Powell To Pivot – Markets Poised For More Upside

Fed Chair Jay Powell’s last Jackson Hole speech is here. It’s the only big news event of the week. Markets are expecting a more dovish Powell and an interest rate cut in September. While I do not think Powell will turn fully dovish, I do think he will give the market some of what it wants. With the last inflation report hotter than expected it would be crazy for Powell to ignore it. He also can’t ignore the weakening employment market. With a number of data points to be released before the FOMC meets next month, I would expect Powell to open the door to lower rates, but temper that with the hotter inflation which is likely to stay warm over the coming few months.

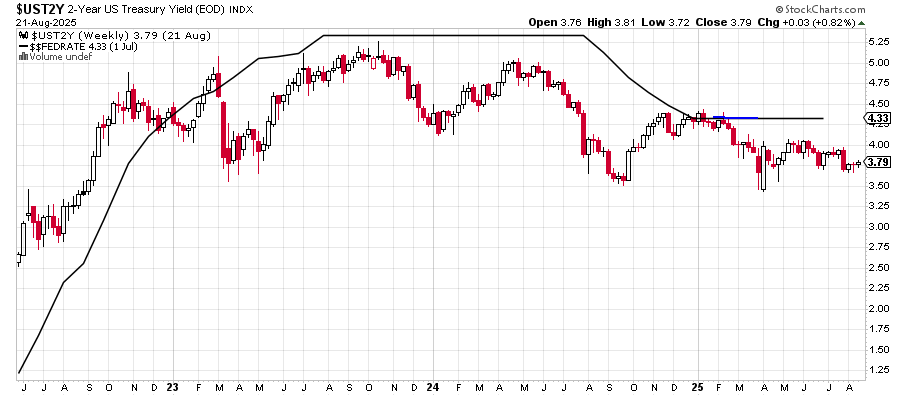

The 2-Year Note has been calling for a rate cut since March. Currently, it says that rates should be .50% to 0.75% lower. As you know I have been pounding the table for a rate cut since March. My plan was for a March cut, a break in May and then a June cut.

I always wonder why the supposed smartest bankers and economists on earth somehow fall into dumb group think when they join the Fed. Seriously, what on earth happens to their DNA when they walk into those meetings? They wait way too long to hike. They wait way too long to cut. From Greenspan to Bernanke to Yellen to Powell, it’s an embarrassment. And it’s not partisan as they all don’t support the same political party.

So many ridiculously poor decisions from fueling the Y2K bubble to the housing bubble to thinking sub-prime was contained to all those QE programs to letting inflation soar to not cutting. UGH. It’s just not that hard folks.

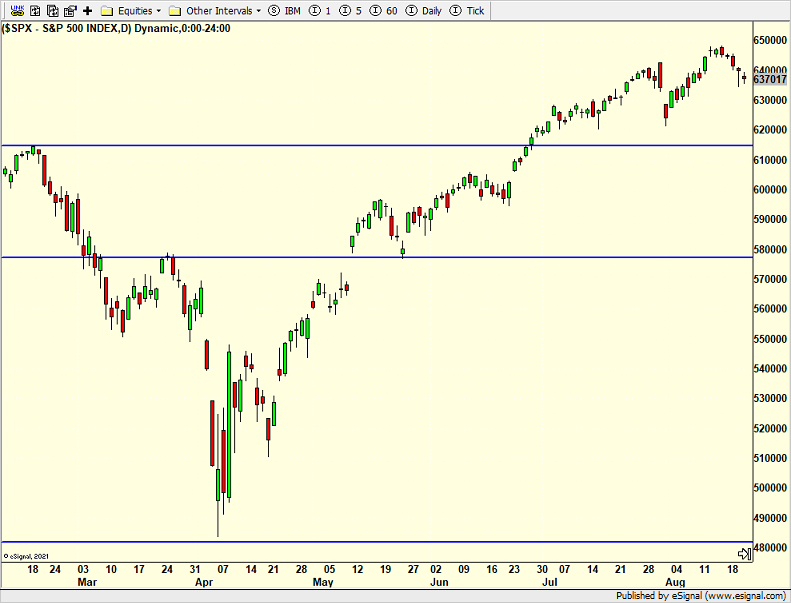

I do love the fact that markets have come in leading up to Powell’s speech. The S&P 500 is first. I wrote the other day that this was a little pullback to buy as the media and pundits were focused on weak seasonals and a collapse.

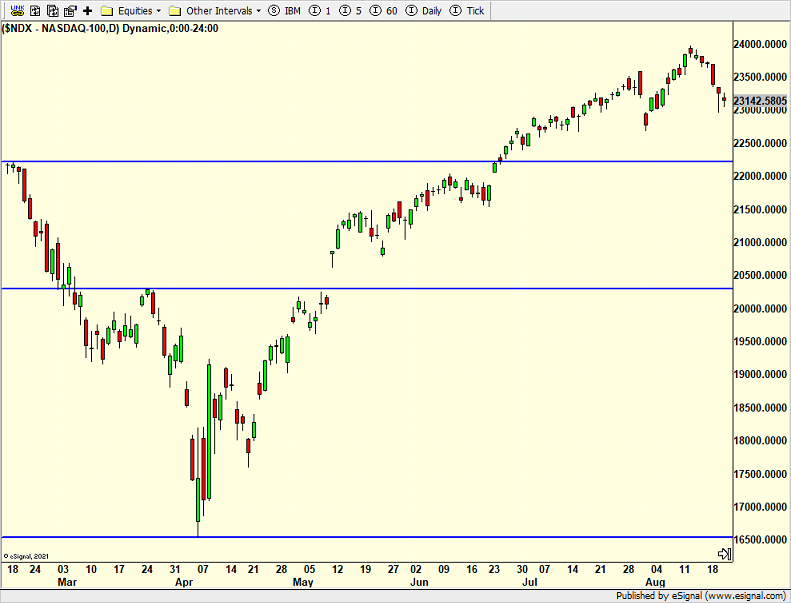

The NASDAQ 100 is next. When I heard pundits and the media all worried about Palantir, Meta and Nvidia, I felt comfortable in buying which I advocated over the past few days.

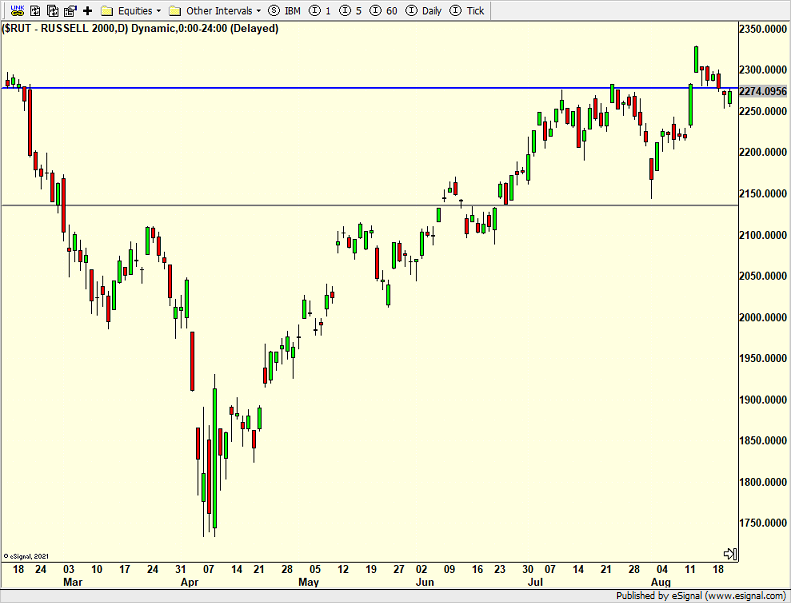

Small caps have been the bigger story. I have written about that opportunity for the past few weeks, warning that I still had road rash and tire marks from being dragged and run over so many times attempting this trade over the past decade or so.

I have posted the chart below a number of times. It is simply the Russell 2000 small caps versus the S&P 500. Small caps have had very constructive behavior since the tariff tantrum bottom in April against the backdrop of pundits hating and dismissing the set up. From my seat that equals opportunity. If I am wrong, I have no issue stopping out and moving on to something else.

Another run to new highs is a plausible scenario over the coming weeks. And I would have no problem selling into that move after buying the recent weakness. Absence an exogenous event, the market is not in a position for a large decline. Pullbacks should continue to come this quarter. And I am a buyer until proven otherwise.

Everyone has been bemoaning the end of summer this week in CT as the temps have been cool and windy with the hurricane’s influence offshore. It’s also the last weekend before school starts in CT, adding to the disappointment. With my wife at a yoga and pilates retreat in the Hudson Valley and my daughter visiting a friend in the Hamptons, it will be a boys weekend in CT. I hope we survive.

On Wednesday we bought more TQQQ, more COIN and more MQQQ. We sold some CELH. On Thursday we sold EMB, PCY, QLD and some MQQQ.