Sell The News, Buy The News, Scratch Your Head On The News

What a week it has been! And I am always happy to be home from the road even though the weather was sunny and pleasant down south.

Between the Fed, employment report and earnings from high profile names like Apple, Amazon, Google, Facebook and Microsoft, the markets have had a ton to digest. And with all that news you would think that there would have to have been a big move in the stock market. However, conventional wisdom would be wrong as you can see below.

The S&P 500 is less than 1% from where it was one week ago. Lots of fanfare. Not much progress. Today has a post-Fed study which says the S&P 500 has a 68% chance of being down.

I won’t rehash my reasons for taking some risk off the table, but the do remain. Again, I do not believe a big decline is coming. Markets may just move sideways and work off some of the issues. They also may pull back a few percent. This could be the very start of building the Q1 peak I am looking for or I could be totally wrong and stocks soar even more into orbit.

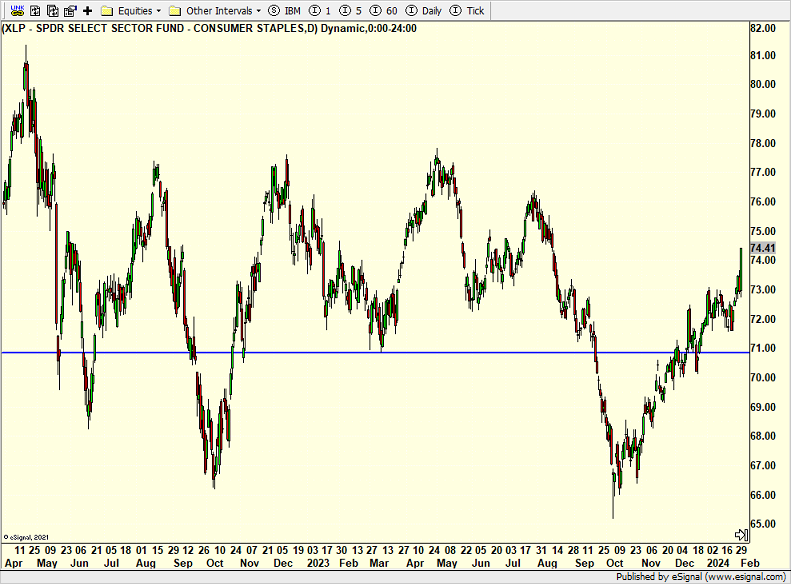

The New York Community Bank news is unsettling but certainly not unexpected. What concerns me is that consumer staples are finally rallying at the expense of the more “risk on” assets. It’s something to watch. Utilities are not rallying, at least not yet.

Stocks and sectors that sell off on good news concerns me. That’s my focus right now in the heart of earnings season.

Looks like a beautiful weekend up north with sunshine and temps in the teens and 20s. A far cry from the 70s earlier this week in the Sunshine State. I sense lots of turns on good, firm snow followed by comfort food and plenty of naps.

On Wednesday we bought levered S&P 500 and more levered NDX. We sold EPOL, FNCL and some ITB. On Thursday we bought RYPMX, PMPIX and FDLO. We sold levered S&P 500 and some IWO.