New Month & Quarter – Could Banks Be a Winner?

The new month and new quarter begin today and the typical tailwind may be somewhat muted because of how strong stocks were last week. Nonetheless, we still have positive seasonals this week. With the masses looking to avoid showing banks on their Q1 ending reports I wonder if we see some reversion to the mean for the super hated sector that was in the spotlight for much of Q1.

I can’t say the chart above of the banks really creates any warm and fuzzy feelings. It “should” have rallied by now. And it definitely needs time to repair. We own a bank instrument in one of our strategies that I am trying to be patient with. And my sense is that there are thousands of investors looking to dump shares into a rally. So, either the rally never comes or the rally is stronger than most expect.

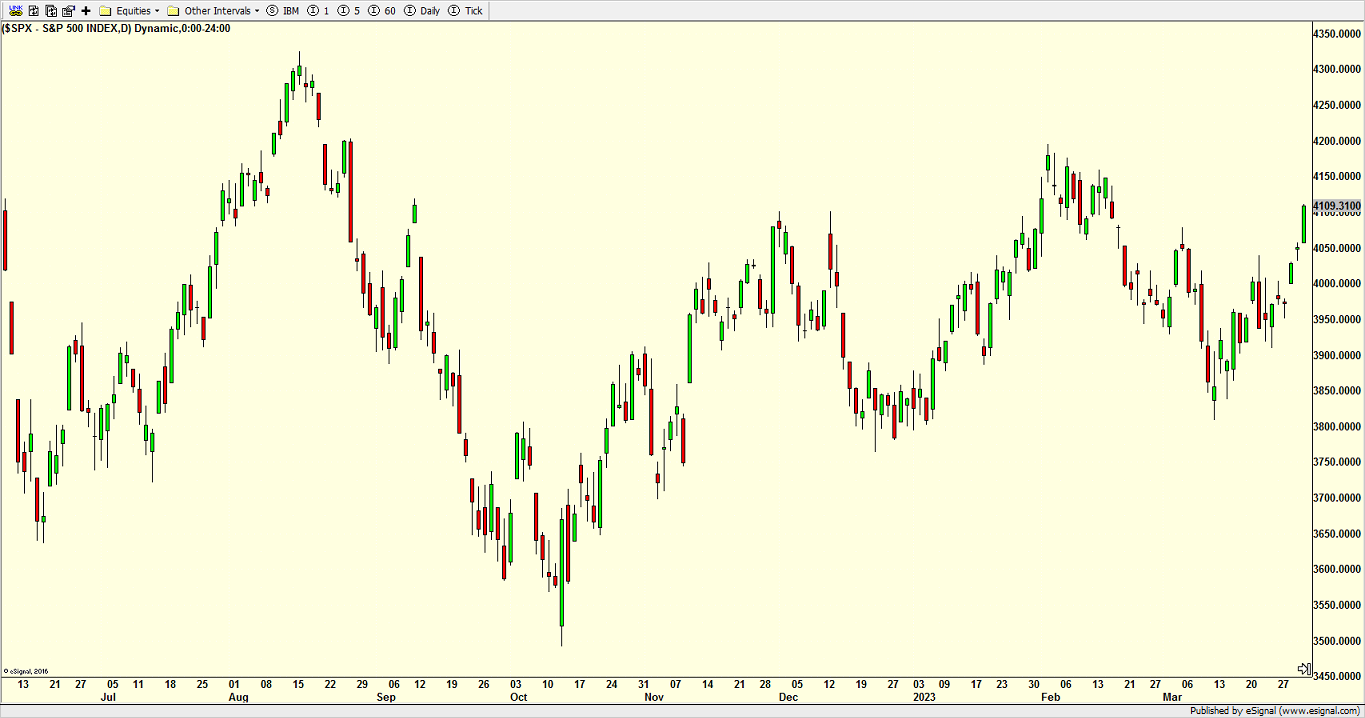

Last week, I discussed some key short and intermediate-term levels for the major stock market indices. All indices easily exceeded their short-term hurdles. The bigger and more challenging ones were new highs for 2023. The NASDAQ 100 is well above while the S&P 400 and Russell 2000 are well below. The S&P 500 lies somewhere in between as you can see below. I do expect new 2023 highs this quarter, however, that may be a catalyst for a meaningful pullback.

After a very strong rally off the March lows I am still seeing the masses hate and disavow the rally. That’s good and I love it. But that trend shouldn’t continue. Sooner than later we should see people begin to get excited. I can’t still be one of few people calling this a bull market.

Finally, tonight is the last time to root for the UCONN HUSKIES as he men’s basketball team is only 40 minutes from their 5th national championship. One for the thumb! LET’S GO HUSKIES!

On Friday we bought VGK, RYGBX and more high yield funds. We sold SPY.