Signs Point Higher this Week

After a solid end to September and Q3, stocks open the new day, week, month and quarter flirting with all-time highs. Of the major indices, only the NASDAQ 100 isn’t there, but I expect to see that achievement this week. When I think of October, Reggie Jackson’s three home run game in 1977 comes to mind along with Halloween, fall foliage and stock market crashes. As I already wrote about, while October is known for huge market swings, 2017 is on the atypical side with near record low volatility.

I updated my research regarding October and you can read about it HERE. Additionally, the always interesting Rob Hanna from Quantifiable Edges offered that when the S&P 500 closes the month at its highest close, the next 5 trading days are seasonally very strong with 21 wins and 7 losses since 1995. The average trade earned a stout 1%. This trend jibes very well with what I discovered about the first 5 days of October in an uptrend. I will be looking for a short-term peak next week.

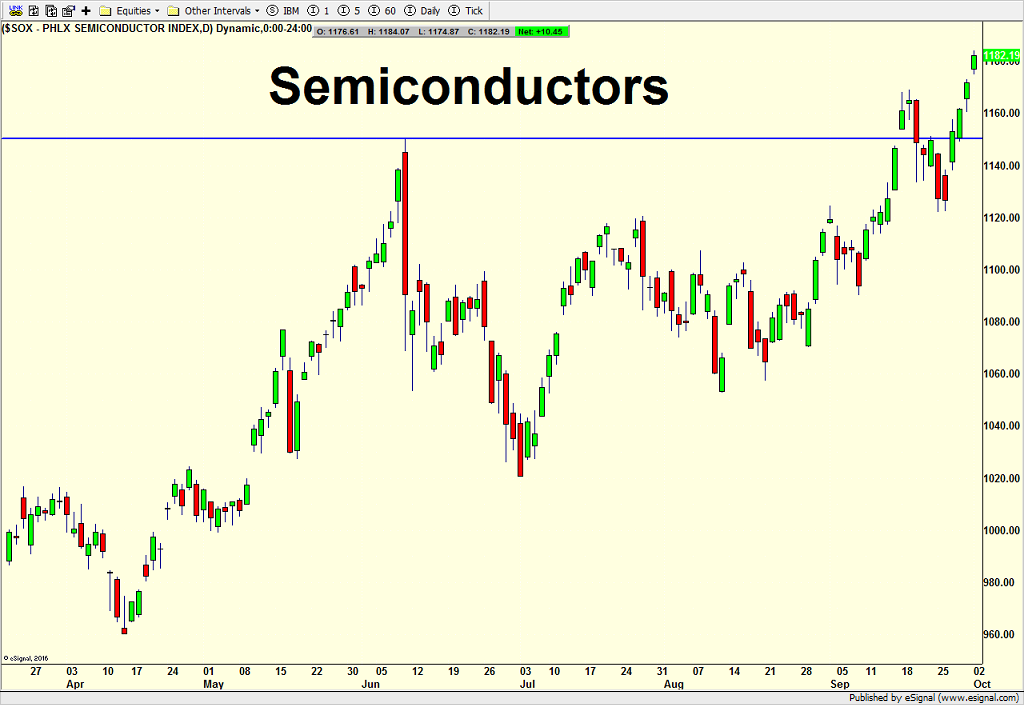

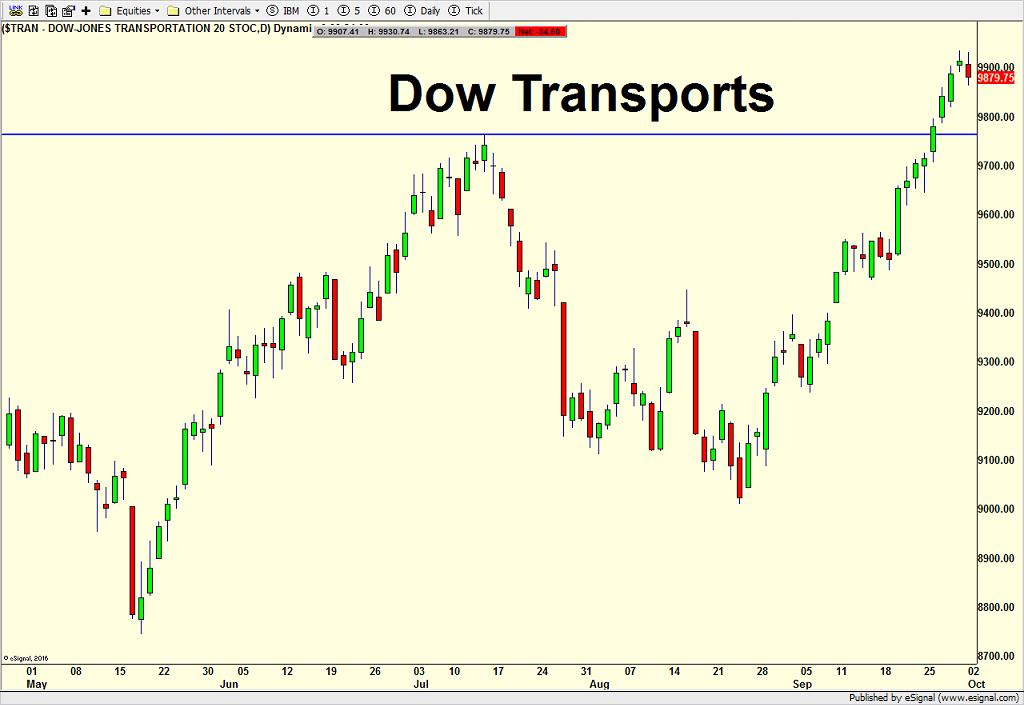

On the sector side, strong leadership continues to support buying any dip with semis, transports and banks all stepping up big time. Discretionary is fine, but I am beginning to see the early stages of intermediate-term underperformance. High yield bonds are behaving well and there is just no evidence that the 8+ year bull market is ending. Sorry bears…

If you would like to be notified by email when a new post is made here, please sign up HERE