Santa Is Coming To Town

The home stretch is here. I keep hearing that it’s been an unusual or odd year. I don’t really think so. We had the 10%+ correction by July 4th that I forecast. The recovery was way faster than I thought. And everything else just went on its merry way. I will have so much more to say about the year as well as my 2026 Fearless Forecast in the coming weeks.

The famed and popular Santa Claus Rally (SCR) begins at the close on Tuesday and ends at the close on January 5th. There is no debating this, contrary to what some pundits say. It is what it is. In short, stocks are supposed to rally. If they don’t, it’s warning sign for a challenging Q1 and/or Q2 2026. That case played out very well in 2025 with a 20% decline into the tariff tantrum.

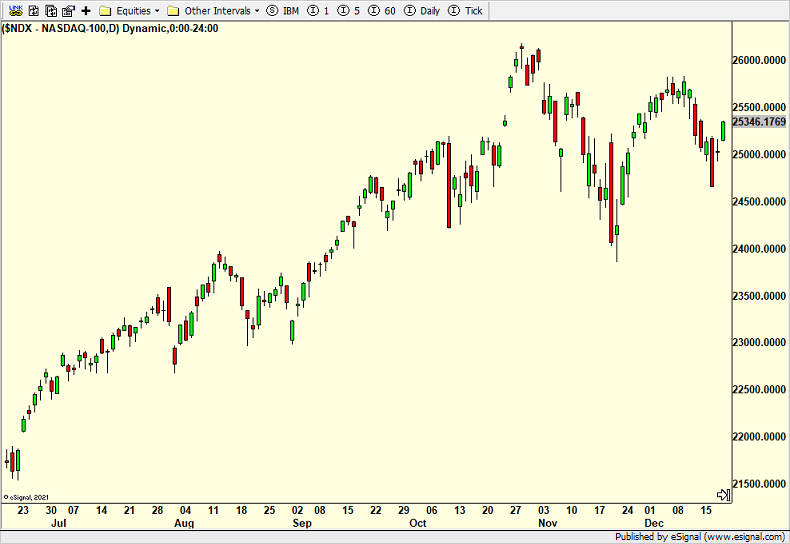

The stock market is on fine footing heading into 2026. We reviewed the Volatility Index last week and it remains a teenager which is good. The Dow Industrials, S&P 500, S&P 400 and Russell 2000 are all poised to see new highs shortly. The once leading, sexy and popular NASDAQ 100 is another story. Until it closes above 25,750 the index has to be labeled neutral.

On Friday we bought XLC, IYT, more TDAY, more TSPY and more JNK. We sold XLRE and some RSPU.