Nice Bounce But Not Convincing

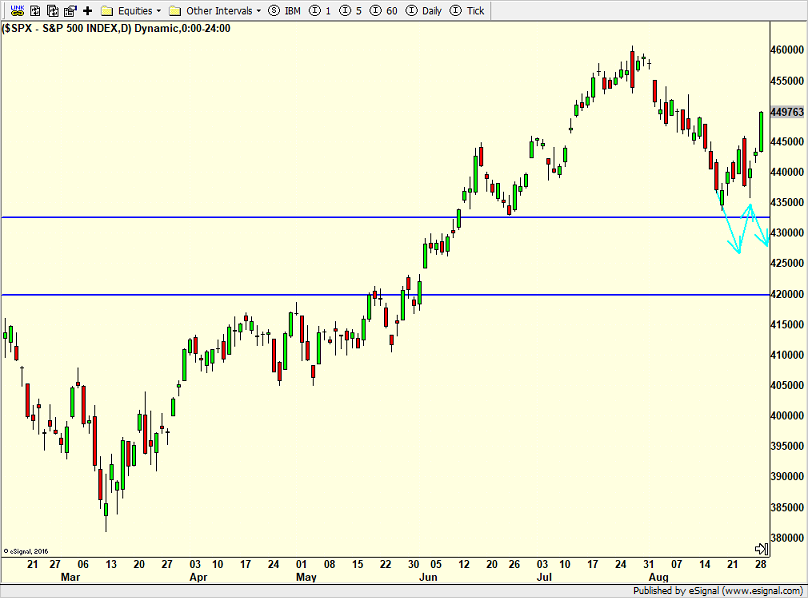

Long-term bond yields have come down over the past two weeks. Ya know what that leads to in this climate? Stocks have bounced nicely over the past week although I sense that yesterday was the day of recognition, the day when people realized there has been a little rally. Usually, we see some weakness a day or two later. At this point the S&P 500 has regained a little more than half of what it lost.

If my thesis regarding the pullback remains correct, the rally should end sooner than later. Nothing special there, just that if it goes much longer and higher, it will be at the old highs. So far we have been nimble with our new positions and I am only giving them a small amount of risk to prove I am wrong.

Interestingly, the bounce has not only not turned our indicators and models more positive, it has done the exact opposite. Our most aggressive models continue to lighten up and reduce exposure. We will see if that is just a one or two day thing or something more meaningful.

Month-end is upon us so we have to always be on the lookout for some portfolio games.

On Monday we bought DXHYX and more QQQ. On Tuesday we sold some levered NDX.