Semis & Junk Bonds Say the Bears Are Wrong

After trying to score new recovery highs late last week, stocks are set to open modestly lower to begin the week full of earnings and the first FOMC meeting of the year. For now, I am sticking with the same theme from last week. The market is in pause or pullback mode. So far, stocks have done nothing wrong.

Leadership has been strong and constructive with all four key sectors contributing. I have to say; behavior in the semis is extreme right now. After the sector surged 6% last Thursday, Intel announced poor top line revenue yet the sector tacked on big gains on Friday. I haven’t seen this kind of action in a long time. And today, Nvidia also announced bad news, so we shall see what the bulls can do, if anything. Absence a lot of selling, the bulls would be firmly in control which portends good things for the tech and the market.

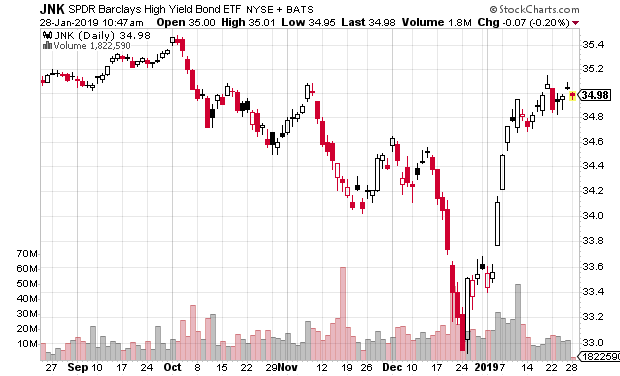

Finally, junk bonds have really come on strong and are trading at their highest levels since November, much stronger than the stock market. This is yet another sign that the bears are wrong over the intermediate-term. If the 20% decline in Q4 was just the beginning of the bear market, you would expect the credit markets to experience feeble bounces, not the powerful rallies we have seen in both high yield and bank loans since December 26.