Not Ready To Upgrade 1-3 Month View Just Yet

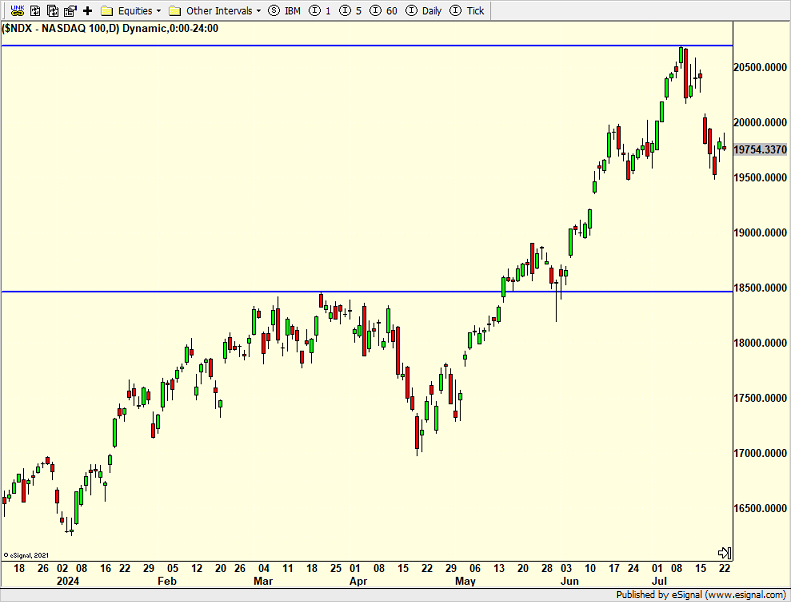

Two weeks ago I downgraded my 1-3 month view of the stock market as you know, looking for a 4-7% pullback. However, we also saw an epic surge in participation which was one of the concerns I had. I wasn’t sure how that would all play out. I shared that for the first time since 2018 I think, we had sold out of all of our sector semiconductor position. We also reduced position sizes in Nvidia and Tesla. Yesterday, we took more action to reduce risk and position sizing in the NASDAQ 100 as the index looks like it wants to see new lows for July. Regardless of how that worked, I was glad to execute those trades. It was time.

What is emerging in the stock is new leadership, at least in Q3 with small and mid caps leading and mega caps lagging. Technology is taking a backseat to financials, healthcare, biotech, industrials, materials, utilities and REITs. I laughed when pundits argued that tech was about to re-surge because VP Harris is from CA and more friendly than President Biden. That’s about as true as Donald Trump liking China because he owns properties internationally.

Stock are digesting gains. They are pulling back. There is more downside left. However, the bull market ain’t over. Google’s and Tesla’s earnings reports won’t help today. UPS’ stunk yesterday.

On Monday we bought more RYHRX and levered NDX. On Tuesday we sold PCY, EMB, some ENPIX, some QQQ and some levered NDX.