***Q2 Client Update***

Many people like to read my very “brief” quarterly client update which I select excerpts. If you’re one of them, please read on. If not, feel free to stop now. Always happy to hear comments and questions.

Let’s dive right in, be upfront and recognize that Q2 was a very challenging quarter in almost every asset class and across the spectrum with poor performance at a level not seen since Q1 2020. In fact, although the stock market did not see the magnitude of 2020’s plunge, the bond market experienced the single greatest decline as well as the longest decline in history. Combining the two markets together, the first 6 months of 2022 were the worst start to an investing year since 1970.

Economically, Q1 GDP growth was negative although I have stated that I thought it was an inventory anomaly and not something more sinister. Inflation continued to hit levels not seen since the greatest inflation fighter in history, Fed Chair Paul Volcker, was at the helm in 1981. Long-term interest rates soared from 1.5% to 3.5% and the Federal Reserve seemed hellbent on hiking short-term interest rates to match long-term ones.

Given all these negative facts, the on the surface conclusion must be that tougher times are ahead for stocks, bonds and the economy. But before you jump to that conclusion and prepare for the worst, the facts are not in evidence to lead to some version of Armageddon. Rather, let me offer without editorial what happened in the past.

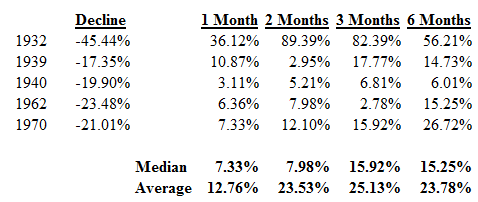

Since 1920 the stock market has been down at least 15% on June 30th exactly five times, 1932, 1939, 1940, 1962 and 1970. Contrary to popular belief, 2008 and 2002 did not qualify. Below you can see how the stocks performed over the ensuing number of months, powerful results.

For full transparency and to answer a question that I assume will be asked, 15%+ seemed like a strong line in the sand where things were so bad, they were actually about to become good. I say that because when I looked at June 30th performance between -10% and -15% the results were much less compelling.

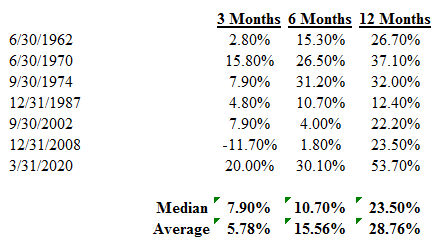

When I looked at times when the stock market was down at least 15% on a quarterly basis I only found 7 instances, 1962, 1970, 1974, 1987, 2002, 2008 and 2020. You can see the dates and how stocks performed over the ensuing number of months below.

Both studies lead to very positive conclusions for stocks. In my daily market diary, which sits in between my keyboard and my phone I literally have dozens of studies from May and June that largely conclude a stock market 20-30% a year later as hard to believe as that sounds.

Remember, greater than 20% declines are not seen that often. There have been 10 since 1950. Greater than 30% drops have only been seen 6 times. Buying into stock market declines of at least 19% over the years has been the single best buy signal I have found. While down 19% does not imply the ultimate impending bottom, the reward has been tremendous for investors. Of course, in 2008, 2002, 1974 and 1931 investors had to endure more significant pain, but even in those generational years, the coming rewards were historic.

And while we are on those four horrific years, 2008 in particular, let me state again that 2022 looks absolutely nothing like 2008. In 2022 bonds and the Japanese Yen plunged, inflation soared, and banks have record capital. In 2008 bonds and the Japanese Yen soared, inflation plunged, and banks had almost no capital.

2022 has seen a bear market in stocks and bonds, not because someone in academia proclaimed that some arbitrary level equates to a bear market, but because every rally has failed and induced more selling. That’s the best definition of any bear market. Rallies are immediately sold.

Pivoting back to the second quarter, it was full of non-market moving events. The mass shootings in the country not only continued but became more gruesome. The January 6th hearings in the House began. As an aside, I do not believe the Department of Justice will prosecute former President Donald Trump because of the proximity to the midterm elections and then the presidential one. That opinion has nothing to do with any evidence presented nor politics. If I am wrong, I also do not believe it will have any market nor economic impact.

On a lighter note, something we always need, Kansas won the NCAA men’s basketball tournament, Golden State won the NBA championship, Colorado took the Stanley Cup and Scottie Scheffler won The Masters. Judge Ketanji Brown Jackson was seated on the Supreme Court and perhaps the most impactful ruling in decades was handed down regarding Roe versus Wade. Q2 was busy and impactful away from the markets.

The war in Ukraine continued and my thesis remained the same. Regarding the markets, it had very little impact, including in the energy and agriculture space no matter what has been said an opined in the media and by pundits. Crude oil peaked on March 7th, exactly one day before I sent out a video showing evidence that the high was imminent. Heating oil did not follow until April 29th and gasoline not until June 6th. This lag was more about refining capacity than it was a supply shortage.

Ukraine may be referred to as the breadbasket of Europe, but wheat prices followed crude oil and peaked on March 8th, something few people either recognize or accept. You wouldn’t know it from listening to the media as those falling prices do not garner interest nor support the narrative. Remember, when commodity prices sharply rise or fall, it takes time for that to filter through the economy to the end user. While prices often rise faster than they fall to the consumer, there are always other factors involved, like labor, packaging and transportation.

All of that leads to one of the main themes of 2022 and for the past few years, inflation. Jay Powell, the Federal Reserve, Janet Yellen and the Treasury made one of the all-time colossal blunders when they labeled inflation as “transitory”. In other words, they collectively believed it would be temporary or not persistent. We can all argue whether they genuinely thought that or not, but it’s irrelevant. The Fed left interest rates too low and for too long and continued buying treasury and mortgage securities long after it was apparent that help was not needed. The government created and spent more money on additional relief long after the economy had turned the corner and was expanding. And the commodity boom went into overdrive.

Inflation is peaking for the cycle although the way it is calculated and what data drop off in Q3 may make it seem more troublesome than it is. Commodities have peaked and rolled over. Energy and food relief for consumers is on the way although it will take a few more months. Remember one key element of high prices. If they remain elevated but do not accelerate to the upside, there is no inflation, just high cost of living. Inflation is a series of higher prices, regardless of whether they are historically high or not.

In response to inflation the Federal Reserve has been hiking interest rates all year with another ¾% coming on July 27th. That will bring the Federal Funds Rate to a maximum of 2.5% this month. Since the Fed follows the two-year treasury note and that rate is now roughly 3%, the markets see the light at the end of tunnel. It is very possible that the upcoming ¾% raise will be the last ¾% one for this cycle. The Fed could decide to pause or hike in smaller increments in September. We will learn much about their future plans when they meet in Jackson Hole, WY August 25th-27th. I have a feeling that meeting results in fireworks.

Almost everyone credits Paul Volcker’s relentless rate hikes for stomping out inflation in the early 1980s. However, people forget that the U.S. dollar was strong and rising. That in itself is an inflation killer as a strong currency makes imported goods cheaper, i.e., lower prices. Today, we have the strongest dollar since 2002.

First look Q2 GDP is set to be released after I publish this. After Q1’s negative print and the chance for back to back negative quarters, the media and pundits will likely be warning of recession. As I mentioned on the blog and in two videos, only the Nation Bureau of Economic Research (NBER) officially declares recessions and I do not sense they are close to calling one now.

While there are a good number of warning signs of impending recession like the inverted yield curve, consumer confidence, consumer sentiment, leading economic indicators and housing starts and sales, let’s not forget that the economy created 372,000 new jobs in June with the unemployment rate near 50-year lows at 3.6%. Recessionistas claim that employment is the most lagging indicator and they are correct. However, it is still going to take some time to work off the strong labor market with wages increasing more than 5%. I came into 2022 calling for recession and I am sticking with that. If I am wrong, it will end up being that recession began late in the year.

As interest rates soared, the technology sector was especially hard hit, particularly in the April-May period. The market severely punished tech companies that were not profitable or grossly overvalued like Peloton, SNAP, DocuSign, PayPal Wayfair, Etsy and Zoom. In other words, the old stay at home stocks. As long-term yields peaked in early June these decimated stocks as well as tech in general saw a strong bounce. And yields likely hold the key to tech’s performance the rest of 2022.

Q2 earnings season is upon us and besides seeing beaten down share prices, analysts have finally started cutting earnings numbers. That additional hit to sentiment likely lets stocks bounce further in Q3. Markets will be squarely focused on if companies warn about Q3 and Q4 and what their outlooks are versus actual reported numbers. And you know one of my favorite adages; it’s not what the news is, but how markets react. Stocks that rally on bad news can usually be bought as share prices were washed out with the news already priced in. The opposite is true with good news.

We came into 2022 using 1994 and 2018 as good analogs to what may happen this year as both Feds were overly aggressive, and both were mid-term election years. The general themes remain in place and that could lead to a rip-roaring bullish year in 2023 if there is the elusive soft economic landing. Even with a mild recession, like 1980 or 2001, the stock market has largely discounted that and 2023 should still see a big year. Only a moderate recession would alter that magnitude although I still think 2023 could be up single digits.

In any forecast I create I always take a step back and figure out how I will be wrong. What could throw a monkey wrench in my scenario? In this case, if energy has not peaked and crude oil begins the march to $175 or $200 a barrel that would be damaging to the economy and markets. Also, in the face of a slowing economy, inflation has not seen its peak and continues to 10%+. While I do not rate those scenarios as likely, they remain possible.

At this point in the report, I usually write about my barbell strategy to investing. If you picture a barbell from the gym, there is a long, thin bar with big weights on both ends. Think of those weights as our conservative strategies and aggressive ones, the exact proportions do not matter yet. In theory, your money would have higher weights to conservative and aggressive strategies, especially if you are in or very close to retirement, and lower allocations to the middle of the road strategies. This barbell approach has also worked very well with monies being transferred in from 401K and 403b plans as those pre-packaged plans rely heavily on bonds for the more conservative approach and do not account for interest rates rising. Additionally, their aggressive choices do not usually reward the risk taken. If you would like to learn more about the barbell approach, we can set up a meeting, call, Skype or Zoom.

The first 6 months of 2022 have been the most challenging start to a year in the modern investing generation. However, stock and bond market performance following poor periods like this is much more sanguine and enjoyable. I continue to argue that 2022 is not a year like 2008, 2002 or 1974. I thought the year would be choppy, sloppy and require patience. I did not see the magnitude as great as it has been.

Looking ahead, the dog days of summer should be much kinder to the stock market, regardless of what lies ahead. The most likely path is for a rally into at least September before it will be time for stocks to put up or shut up. Between now and then the Federal Reserve is going to raise interest rates by ¾% and Q2 GDP will print plus or minus around the 0% line. Even if it is negative which is more likely and we hear the chorus of recession calls, only the National Bureau of Economic Research can officially declare start and end points for recessions and the data do not support recession right now.

And the employment market is too strong right now. It is going to take time to work off the 372,000 new jobs created in June, regardless of whether those jobs are just returning from the pandemic. If I was forced to offer a landscape for recession, I would say the look will be uneven like 2001 and 1980. Some sectors might not even feel weakness, like travel and leisure. Others like technology and housing will be hit the hardest. I won’t be surprised to see a few tech companies announce hiring freezes or even mild layoffs in Q3.

If Jay Powell and the Fed are able to engineer that rare unicorn of a soft landing, I expect the stock and bond bear markets to be over and Dow 40,000 to be seen in 2023. If the economy is in for a mild recession beginning in late 2022 or early 2023, the markets have already seen most or all of their downside. In that case, I would expect stocks to peak in Q3 with one more decline into Q4 or very early Q1 and then a 15-20% year in 2023. If I am totally wrong and there is a moderate recession the stock market would likely decline another 10-15% and bottom in Q1 2023 with the year still closing higher 5-10%.

In both recessionary scenarios, the bond market continues to rally, and I continue to like bonds at least through the end of 2022 as the U.S. economy slows, unemployment rises, and inflation rolls over for now. At the same time, the Fed pivots away from aggressive rate hikes, the U.S. dollar weakens, and gold sees a significant rally. In my mind I cannot see a path where Jay Powell is hauled before Congress as the economy loses 50,000 to 100,000 jobs in a month (if that’s the case) and holds his ground to fight inflation. There would be bipartisan hatred for Powell, and few will care about higher prices when the unemployment lines grow in Congressional districts.

It was so great seeing so many folks at our client appreciation event on June 14th with LPGA superstar, Christie Kerr, doing a live wine tasting right from an LPGA event. While the wine and food were excellent, the best part was seeing so many of you socializing after some long years of COVID. I loved seeing other folks join via Zoom as we did for previous events during the pandemic and we will continue to do in person and remote events in the future.

The office is fully back to normal regarding meetings although we will always offer Zoom, Skype and most other virtual meetings to suit our diverse and ever-growing client family. In the end, it does not matter to me how we meet as long as we do, in fact, meet for retirement projection updates, portfolio reviews and social security analysis’.

Please continue to share your feedback, positive and negative. Investing is a marathon not a sprint and the long-term future continues to look very, very bright. We look forward to sharing that with you over the coming years. Again, here is the link to my calendar to schedule a meeting in the office, call, Zoom meeting or Skype. https://schedulewithpaul.as.me/

Thank you for the privilege of serving as your investment adviser!

Sincerely,

Heritage Capital, LLC

Paul Schatz

President

Here is the link to our disclosure documents including our privacy policy as well as our ADV Part 2A & 2B. https://investfortomorrow.com/disclosures/

According to SEC and state regulations Heritage Capital, LLC will deliver Form ADV Part 2 to all clients within 60 days of its annual amendment filing date. Here is the link to our disclosure documents including our privacy policy as well as our ADV Part 2A & 2B. Additionally, we may engage unaffiliated investment advisers as sub advisers to assist us with management of client assets. Our services under the investment advisory contract do not include financial planning. https://investfortomorrow.com/disclosures/

Past performance may not be indicative of future results. The above individual account performance information reflects the reinvestment of dividends, and is net of applicable transaction fees, Heritage Capital’s investment management fee (if debited directly from the account), and any other related account expenses. Account information has been compiled solely by Heritage Capital, has not been independently verified, and does not reflect the impact of taxes on non-qualified accounts. In preparing this report, Heritage Capital has relied upon information provided by the account custodian. Please refer to formal tax documents received from the account custodian for cost basis and tax reporting purposes. Please remember to contact Heritage Capital, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you want to impose, add, or modify any reasonable restrictions to our investment advisory services. Please Note: Unless you advise, in writing, to the contrary, we will assume that there are no restrictions on our services, other than to manage the account in accordance with your designated investment objective. Please Also Note: Please compare this statement with account statements received from the account custodian. The account custodian does not verify the accuracy of the advisory fee calculation. A copy of our current written disclosure statement discussing our advisory services and fees continues to remain available upon request.