NASDAQ 100 New Highs – Gold Setting Up – Semis

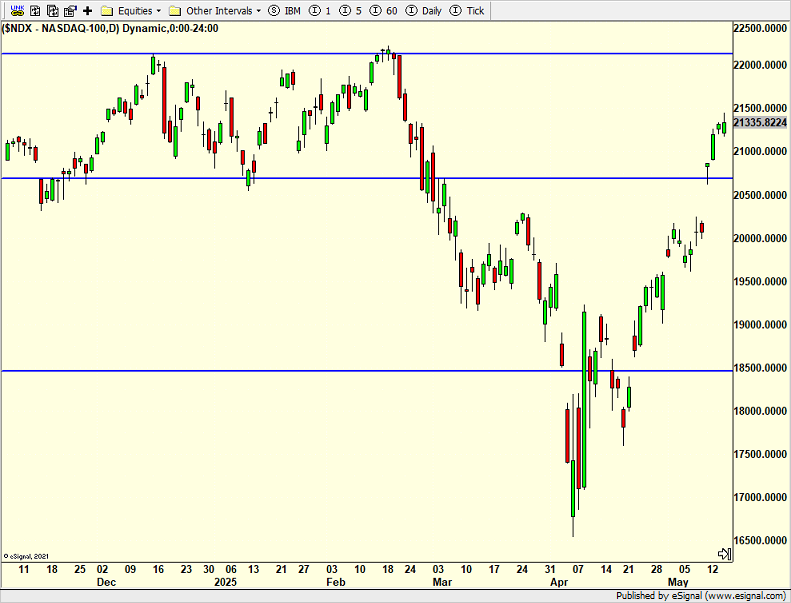

The bulls have completely run over the bears much quicker than I thought and to a larger degree than I thought. That’s okay. No problem here. The NASDAQ 100 below has its sights on the old highs. I didn’t think that was in the cards until later this year. But here we are. People are getting more bullish which is expected. That’s okay until it’s not, meaning that bullishness is fine as long as it doesn’t get greedy, giddy and euphoric.

Gold and the gold stocks have had a nice, tidy pullback. It looks like a bounce, or more, is setting up in the short-term. If a rally takes shape I would expect a run to new highs. Rolling over before new highs would be confirmation of a significant change in character and likely spell the end of of the bull market leg, but perhaps not the end of the bull market.

Lots of chatter in the media and by pundits about the massive rally in semiconductors. We have been very, very light on semis since last June/July. While they have soared since the April bottom, I still do not have strong conviction in their leadership just yet. They will need to do more work repairing the damage for me to turn in favor. And it’s possible to likely that they will not do what I want and that I will miss the whole move. So be it. I can find many other areas to buy and own.

On Wednesday we bought GXG. We sold EIS and BIPIX. On Thursday we bought SDS, RFRAX and more XHB. We sold QID.