More Bullish Setups in The S&P 500 – Don’t Ignore The Dow Industrials

Friday was an ugly day. While the indices showed very modest losses, they, were strong in the morning, lost all of the gains and then some before closing at the lows of the day. In a vacuum that would suggest a short-term peak. But remember, we don’t manage money in a vacuum nor analyze things that way. Yes, it was a Friday in a holiday-shortened week, but I also don’t want to qualify it either.

Below is the S&P 500. It’s hard to see but it closed down on Wednesday, Thursday and Friday after just closing at a fresh 52-week high. This is just another in a long line of positive trends for the market. The set up for stocks remains bullish. Weakness should be bought until proven otherwise.

Towards the end of my webinar last week, I discussed some possible ranges for the S&P 500. 4300-4500 is as good a range as any. I can even make a less bullish summer case for 4150, but other things would have to set up. And regardless of the pullback which I think is mild to modest at worse, we should see the S&P 500 continue to make further new 52-week highs this quarter and year.

I think the real fun comes if or when the S&P 400 and Russell 2000 decide it’s their turn to lead for more than a few days or week. And I think that’s coming at the expense but not the detriment of mega cap technology. More on that later this week.

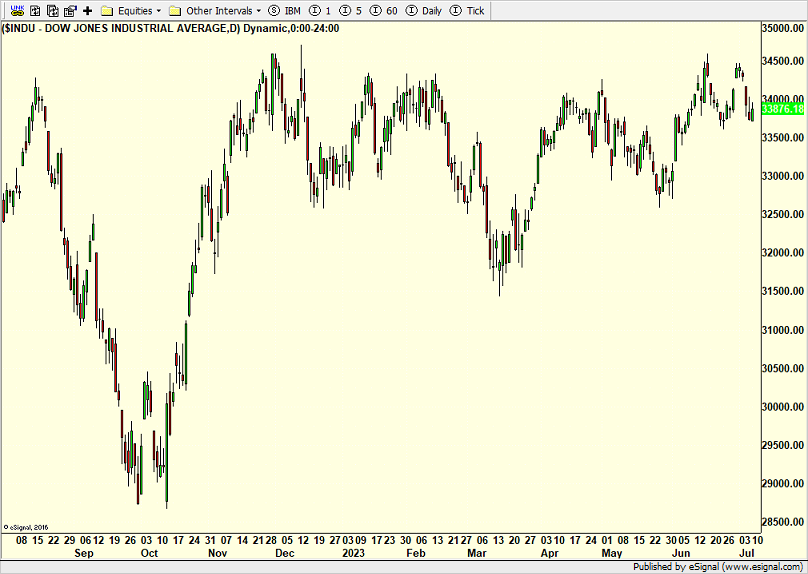

Finally, I can’t find anyone excited about the Dow Industrials which puts me on alert that there is something there. Only the timing is the question mark. We already own a position as well as a new position in large cap value. To do that, we sold some of our position in the NASDAQ 100 which has been the insane leader in 2023.

On Friday we bought SSO. We sold FSTA, SPXU, PJP and XLV.