadened out. That theme sound familiar? I said that the broadening would not have to be at the expense of tech. Both could and should rally.

I think Mother Nature is working on four straight beautiful weekends in CT. The heat is gone along with the oppressive humidity. Fall baseball for D is on tap. Hoping to play golf, but my back is not in great shape from swinging poorly. Definitely seeing a group a friends at The Place this weekend. It’s one of my happy places.

I am traveling to see clients next week so my publishing schedule may be a bit off.

On Wednesday we sold some FDLO and some RKT. On Thursday we bought IJT and more XLRE. We sold QLD.