Semis Breaking Out But Some Concern Out There

Stocks begin the new week on decent footing yet I remain of the belief that strength is a better selling opportunity than a buying one for now. While the underpinnings are not suggestive of recession, bear market nor 10%+ stock market correction, I continue to see evidence that a mid single digit pullback may be in the cards over the next 6 weeks. It’s also the single weakest of the year based on history. This one single week performs more poorly than any other according to data miner Rob Hanna of Quantifiable Edges, always a great read.

From a price standpoint, the Dow and Russell 2000 are the leading indices, but the others are not far behind. I do expect every major index to see new highs by year-end. The tech-laden NASDAQ 100 which is totally dominated by the FAANG (Facebook, Amazon, Apple, Netflix and Google) stocks had been the market’s big leader, but ceded way this quarter. On the right side of the chart, you can see the index trading between those light blue lines. In other words, it’s becoming coiled up for a big move. At this point, the direction of that move is not clear although more than 50% of the time, it’s in the same direction as the previous trend.

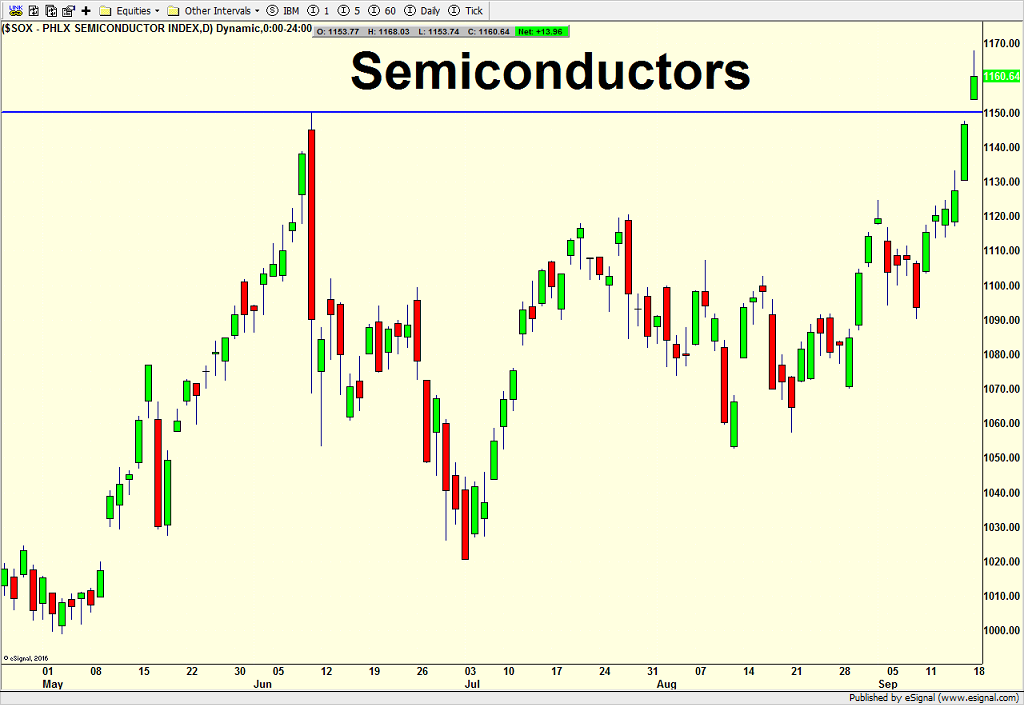

I have written much about the semis lately and how they have shouldered the leadership burden all quarter. Today, the group has broken out to new highs where the grouping of sell orders is more difficult. It will be very, very important to watch how this sector performs over the coming week. Giving much back in here will not bode well for stocks, especially tech.

If you would like to be notified by email when a new post is made here, please sign up HERE