Nvidia & Less Government Intervention

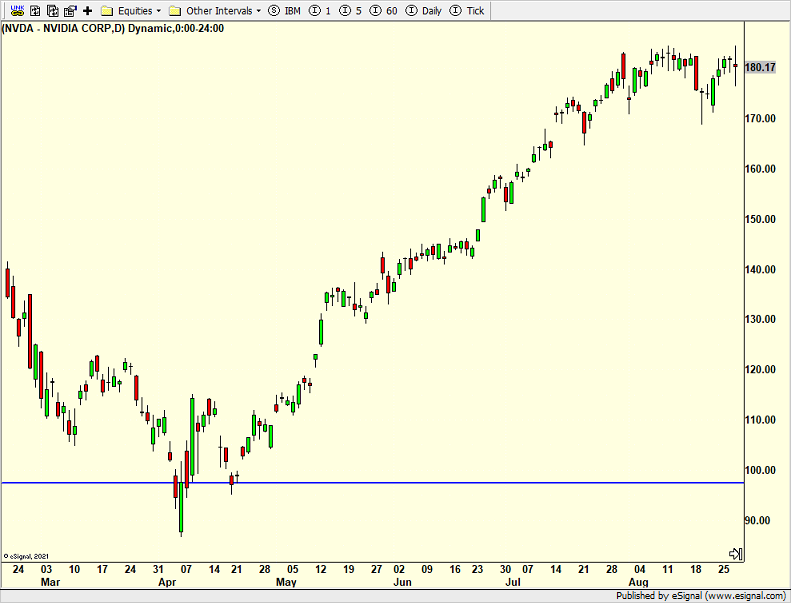

I absolutely loved that Nvdia’s earnings did not set off a massive move in the stock. For our models, it makes trading easier when one stock doesn’t have an outsized impact on a given day. As I wrote about the other day, the stock is maturing and the more and more people who own it and focus on it, the less likely we will see surprises and outside the norm reactions. The unintended consequences are that growth rates will also flatten out and then decline.

Some folks noticed I did not comment on the administration’s behavior from the other day. So here you go. I am a free market with guardrails guy. I like small government and less government intervention, regardless of party. I have been firmly against this or any president publicly attacking the Fed nor its Chair. It undermines the independence and damages credibility. It’s also not good for our capital markets. I know Truman and Nixon also had more public beefs with the Fed in different times.

I do not like any president picking winners and losers and corporate America. I want all of corporate America to succeed on a level playing field. As such I am firmly against the government taking equity stakes in any company, including Intel.I do not want the government buying stakes in a bunch of “strategically important” companies which would disadvantage others.

I was firmly against what the government did in 2008 with Fannie Mae, Freddie Mac, AIG and the banks. I thought it was horrible and rewarded bad behavior. I couldn’t have been more against what the government did with GM and Solyndra in 2009. I think the capital markets should punish excessive risk taking and bad behavior.

To end, both parties have done all of this. It’s not one sided.

The unofficial end of summer is here. BOO! It’s felt like fall in CT for a week although we still have a drought and I have yet to make a bonfire this year. I see golf and lots of family time this weekend as the middle guy goes back to Boston on Tuesday. He’s the quietest of the three so the house isn’t likely to get quieter just yet.

On Wednesday we bought more IGV. We sold some QLD. On Thursday we bought PCY. We sold QLD and some SSO.