Nvidia Delivers (Sell) – Weird Behavior Follows – Pay Attention

Thursday was definitely a weird day in the markets. And I am not talking about Nvidia which is all the rage. Heading into its earnings I wrote that the stock was a buy on Wednesday as it should pop on the news.While I usually do not flip stocks that quickly, the stock is now a sell on the news and overreaction.

Stock market action on Thursday was strange and not exactly in a good way. We did a fair amount of rebalancing and I expect that to continue on Friday with the overall goal of reducing risk whether through outright exposure reduction or selling more volatile positions and buying lower volatility ones.

Yesterday on the NYSE, there were only 650 more stocks that went up than down. With a 2%+ advance, that number should have been almost 2000. On the NASDAQ the net number was only +300. It should have been +2000. All that means there was an insanely large amount of buying in a select few stocks, a movie we have seen many times during the bull market. Thursday, however, was the most egregious.

Twitter was all the rage about a post that said the last time the NASDAQ 100 rallied 3% to an all-time high was march 2000 right at the peak of the Dotcom Bubble. The media couldn’t stop parading that around. Folks, one instance is 100% meaningless. It’s as useful as those who connected Joe Biden’s tie color to daily stock market performance.

I do not love how stocks are behaving. I said the same thing in early January when we reduced exposure in those non-aggressive portfolios which were carrying more than 100% exposure. If the stock market spirals higher, so be it. But I do not think it is prudent to be overexposed. This is a short-term comment. Please don’t read too much into it.

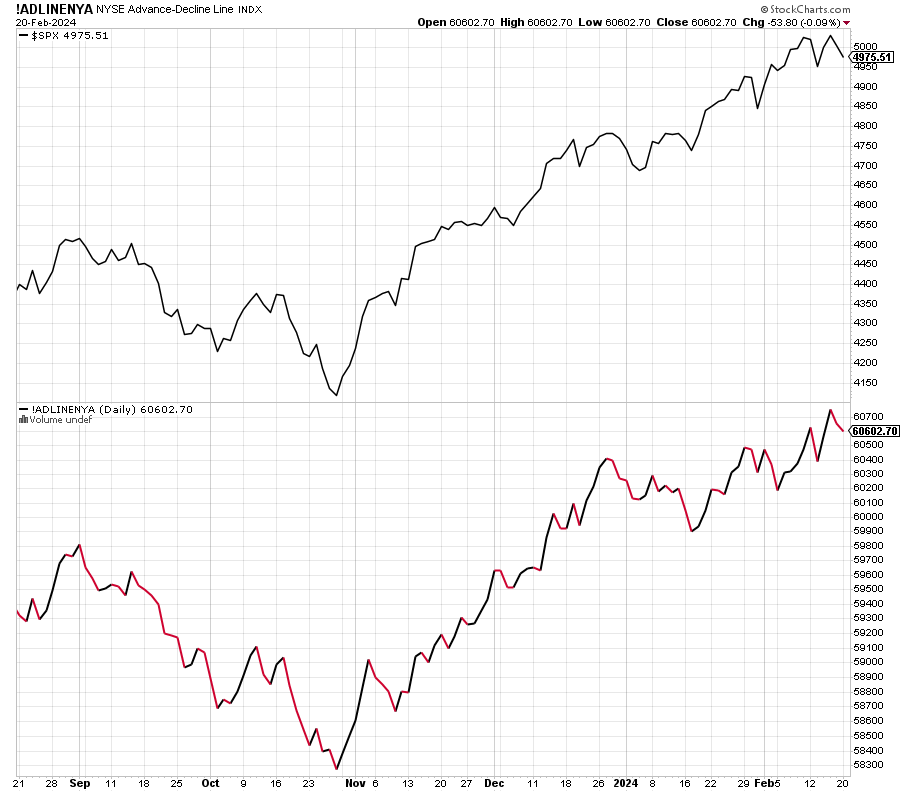

On the flip side, let’s look at intermediate-term participation. While so many pundits have been crying about the narrowness of the rally, the NYSE Advance/Decline Line just hit an ALL-TIME HIGH. In the chart below you can see the S&P 500 with the A/D line below. This is absolutely not the kind of action you see if a bull market is peaking or ending. Sorry bears. The anticipated decline will be one to buy.

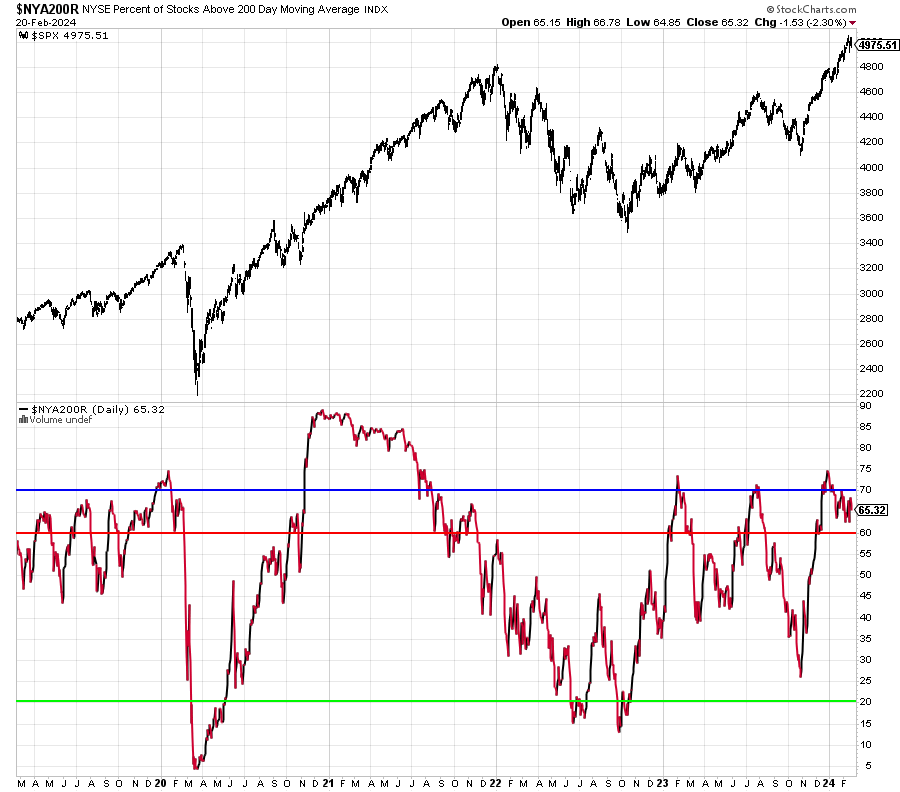

If you accuse me a cherry picking one indicator, here is another one. It shows the percentage of stocks in long-term uptrends, now at 65%. While I would like to see the number at 70% or above, this is a far cry from the 57% seen at the last bull market peak in January 2022.

Overall market participation could be better, but it is not the death knell as so many would have you believe. Frankly, I thought there would be some punishment for the December late comers this quarter, but that hasn’t materialized yet. Stay tuned. My thesis still has a Q1 peak followed by a 5-10% decline by Memorial Day.

On Wednesday we bought PCY. We sold PMPIX. On Thursday we bought EMB, DXHYX, XSD, NET, HSY, more ITB and more PFF. We sold FDEV, TLT, GSG, levered S&P 500 and some BA.