Pullback Accelerates

First, lets’ start off with the Fed model which was woefully wrong on Wednesday, calling for a post-2pm rally. When markets don’t do what they’re supposed to do, they often accelerate in the opposite direction which is what we saw on Thursday. The two-day decline was real, lopping 2-4% off of the major stock market indices.

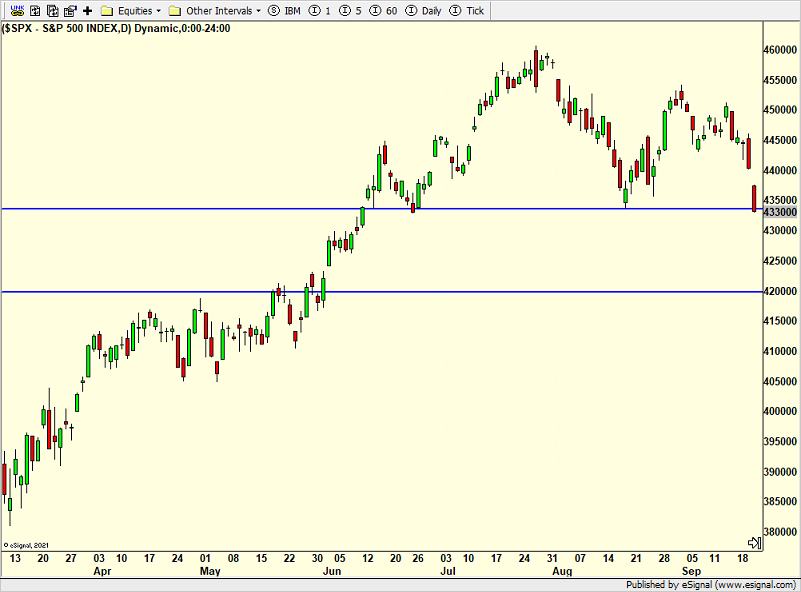

Below is the S&P 500. At the close it met my minimum downside target of breaching the August low. You can see the two blue lines which represent the area where I see the bottom forming. Time-wise, the window is now open for the next two weeks.

Turning to the NASDAQ 100 which is dominated by 7 stocks that were huge leaders and outperformers, we can see below that it is stronger than the S&P 500, but also falling hard over the past two days. I would expect the index to also breach the August low before the bottom is in.

While the pieces are coming together nicely for a bottom and Q4 rally as I have been writing about, it is never easy nor fun to live through. Declines shakes investors’ faith and they don’t reengage until the best opportunity has been exhausted. Next week I will be keenly watching for sectors that are beginning to shape up for a rally. Right now, it’s hard to see.

Lots of chatter about bonds and yields. It feels like people just woke up and realized that the bond market is behaving poorly. That is usually a prescription for a bounce.

Last weekend, the weather people treated the Atlantic storm as it was about to crush New England. All kinds of warnings and caution. Of course, it just breezy and you wouldn’t know anything was out of the norm. This weekend it looks like CT is getting hit with tropical storm remnants which could be a weekend washout. Hoping to stay somewhat dry…

On Wednesday we bought TUR. We sold URA, SLCA, COOK, EPOL, QDEF, XLB, some ITA, some SOXL and some DXHYX. On Thursday we bought levered S&P 500. We sold TQQQ, DXHYX and some levered NDX.