Russell Catching Up – No Unicorns Nor Rainbows Elsewhere

The bulls completed last week with another bang. It was a good and fun week in bull land. The Russell 2000 small caps were the big stars. Recall that I offered them as well as the S&P 400 as good opportunities to play catch up. While it’s great to see, I have enough battle scars from chasing these guys to last a lifetime. So many times over the past decade, the Russell has quickly melted higher only to be hit with a sledgehammer as it tried to follow through. Buyer be a little aware.

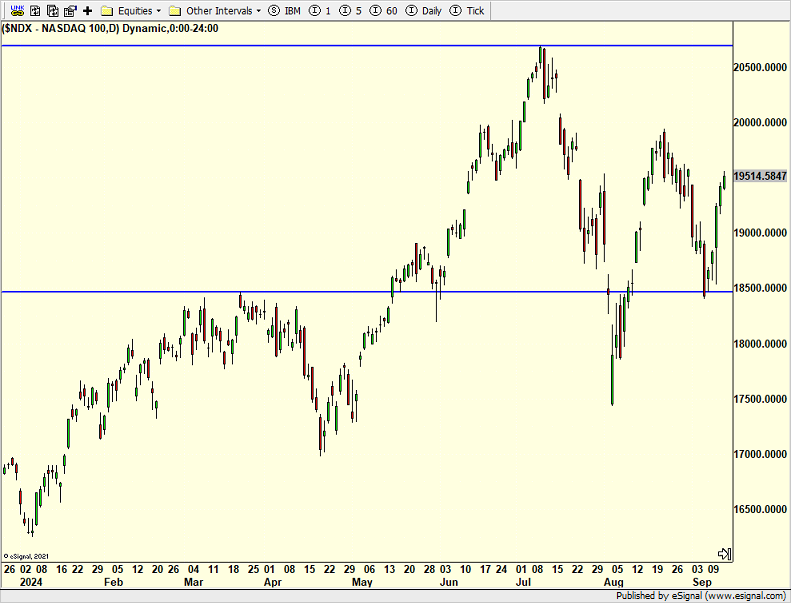

The NASDAQ 100 continued its bounce, but it is no longer the strong leader. In fact, two of our models actually went short the index (a play for lower prices) on Friday’s close along with the S&P 500. These are very short-term trades, but it does offer how much risk has increased.

The other thing I want you to notice is that the NASDAQ 100, Nvidia and Apple, to name a few, have essentially gone nowhere since June. For all the media hoopla and analyst chest beating, it hasn’t been all unicorns and rainbows.

On Friday we bought QID, SDS and more SRPT. We sold levered S&P 500 and some levered NDX.