One Down Day. New Bear Market?

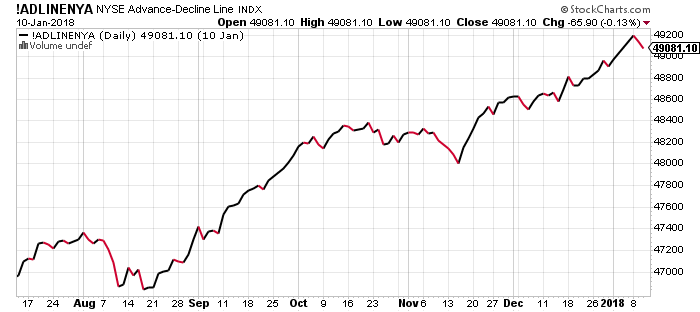

In what continues to be an epic start to the New Year, the stock market finally did see a down day, albeit very small. The major indices closed fractionally lower without any damage being done. Yes, some have mentioned that the rally is “narrowing”, meaning less participation, however the NYSE A/D Line just hit an all-time this week. That’s a hard case to make that trouble is looming.

Other have noticed that some of the weekly employment data is just beginning to soften and that sometimes leads to recession 6-18 months later. Okay. No arguments.

High yield bonds? While they are down this week, they have certainly kicked it up a notch over the past new weeks.

With all of the major stock market indices at all-time highs and in gear to the upside, it’s really hard to find fault here for more than a mild pullback. As I continue to offer, strength does beget strength.

On the sector front, leadership is very, very strong, especially for so late in a bull market. Banks didn’t wait long to reward my forecast of new highs this quarter. Transports and discretionary continue to soar higher. Semis revisited their November peak this week and have paused for the time being. Putting it all together, this is not the kind of behavior stocks typically see before a significant decline begins, let alone the end of the bull market.

If you would like to be notified by email when a new post is made here, please sign up HERE