Pullback Not Over – More Selling To Come – Dow Theory Has Been Warning

Stocks sold off hard for the second straight employment report. Recall that the mini-crash was August 5th which was on the heels of an ugly day for the bulls, the monthly jobs report. It remains September which is a seasonally poor period and we have the election overhang.

Friday was ugly. The bulls can’t spin it any other way. The markets are on their way to oversold and then setting up for a good Q4, but they are not there yet. Pre-market futures show strength which, frankly, is not what the bulls want if they’re looking for a low sooner than later. Lower prices are coming.

Someone asked me about old fashioned Dow Theory which basically say that the Dow Industrials which makes the goods and the Dow Transports which delivers the goods should be in sync to confirm rallies. If they diverge, that is a warning sign that something may be wrong in the economy.

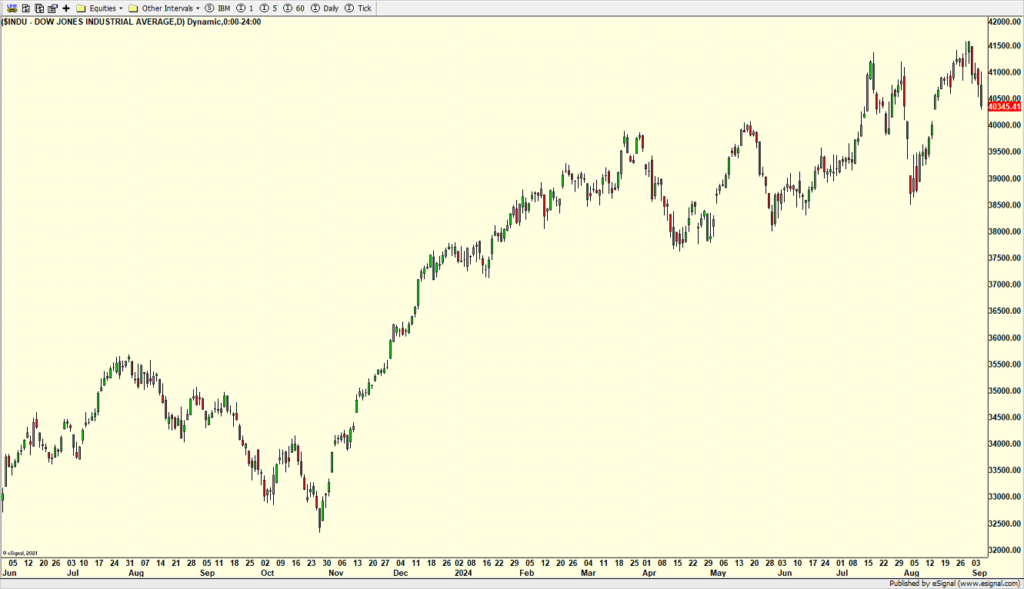

Below are the Dow Industrials. Nice price action going from lower left to upper right. All-time highs this month.

Now let’s look at the Dow Transports. They have not confirmed in over a year, signaling a Dow Theory non-confirmation or sell signal. What I cannot speak to is whether the modern economy impacts this old line thinking. I really don’t know.

Don’t for the delay in getting this out. I wrote most of it before sunrise, but then flew to FL and was without WiFi in the air. It was 49 with super low humidity when I left this morning. In FL, it is 93 with high humidity.

On Friday we sold IVW, FDX, FVD, SPYD, CWB and some PM.