Lots Of Opps Building

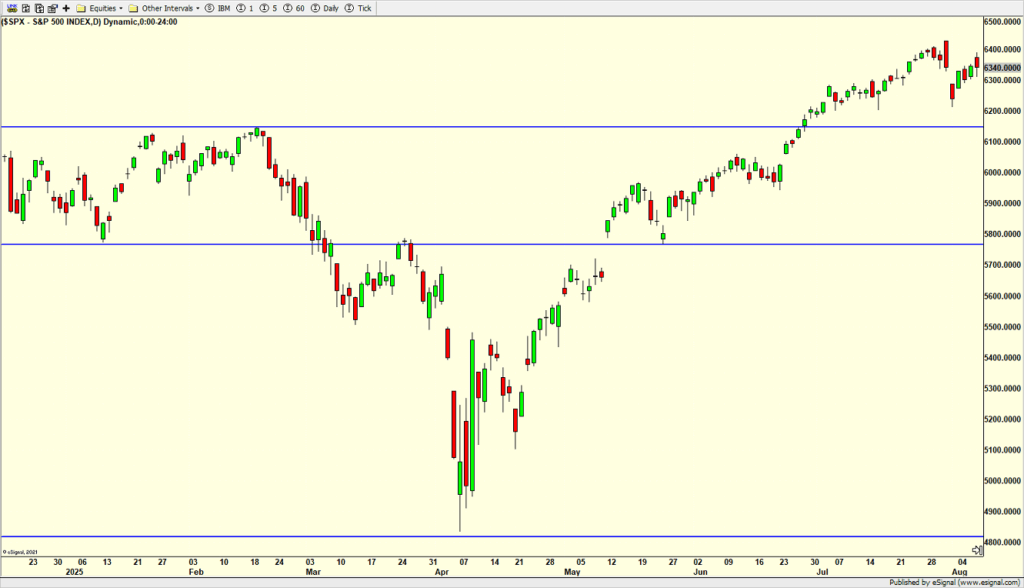

After the two-day reversal and pullback, stocks have bounced, getting close to the area where they should fail if they are going to fail. I still think the lows from last week will be exceeded this quarter, but like everything else, I will not die on that hill.

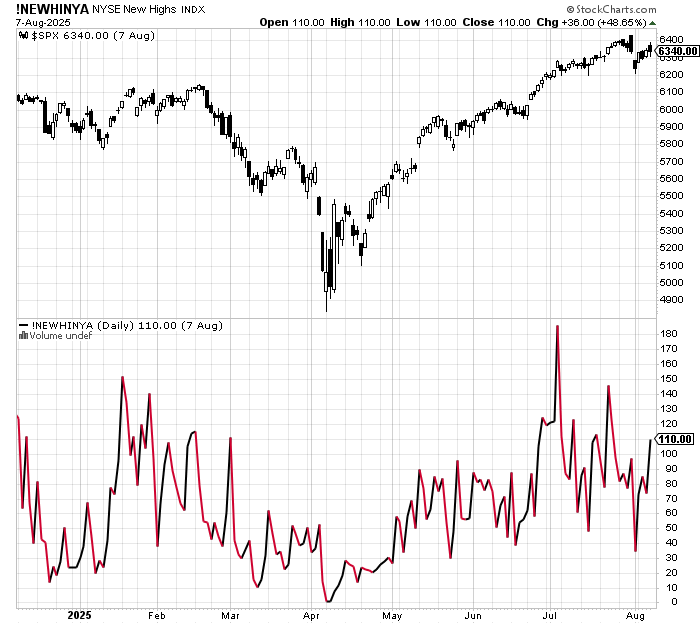

The other day I posted a chart of stock making new 52-week lows to see how much deterioration was under the surface. Someone asked about stocks making new highs. Here it is below for 2025.

We see some minor weakness, but I can’t say I am that surprised given the age of the bull market and mega cap dominance. In a perfect world, whatever pullback we see in Q3 becomes a strong buying opportunity for the broad market. I know. I know. That hasn’t worked out in ages.

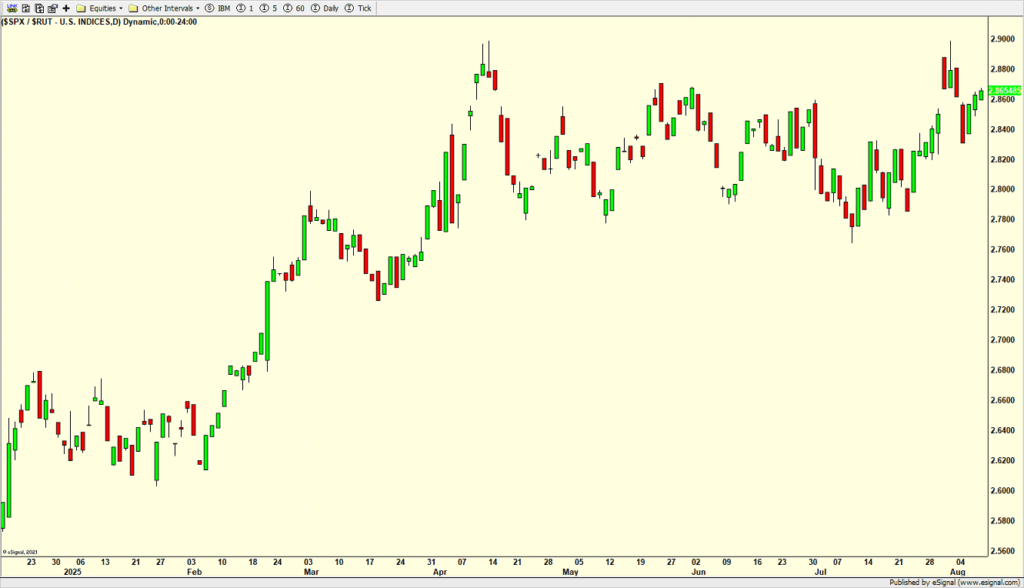

Below is simply a chart of the S&P 500 versus the Russell 2000 to see if there has been any major shift. The Russell 2000 which is small caps has held its own for months, but it certainly is not leading. Should that happen, we could see another full leg higher for the bull market.

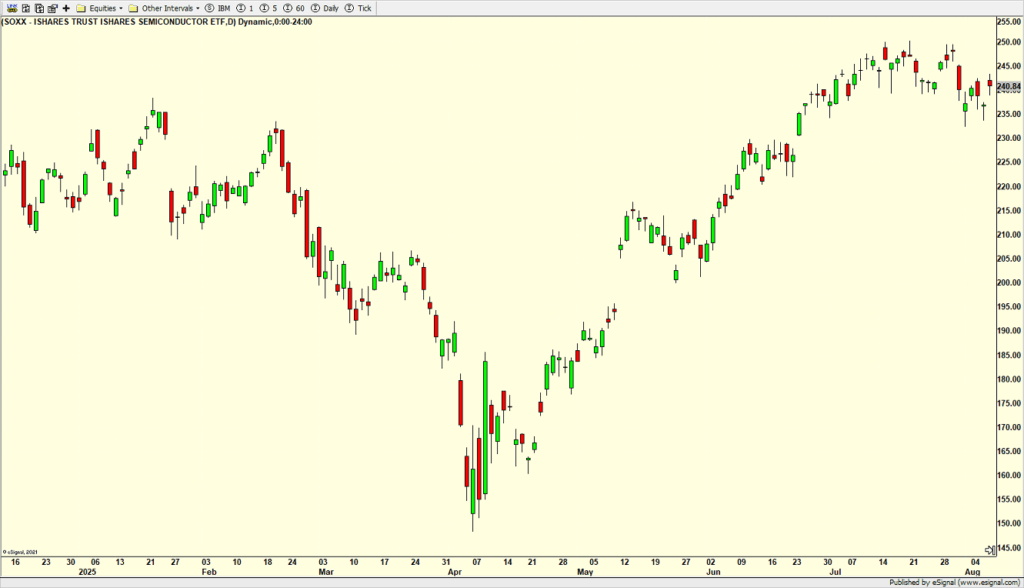

We bought our first sector position in semis all year the other day. I knew I was missing the boat off of the April bottom, but the sector never lined up according to our rules and we focused our monies elsewhere. Our position right now is small and it is on a tight leash.

When August weekends come around I get a little bummed because summer is getting closer to ending. It always seems to fly by, doesn’t it? A wedding in the Berkshires is on tap. After being horizontal all week from some mysterious virus I picked up in Scotland, I am hoping and praying to turn the corner. It’s been frustrating as I have not been as productive as I planned and the calendar is fairly full. Each day is just one day closer to getting back to normal, or whatever I was before the trip.

On Wednesday we bought SOXX and more SII. On Thursday we bought more SSO. We sold XOP and some DWAS.