Private Credit & Contagion Risk The Culprit

I have been discussing a 2-5% pullback for a few weeks, certainly not knowing why the market would pull back, only that it was set up. We now know the culprit, private credit and regional banks.

For months, the alternative asset managers have been falling and hit with the ugly stick. Ares, KKR, Blackstone and Blue Owl are among the major ones. I had no idea why other than thinking there was an interest rate dislocation somewhere. That assumption was wrong.

What we learned this week was that the private credit sector, meaning the firms that essentially replaced banks in riskier loans over the past decade, has problems that is bleeding into the regional banks. Ares is one firm and that’s below although it’s somewhat diversified. This chart looks nothing like the S&P 500 or NASDAQ 100. It has looked sick for months. Lots of saw it and commented on it. Few truly understood it.

Blue Owl is below and that’s more of a pure play on private credit. It looks downright awful, approaching the tariff tantrum lows. Interestingly, this is one company that people were crowing about last year as the model for how new age firms should operate. Of course, the masses are usually wrong.

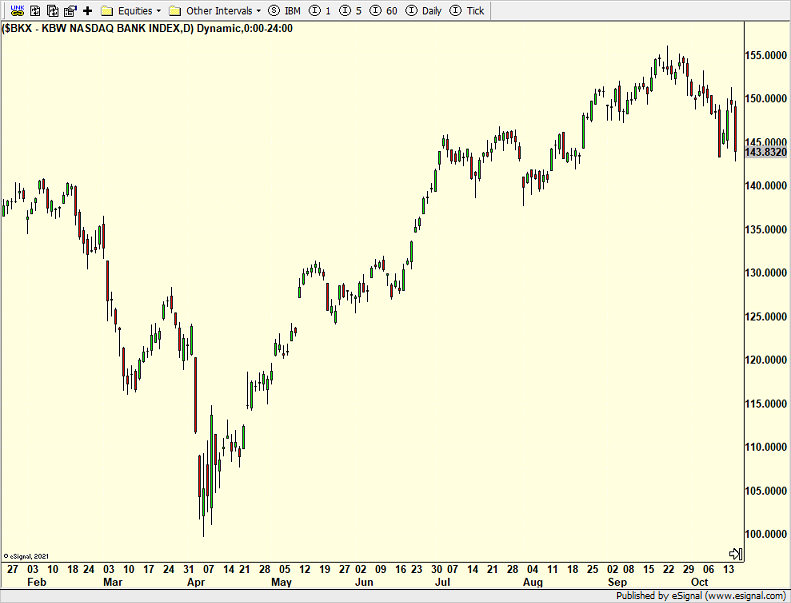

Finally, the regional and smaller banks took it on the chin of late. Great earnings were a selling opportunity and some very loud and vocal in the media were gushing about the banks just over a week ago.

Across social media and on TV, more than a few people are invoking 2008 and the Great Financial Crisis, although not exactly at the level as during the tariff tantrum. I love hearing this. I came into the industry in 1988 right after the crash. If I had a nickel for every time someone invoked the 1987 crash, well, I would have a zillion nickels. The GFC isn’t far behind.

As long as people remember an event enough to invoke it, history is not going to repeat itself. At some point, there won’t be many of us left who remember 1987. Then another crash can happen, but not until then. People use the words “crash” and “bubble” like they are regular events. They are not. 1987 was 20% in one single day.

Zions Bank, a large regional player, announced that a $50M commercial loan went bad and they are fighting it in court. The markets are worried there will be contagion. Right now, I think the reaction may be overblown.

A real fall weekend is ahead. I thought I would be watching the little guy pitch, but his elbow is sore from last weekend. Proud father from watching my son throw a two-hit shutout in the middle of the Nor’Easter last Sunday. I’m sure I can find a golf game or a few football games to watch and there remains the endless projects around the house before winter. And for the those keeping score at home, Okemo in VT along with a number of CO resorts have started blowing snow. Mammoth CA has the natural stuff by the feet already.

On Wednesday we bought THIR, PINK, more TSPY and more KSPY. We sold LFEQ, CALF, some CVS, some SNOW and some JNJ. On Thursday we bought SSO and more XLRE. We sold SPYQ and GO.