Monday Was An Earthquake – Aftershocks Coming & Then All-Time Highs

Monday changed a lot of things in the stock market. You can call it a mini-crash or a woosh or an earthquake. One thing is for sure, days like that, especially after historically low volatility regimes, can shake investors’ confidence to the core. People react emotionally and usually not in a good way. They sell when they should be holding or buying.

My thesis has been very clear. We downgraded the stock market over the 1-3 month period. We sold or reduced several AI and semiconductor positions along with eliminating our entire sector level semi position. We reduced exposure in some other strategies.

That changed on Monday as we took advantage of the collapse to sell some low volatility positions in favor of more “risk on”. More specifically, we added to Nvidia which has been the most popular stock question this summer and we also initiated a new sector level semi position along with adding risk elsewhere. You can see the changes at the end as usual.

I want to be crystal clear about the risk I am willing to take. These new positions are on a tight leash, at least for now. If they go against me, I will have no issue tossing them to the curb. The outlook fort stocks is brighter than it was three days ago, for sure. And I think the vast majority of the decline is over. Perhaps all of it.

Let’s dive in and see some things that encouraged me on Monday.

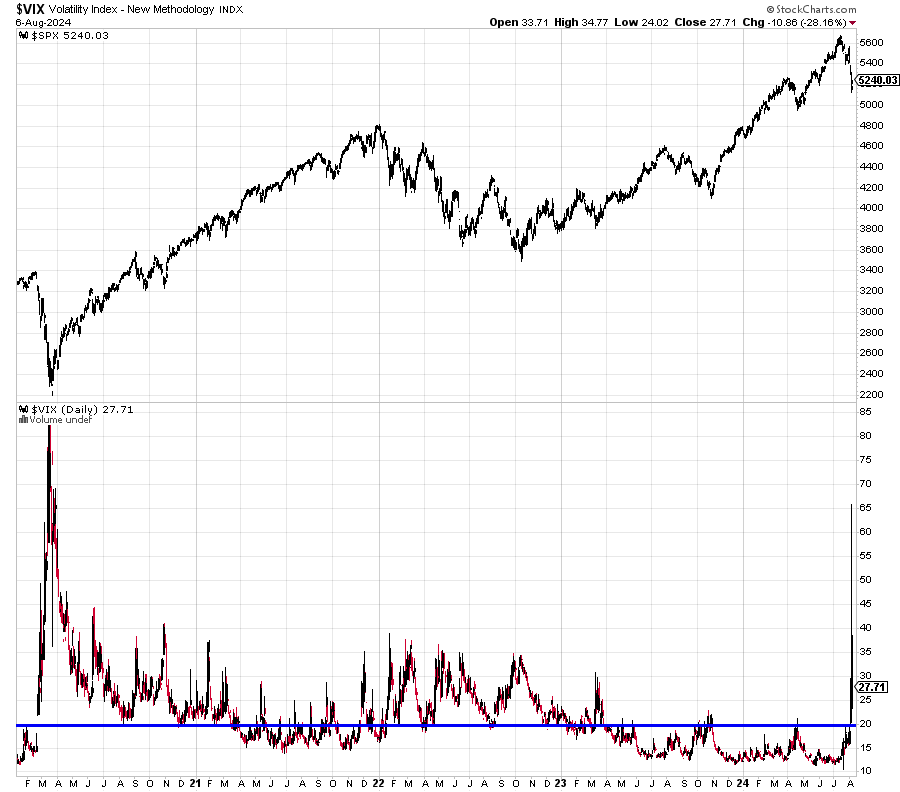

Last month I was concerned that the Volatility Index (VIX) was bucking normalcy and rising as stocks were making new highs. That’s a warning sign. On Monday, the VIX spiked to an eye-popping 65 as trading opened before settling back into the 30s. 65 was the highest since the COVID crash in March 2020.

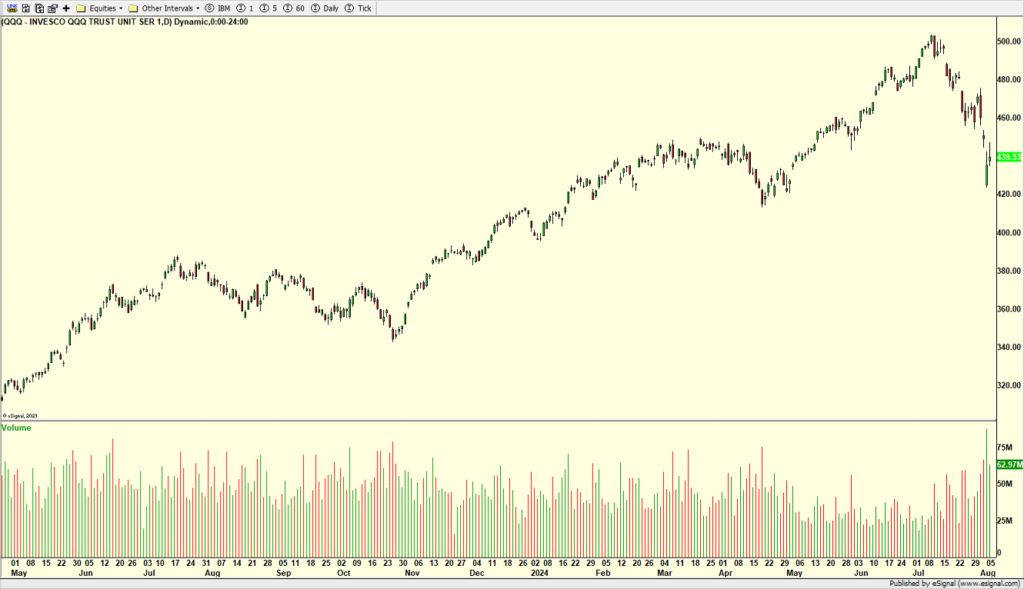

When markets fall investors and traders tend to eschew stocks for ETFs which are mostly more liquid. At lows the NASDAQ 100 ETF, QQQ, typically sees a spike in volume. Below you can see more than 75M shares traded, a good sign for a bounce or a low.

Much of the cause of this decline was a complex, multi-decade trade called the Yen Carry Trade which investors borrow in Yen in Japan at essentially 0%, convert the money to dollars and invest it in the U.S. markets. On the far right of the chart below you can see the Yen rapidly rallying which causes dislocation around world markets. Sentiment in the Yen has become very bullish which likely means the vast majority of the move is over, for now.

Monday was a market earthquake. It is over, but there will likely be aftershocks in the coming weeks and months. I haven’t done the work yet, but this has the feel of October 1997 and August 1998. Many of my indicators and models are pointing to all-time highs later this year which is not a popular view now. I am thankful.

On Monday we bought VKTX, SOXL, levered S&P 500, more NVDA and more QQQ. We sold some DXHYX, CRM and SPLV. On Tuesday we bought FTEC, KBE and IVW. We sold levered S&P 500 and some XLE.