Pullback Proceeding On Schedule – Time Is Needed

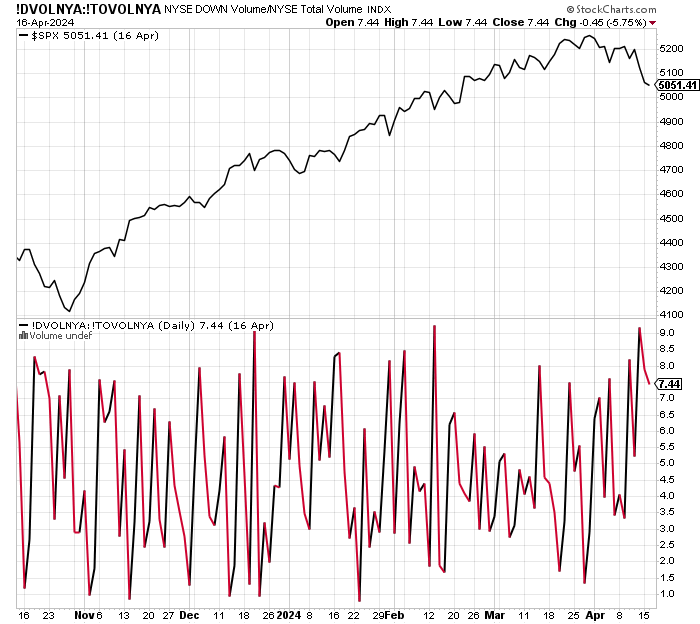

Monday saw the largest down day since the stock market peaked last month. There was widespread selling with 90% of the volume in stocks going down versus up. Below is a chart of the S&P 500 with the 90% volume below. Over the past 6 months, we have seen two instances like this with stocks bouncing and then pulling back before heading to new highs again.

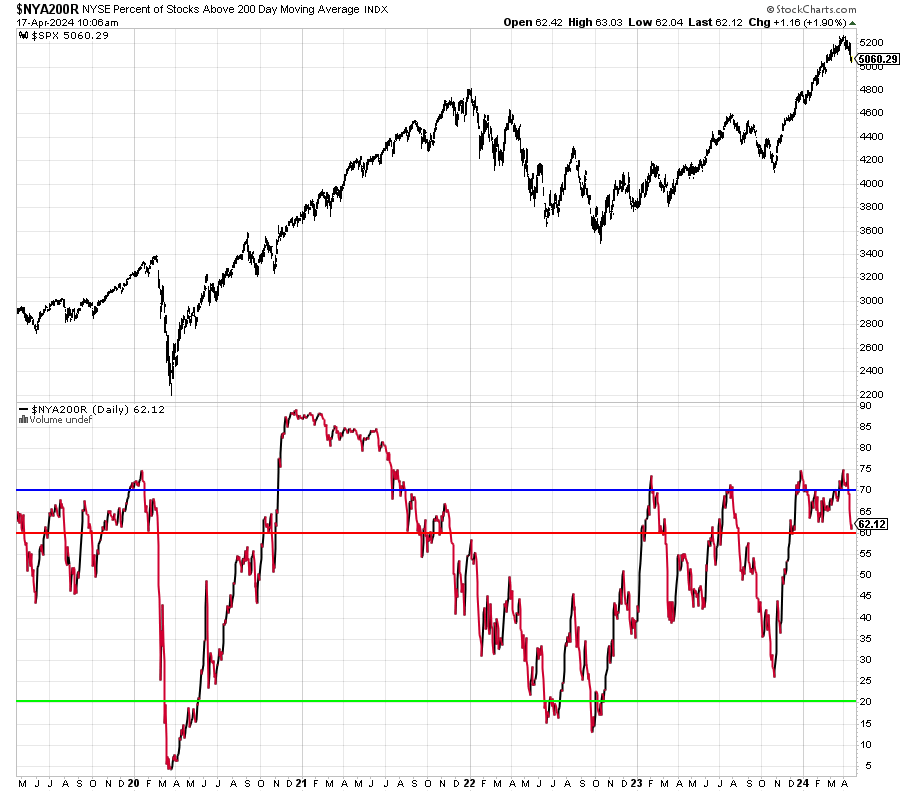

Further supporting my thesis is the chart below. At the recent peak there were more than 75% of stocks on the NYSE in uptrends. Bull markets do not end this way. They end when the indices make new highs and less than 60% of stocks are in uptrends.

The magnitude of the pullback is larger than we have seen, but I don’t think that really changes the outcome much. I was looking for a Q1 peak, followed by a decline of less than 10% that bottoms my Memorial Day. Nothing has changed in that thesis. Stocks should bounce. And they should have another decline, but that’s not necessary.

The challenge in my analysis for a low right here is that I don’t see much in the way of indices or sectors that I want to buy. More time needs to pass.

Walking into work this week, I saw all of the trees in full bloom. While that’s always beautiful, it’s also something that typically does not happen until early to mid May. Everything in CT seems to be about a month ahead of schedule.

On Monday we sold PHDAX. On Tuesday we bought more NET and more ZTS.