Now 6 Straight For The Bulls

I spent Tuesday in New York meeting with clients and visiting the good folks at Fox Business. Although I do like to talk a lot, I am a good listener, especially when trying to take the mood of the public. Today, I basically heard that younger folks are more scared of the current economic and market client than older folks. I know. I know. That’s some generalization. Older folks, say 50+ are pretty much split 50-50 along political lines. Either the world is ending or it’s partying like it’s 1999. I know you will be shocked to hear this, but I am somewhere in the middle, as usual.

When folks tell me that Donald Trump “wrecked” the economy and “crashed” the markets, I ask them to share the data that support the claim. 2022’s economy was weaker and the markets were much worse. When folks tell me that the tariff plan is going to lead an economic renaissance like the 1980s, I ask them to explain how producing so much domestically is a net positive and how eliminating and severely reducing the trade deficit won’t impact foreigners demand to buy or debt. People are thinking binary outcomes. I think it’s much more nuanced.

Right before I joined Charles Payne today, my friend, Jim Bianco, one of the smartest minds in the bond space, shared that in 90 days he will forecast a 90% chance of recession or 15% chance. Now that’s what I call a binary outcome! He admitted that right now, he just doesn’t know because he has no edge on what’s coming out of the White House by July 2nd.

This is what I think. Geopolitics have no place in investing. If it did, no one in their right mind would ever invest with risk as there is always something scary in the world. As I have for 30+ years, quantitative models guide us. They don’t use emotion and they don’t care how I feel. They take in data and give an output. 2023 and 2024 were easy, probably the two easiest back to back years of my career.

2025 has been more challenging, not because stocks went down 20% which they also did in 2022, 2020, 2018 and 2011. It’s a tougher year because our models have not been in sync at all, especially the aggressive ones which hit it out of the park in 2023 and 2024. This year, they have been whipsawed around a fair amount which has been frustrating. Our moderate models have been long varying degrees all year which wasn’t fun during those three fateful days in early April.

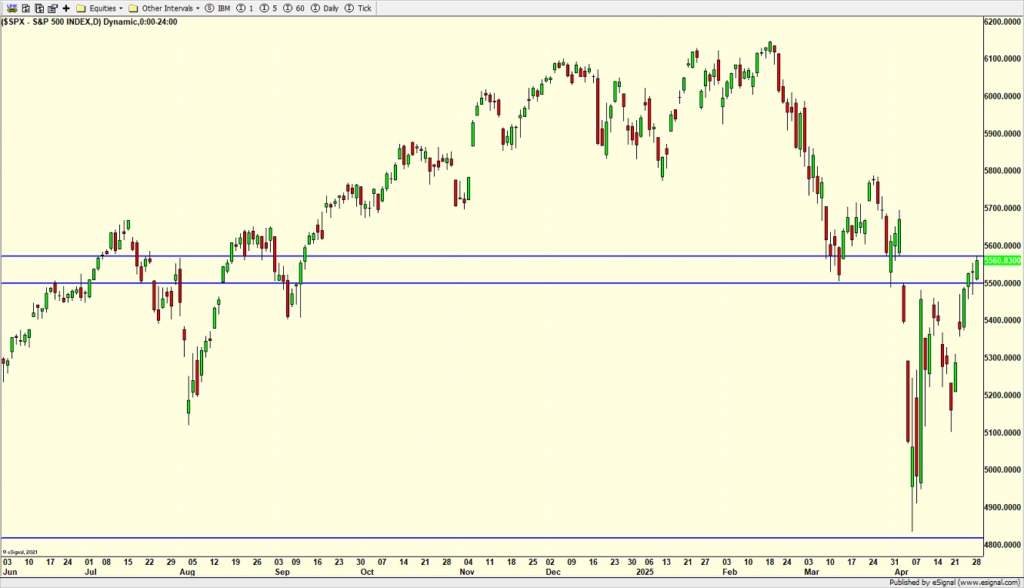

The S&P 500 which is below has rallied back to the level where I thought the rally would encounter some selling, right around 5500-5600. The bears are supposed to make a stand fairly quickly. If they don’t then I will reassess . See how the bottom looks like a “V” shape? V bottoms are very atypical and only happen when the Fed pivots quickly and in a big way. Think COVID Crash 2020, December 2018 and 9-11. If that behavior still holds true then my most likely scenario still has another decline coming over the next month or so.

The Fed is late to the game yet again. Not only did they not cut rates last month, they said they are unlikely to take action in May. They are wrong. Wal-Mart told us about a growth scare. Companies are eliminating future guidance by hiding behind tariffs. Consumer Confidence has fallen sharply. Inflation isn’t the problem. Once the job market weakens, the Fed will wake up and realize that they have been asleep at the wheel. Of course, I hope I am wrong and the consumer doesn’t go into hiding.

On Monday we sold some MQQQ. On Tuesday we bought SPLV, TQQQ, more MQQQ and more CYBR. We sold QID and SQQQ.