Renewed Tariff Tiff/Tantrum from Tweet

We woke up today to one of those infamous tweets from the President. Surprisingly, without notice, he began targeting China and a renewal of the tariff tiff or tariff tantrum. As you know, I am so firmly against tariffs as an economic weapon because no one ever wins. It’s just about losing less. In a perfect world, there shouldn’t be any tariffs at all and each country’s goods and services should stand on their own merit.

As I have said all along, I fully understand why Trump has been taking this course, but I don’t agree with it. And if we can’t make a deal with China, something that the administration has been feverishly working on for many months, it won’t be hard to imagine expanding this battle into Europe. That’s not good.

As you would expect, our stock market is set to open sharply lower on the heels of global markets falling low to mid single digits. One thing I said to a reporter early this morning, 500 Dow points at 26,500 is not what it used to mean at 20,000, 15,000 nor 10,000. We’re talking about 2% which historically is just one normal up or down day in the distribution of daily returns.

The question now is, will this become the beginning of a decline or a short-term wonder.

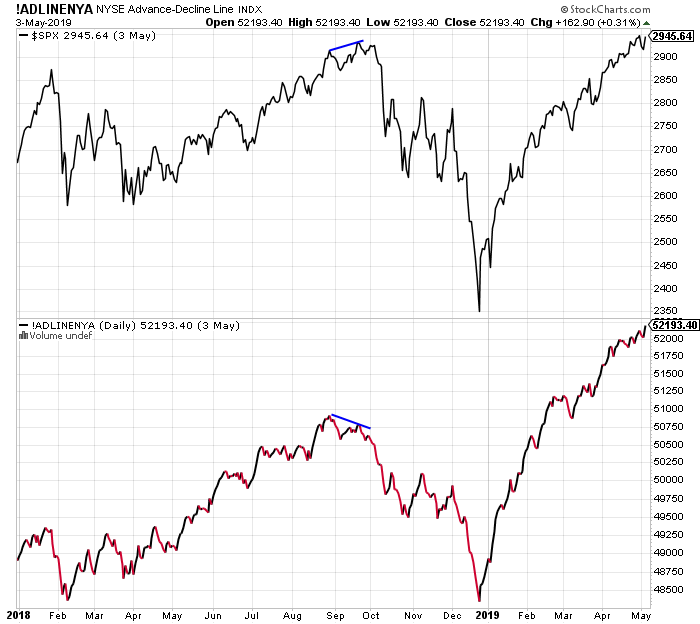

Last week, I commented that I thought stocks had begun a period of digestion or even a mild pullback. I still think that’s the case and not the beginning of a meaningful bout weakness. If the data change, so will I, but with so much internal strength leading up to the recent peak, the odds still favor more upside.

Let’s not forget that the S&P 500 scored a marginal new high last week and the NASDAQ 100 saw a decisive new high. Large declines typically do not begin from all-time highs. They usually take time to rollover by declining and rallying.

Sector leadership remains very solid and the New York Stock Exchange Advance/Decline Line just scored its own all-time high. High yield bonds were in blue skies territory last week. In other words, the canaries were all alive and singing. Bull markets do not end with such positive behavior.

After the big down open, you can expect a quick bounce before the rest of the day begins to shake out. It’s much more important where stocks close and how they close than what happens in the first hour of the day.