More Props For The Bulls

Wednesday was a huge day for the bulls. It started out mildly until Fed Chair Powell spoke with David Wessel from the Brookings Institute. Then the fuse got lit and risk on assets soared. Almost 90% of the day’s volume was in stocks that went up. The Dow Industrials, S&P 500, S&P 400 and NASDAQ 100 all went to new highs for Q4. Only the Russell 2000 lags.

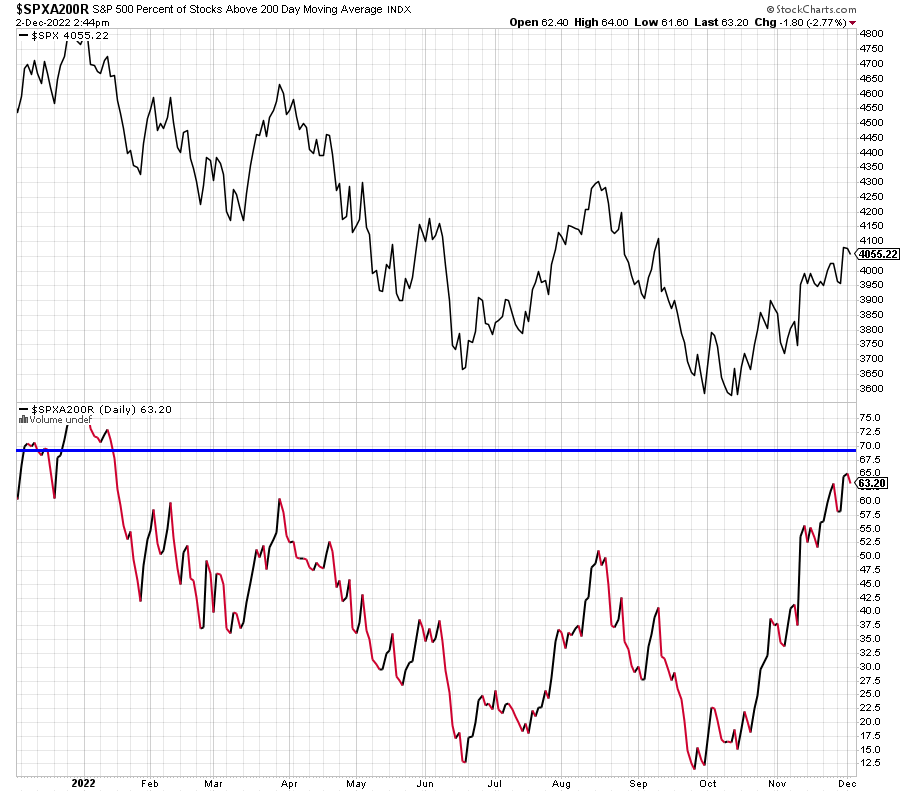

Below you can see the percent of stocks in the S&P 500 that are in uptrends or above their average price of the last 200 days. In short, that means we have seen and are seeing stocks being repaired. You typically do not see this kind of behavior in ongoing bear markets.

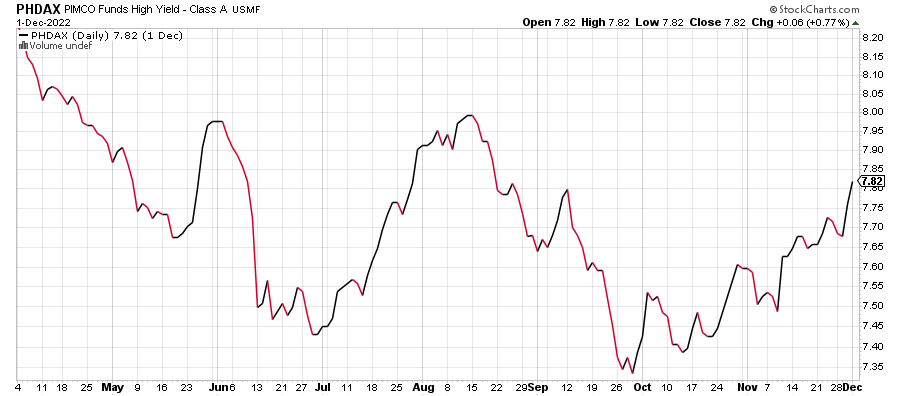

I continue to be encouraged by the behavior of high yield bonds. As a random proxy you can see the PIMCO fund below.

Another late fall weekend, more rain in New England. Come on Mother Nature! This just isn’t fair to the skiers. It hasn’t been a kind start and that trend continues. Of course, those in Utah are celebrating more than 100 inches of snow already.

On Wednesday we bought IR. On Thursday we bought UUP. We sold EMB, PCY, some FAS and some levered NDX.