Not Looking Like a Full-Fledged Correction

On the surface Friday looked like one of the those “puke” days when anything and everything go down. It was an ugly day, but I didn’t see evidence of investors in full panic mode nor selling at any price just to get out and relieve the pain. Friday looked like the makings of an internal or momentum low where selling and would be at its worst for this decline. Of course, one day later, it’s only a guess until there is more to view.

Except for the NASDAQ 100, all of the other major stock market indices got in gear to the downside and wiped out all of January’s return. Yes, January was a down month which will spark cries that 2020 will now be a down year based on the half-baked idea of the January Barometer. I will have more on that in a different post. Right now, the NASDAQ 100 is the lone “go to” index” which somewhat flies in the face of my forecast that 2020 will not be nearly as rewarding for tech investors as 2019 was. It’s a long year and like my thinking that energy will be a later in the year positive story, tech must take some time to cede its leadership position.

Looking at sector behavior, I see a number of sectors which are behaving better than the stock market and they are not just the defensive ones, REITs, staples and utilities. Software, internet, financials and discretionary are all hanging in, something you would not see if this decline was just getting going and accelerating to the downside.

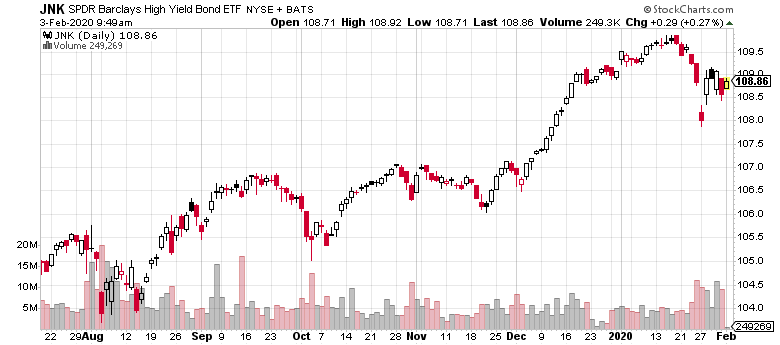

High yield bonds have been hit, but so far, they are holding well above last Monday’s levels, another positive.You can see the chart below.

Stocks are looking higher at the open as The People’s Bank of China, a name that always makes me chuckle, is injecting more than $100 billion into their system as markets reopen after being shut down last week for the Coronavirus. Between that and the feeling that markets might start becoming a little less sensitive to the virus, we could be in the embryonic stages of a little bottom forming.

We still have the Iowa caucuses, a slew of earnings and the employment report this week so I would not bet on a quiet week. I think buying the dip will be rewarded.