New Week, Month and Quarter Begin – Back to Narrowness

As expected, Thursday was a very quiet day in the markets ahead of the long holiday weekend as well as closing out March and Q1. The government released its monthly Personal Consumption Expenditures (PCE) report which is a favorite of the Fed and it showed inflation came in as expected, up 0.3% for the month and 2% for the trailing 12 months.

Early last week, I discussed how the week had a strong seasonal tendency to the upside. The S&P obliged for more than a 0.50% gain. That may not seem like much, but that’s what seasonal trends are, varying degrees of tailwinds. Imagine making 0.50% per week for the year. I guess they would call you Bernie Madoff.

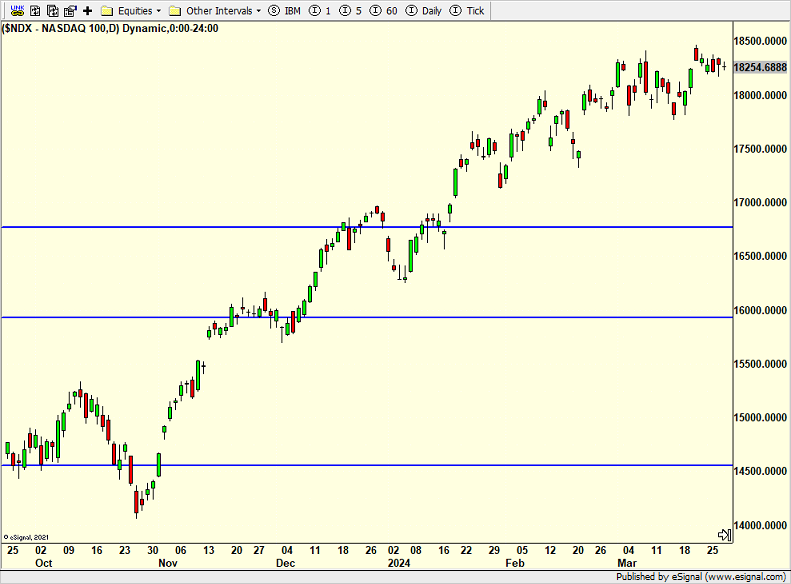

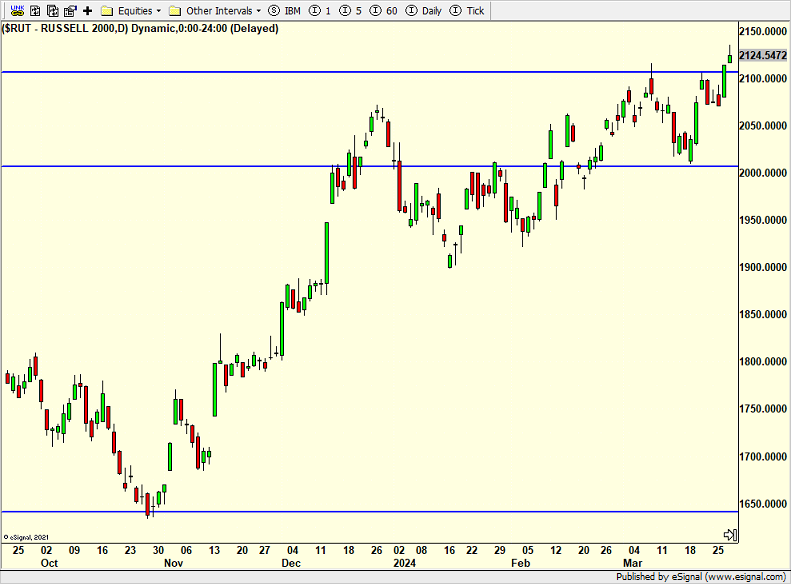

The new week, month and quarter begin with some tailwinds for this week and through tax day. I am most interested in the NASDAQ 100 and Russell 2000.

The former looks like it wants one more spike to new highs before pulling back. The latter looks like it’s ready for some weakness right now. With the media and pundits all now focused on the “other 493” in the S&P 500 don’t be surprised if the Elite 8 or Super 7 or whatever other dumb moniker currently being used outperforms right now.