Medicare, Social Security and a Drop in Stock Market Risk

Let’s start with some general financial planning tidbits. First, Medicare open enrollment started on October 16th and goes through December 7th. If you are 65 or soon to be 65 or want to change plans, this is for you. Do not delay! This is your annual opportunity.

Second, the Social Security Administration just announced that the cost of living adjustment (COLA) for 2024 will be 3.2%. That means your gross social security benefit will rise by 3.2% in 2024. As you know, we provide comprehensive social security analysis on when to file for your benefit along with optimal strategies for couples, divorcees and beneficiaries.

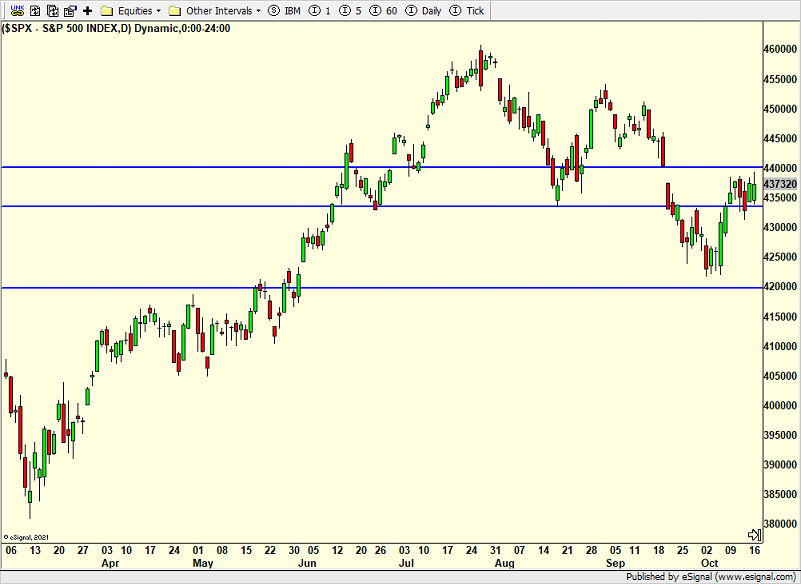

The S&P 500 got close to that 4400 level I wrote about the other day. I like that it backed off on its first attempt. Don’t be surprised if that happens several more times before it succeeds.

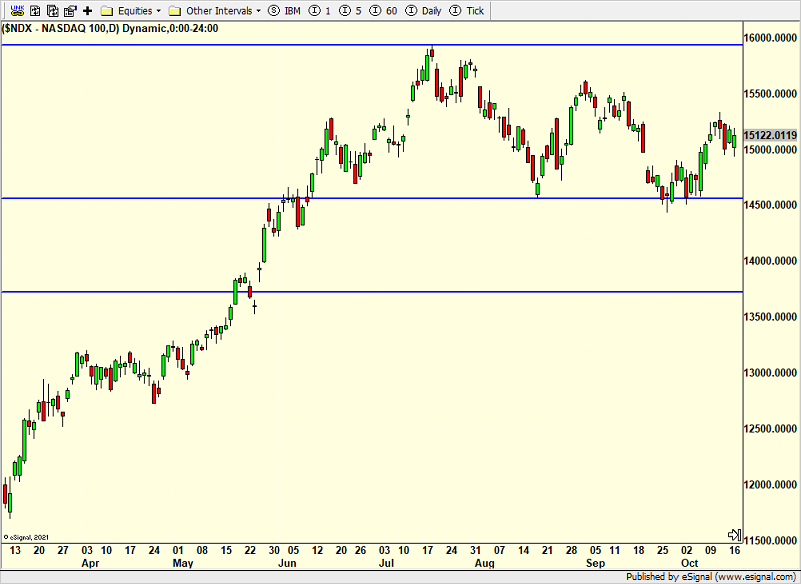

I was asked why I only show the S&P 500 and not other indices. I don’t have a good answer. Maybe I am lazy and just use what’s commonly out there. But I can change it up for sure. Here is the NASDAQ 100 which we trade very often via ETFs and funds. It is much stronger than the S&P 500 and I expect the September peak around 15,500 to be exceeded this quarter with a chance at new 2023 highs in December or January.

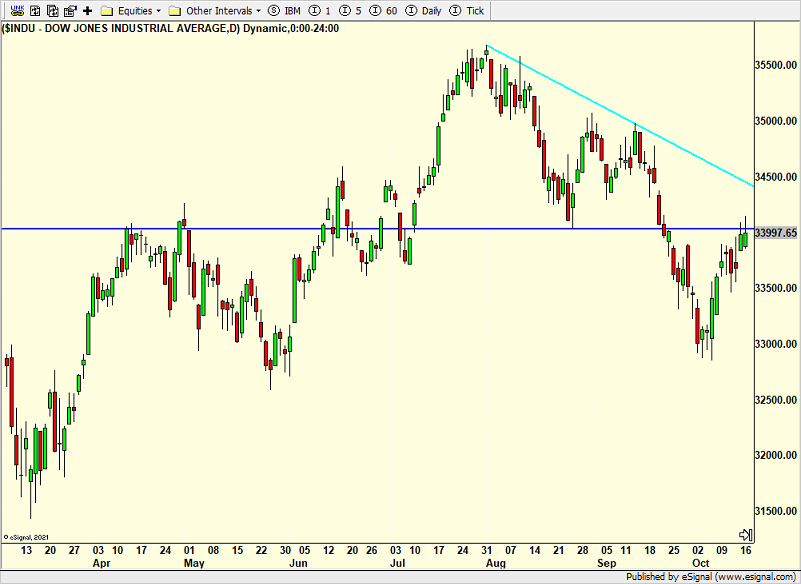

The Dow Jones Industrial is below and it is clearly the weakest of the three indices I am showing. This index is going to have a tougher time making the strides I expect the others to accomplish. However, I also think the Dow will have less risk over the coming weeks.

Let me close with this. If we assume that the October lows in the stock market were significant, then each passing day without price coming back down is a small drop in risk.

On Monday we bought DIA, SPYD, XRT and more levered NDX. We sold some XLV. On Tuesday we bought levered S&P 500 and more SPYD. We sold EMB, PCY, some XLV and some levered NDX.