Not Even Nvidia Could Prevent The Plunge – Time To Prune

As highly anticipated as Nvidia’s earnings were and the huge reaction, Thursday was an even more consequential day in the stock market. First, as I wrote about on Wednesday, I fully expected Nvidia to blow out earnings and the stock to soar above $1000 in the after hours trading on Wednesday. I don’t think there was any great stretch there or new revelation.

The biggest test would be after the open to see what the stock did. For a while it was looking promising as it gained momentum. And while it still closed higher than it opened, it was well off the intra-day high as the stock market sold off sharply. I think the easy money has been made over and over and smart money has sold or is in the process of selling. I think it is absolutely the wrong move to buy the stock here because of the 10:1 stock split which means zero to the value of the company. This is where fools and their money are soon parted.

It was funny to listen to the media and pundits gush about Nvidia and the soaring stock market all morning. One high profile woman from SoFi who has been bearish on technology for 18 months finally gave it a “green light” to buy. Another guy made fun of people who were selling shares into the rally. Stuff you usually don’t see in younger bull markets.

Only a few hours later, the media turned 180 degrees to bemoan that the Nvidia’s jump couldn’t keep the stock market from plummeting from its morning peak. In fact the major stock market indices saw a number of all-time highs on Thursday morning before succumbing to real and present selling pressure for most of the day. We saw 5 day higher turn into 5 day lows in matter of hours.

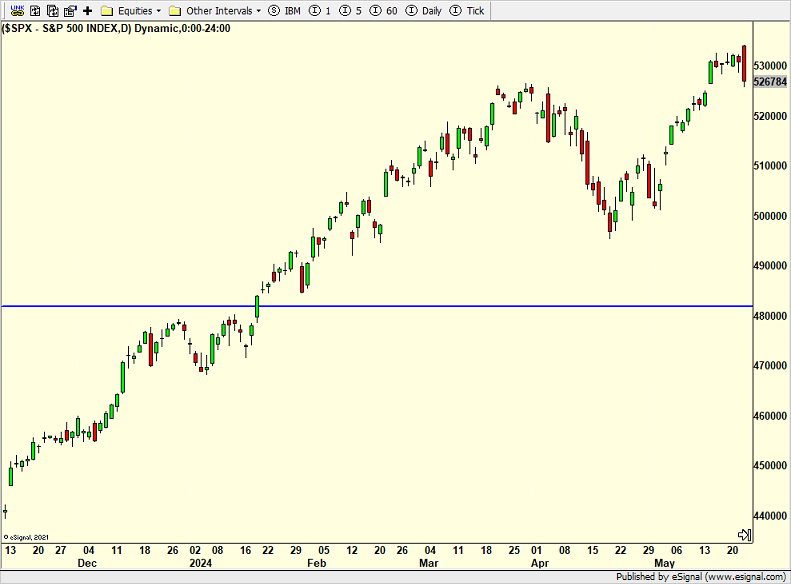

Look at the far right of the chart below. That nasty red candle has many folks calling for a bear market or 10% correction. While it does look ugly on the chart, it has no predictive power for more than a few days to a few weeks. Stocks usually bounce a day later and then see new 5 day lows.

The takeaway to all this is to consider pruning some Nvidia and perhaps some weaker semiconductor stocks while buying weakness in the stock market in June. The rally isn’t over. The bull market isn’t over.

The unofficial beginning of summer is here! Weather looks decent in CT. I sense some swimming and maybe some golf. In the office in the mornings, enjoying the sun, friends and family after. A few of us are doing a bourbon tasting and BBQ which should be fun. Most important, thank you to those who serve and have served, especially to those who have made the ultimate sacrifice for our country and freedom.

On Wednesday we bought levered S&P 500. We sold PCY and some CYPIX. On Thursday we sold BP, NET, EMB, CYPIX and some RYOCX.