OUCH! That Hurt

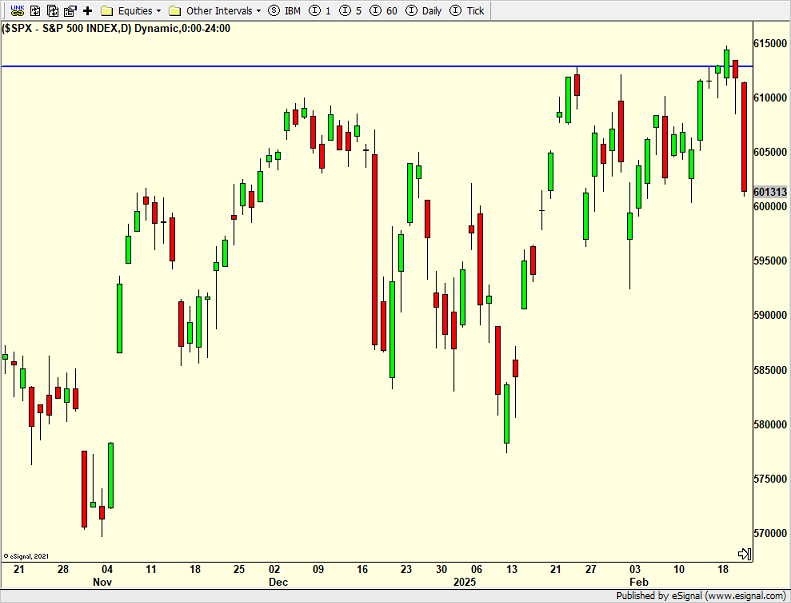

Friday was an ugly day for the bulls and one that caught me a little off guard, just two days removed from a fresh high in the S&P 500. However, in the grand scheme of things, Friday was very much in line with how I have been thinking this year. Wednesday’s new high wasn’t confirmed by much else. It was more of an island of strength that got washed over sooner than later. It was a typical “risk off” day where the sexy and exciting sectors and stocks saw the most damage while bonds and the dollar rallied.

Friday was also February options expiration where large moves can be exaggerated once the professionals lose their hedges. Of course, there were negative headlines that hit to give the media something to attribute. There is likely more selling coming early this week. I would be surprised if Friday was the low for this pullback. Adding some wind to the fire, this week is also a fairly weak seasonal period.

Interestingly, many defensive stocks are rallying strongly as the perception of a growth slowdown takes hold. Some of these almost look like an AI stock which has me thinking it is time to trim exposure and look for some beaten down technology names that are behaving constructively. You can always scroll to the end to see what we bought and sold lately.

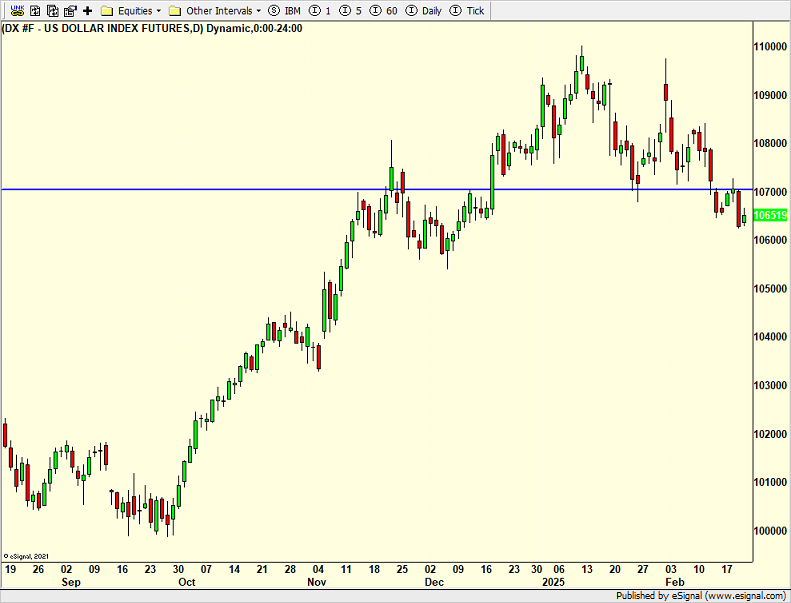

Finally, the bloom has really comer off the U.S. dollar. The masses were all bulled up coming into 2025 and you know how that usually ends up, with the masses being very wrong and late comers punished. The media loves to spin that a weak dollar is good for stocks and a strong one is bad. Except that doesn’t really stand up to scrutiny as you can see below.

On Friday we bought INTC and more MQQQ. We sold TQQQ, SSO and some SNOW.