Pullback Continues Into Next Week

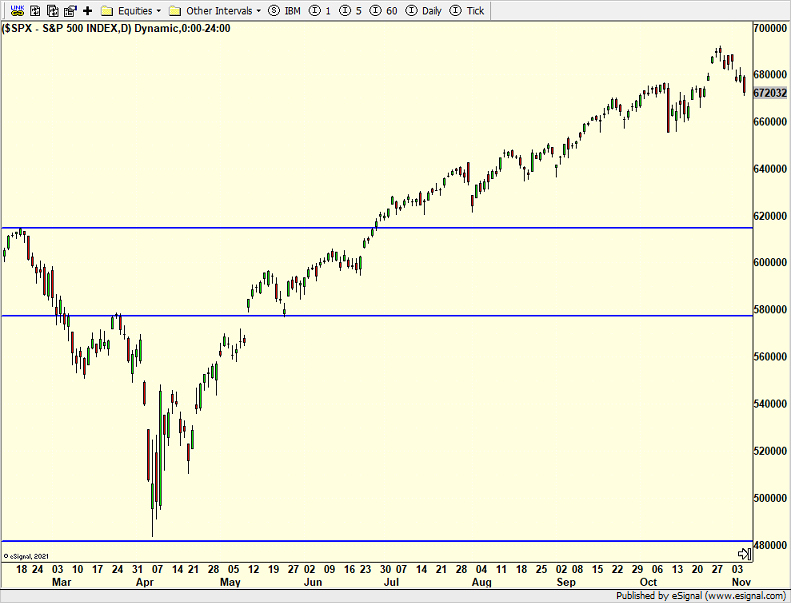

Last week a number of our models downgraded the stock market against the backdrop of euphoric and greedy pockets. On Wednesday I thought we could see a bounce in the S&P 500, but the other indices were not in the same place. I also thought the S&P could still end up a few hundred points lower. I have heard folks targeting the average price of the last 50 days which is only a percent lower from here. It seems to me that the market needs to lop off some of the giddiness before the real year-end rally begins.

Some folks asked if we sold all of our equities because our models are no longer all bullish. That is definitely not the case. Most of what we do is incremental, not all in or all out at once. A number of our models raised some cash, ranging from 10-20%. A few others reduced risk by moving to lower volatility holdings. And our aggressive strategies did nothing as they normally would from an all-time high. They will almost always be maximum long at new highs and struggle the most during the initial decline and new highs because our aggressive strategies view the first pullback from a new high as normal and healthy. It is when it doesn’t quickly stabilize and recover that those models begin to shift.

I do love when I post something contrarian about an asset and people email me that I have no idea what I am talking about. Feels like home! Folks did that when I turned negative on silver and gold a few weeks ago. And then went silent when the metals saw a quick plunge. I am wrong plenty of times, but I have no issue stating that.

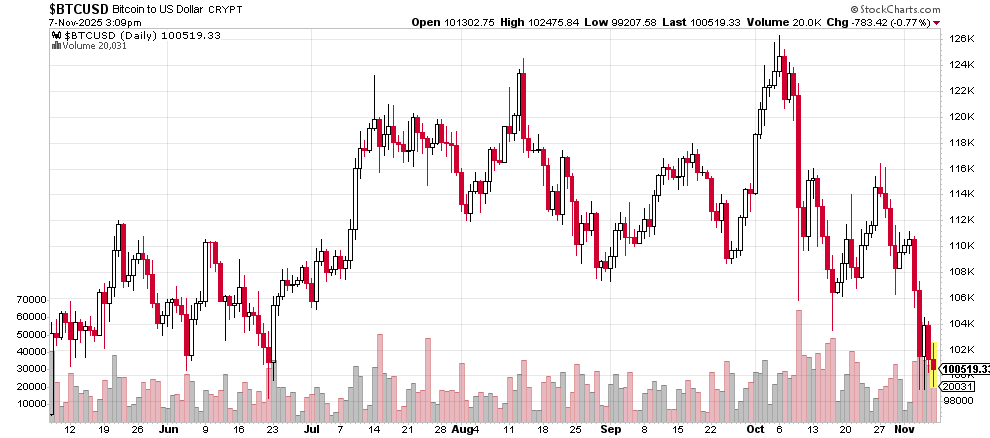

It wasn’t long ago when people were chirping away about Bitcoin going to $1M. I was told it was better than gold and better than AI stocks. It very well may be, but not so fast. Today, we see Bitcoin down from $126K to under $100K. I know I don’t know much, but that looks like a 20% decline to me. As I recently wrote, I am watching Bitcoin for bullish signs of a trade set up, just like I was with gold. The coin needs to stabilize and set up sooner than later or the door will open for more pronounced weakness.

It is so good to be home after time in Vegas for my wife’s birthday and Chicago for the best industry conference out there, NAAIM. Of course, I woke up in Sin City with a bug that continues to linger. Yeah me! I hadn’t been to Vegas since 2006. It seems even more corporate and institutional now. We stayed at the Cosmo and spent our days walking the strip and enjoying the pool. Dinners at Beauty and Essex, Sugarcane and Blue Ribbon were top notch. I loved the speakeasys, like Ski Bar. We saw The Eagles at the Sphere and Chelsea Handler, both excellent shows. The Sphere is an incredible experience. The Eagles haven’t missed a beat, especially with the addition of Vince Gill and Glenn Fry’s son, Deacon.

Below is one of the few Wall Strategists whom I read religiously, Jim Paulsen, former top gun at Wells Fargo and Ned Davis Research. His work is excellent, data-driven and thought provoking. Jim is also a genuinely good guy.

And yes, I usually wear blue…

On Wednesday we bought SLB, EWY and more VNM. We sold SSO, EPU and XLU.