Semis Strong, Shouldering the Burden. Other Sectors Stepping Up.

The stock market continues to quietly drift higher, at least on the surface. The Dow, S&P 500 and NASDAQ 100 have seen new highs this week while the S&P 400 and Russell 2000 look constructive but still well below their peaks. I do expect them to play catch up and see blue skies before any meaningful downside is seen.

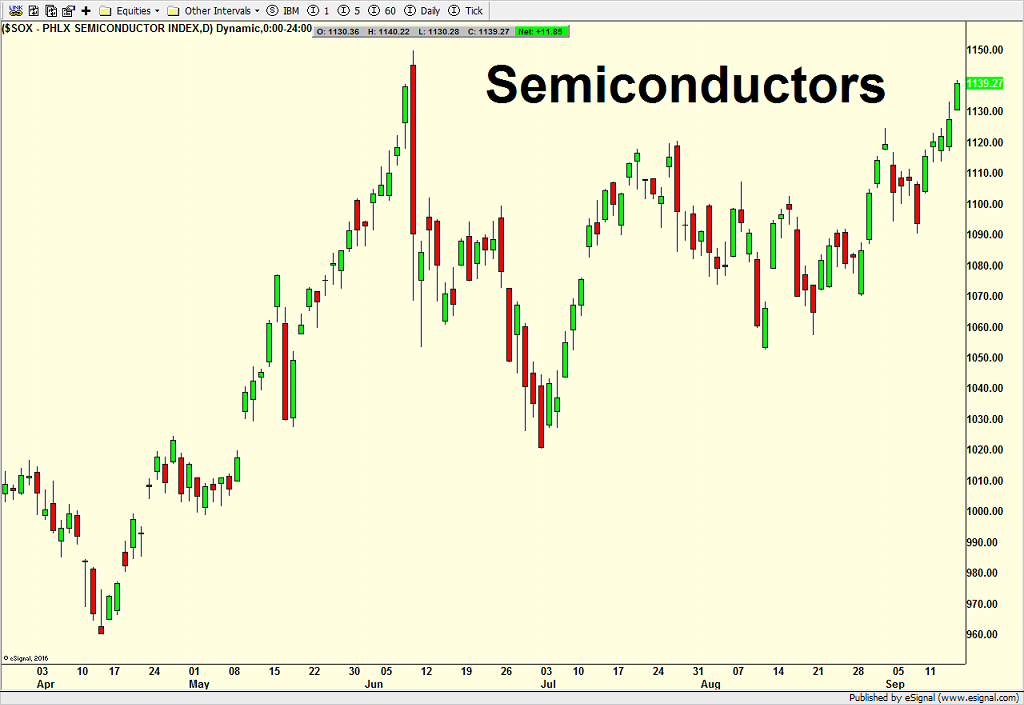

I wrote about the banks earlier this week as being a concern. Discretionary is a bit stronger but also not firing on all cylinders. Transports have rallied strongly and seem poised for new highs. Semis, as I wrote about before, have shouldered most of the leadership burden and are just shy of new highs. That’s been an impressive run and I don’t think it’s over.

Outside the key sector group, I see some really encouraging behavior by healthcare, biotech, industrials, materials and energy. While some analysts question market participation, this behavior counters that argument. Furthermore, although the percentage of stocks above their long-term trend (200 day moving average remains in a downtrend as you can see in the first chart, the second one is a longtime favorite, the NYSE Advance/Decline Line. For me, the latter is a better representation of what’s going on beneath the surface.

Here’s the bottom line. While the stock market is not without short-term concerns and I am still looking for some weakness next month, the majority of the key indicators are in good shape. Bull markets do not end with behavior like we are currently seeing.

If you would like to be notified by email when a new post is made here, please sign up HERE