Risk On Rules – Late Comers Punished in Gold & Silver

FYI, the annual Medicare enrollment period is now open through December 7th.

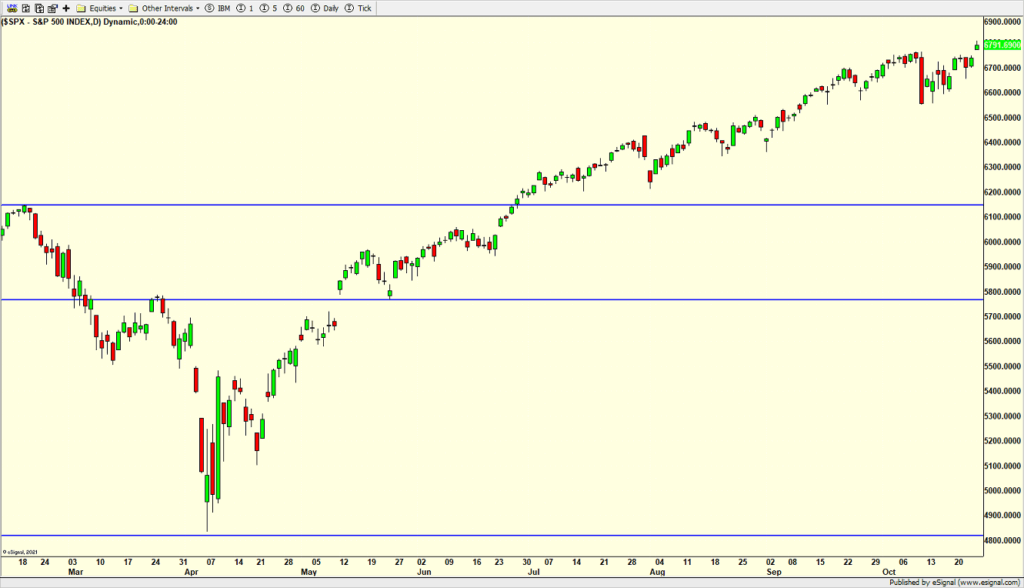

Friday was the fourth Friday of October if I read my calendar properly. Very strong seasonal tailwinds begin today with the stock market already at all-time highs. Additionally, this is the last week of October where more strong seasonal tailwinds begin.

I had thought the big down day with the long red candle a few weeks ago would not be the lowest low, meaning that I saw more downside coming after that. Clearly, that has not been the case and the great performance chase to year-end continued almost unabated which is fine by me. At some point all those people who sold in April and have been sitting under-invested or on the sidelines will use up their available buying power. But that doesn’t seem to be the case right now nor anytime soon. They remain stuck on the outside looking in for six months. As I have written too many times to count since mid-April, any and all weakness should be used as a buying opportunity until proven otherwise.

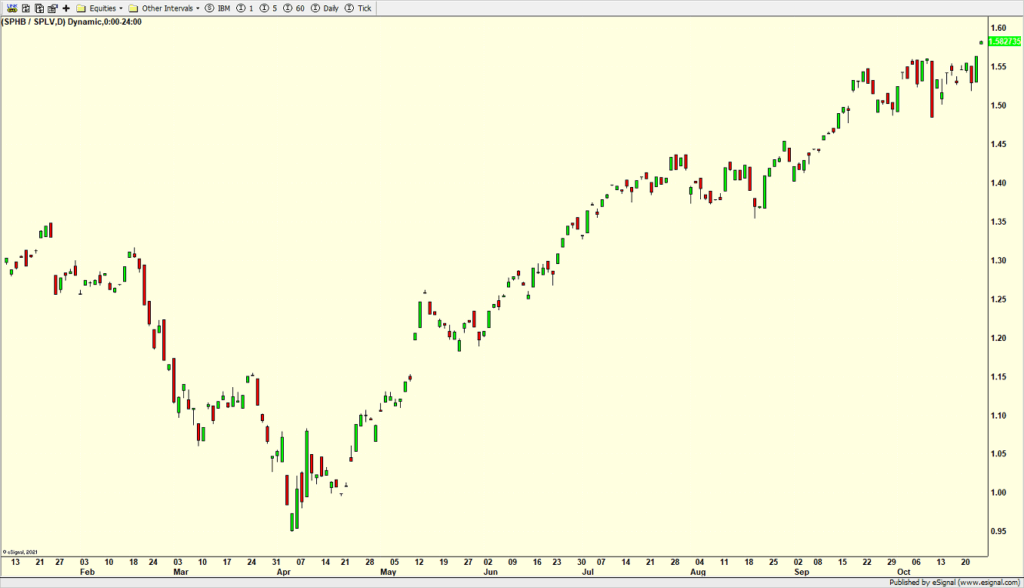

My friend, Ari Wald from CIBC Oppenheimer, often comments on the behavior of the high beta sector which are stocks that move more than the S&P 500 in both directions. It is a “risk on” play. Below is a chart of high beta versus low volatility. When the line is moving up from lower left to upper right, that tells us high beta is leading. High beta doesn’t lead right before bear markets. High beta doesn’t lead right before 10%+ corrections. High beta doesn’t lead right before recessions. High beta has rightly led since Q2.

Finally, I have written about the greed and euphoria in rare earths, gold and AI. I shared a few anecdotes of folks strongly advising me to buy silver and the metals just before the recent peak. As I have shared here, I have an almost impossible time to trying to buy things that have gone parabolic like gold and silver did. Buying the pullback is much more comfortable for me. At least then my risk is defined. Fools and their money are often parted. Late comers are almost always punished and this is a classic example.

On Friday we bought NJNK and more TLT.