Small Caps Breaking Out. Certain Sectors like Dotcom/Bitcoin

After finally seeing a down day, the bulls came right back to work on Thursday with a blistering effort and very strong internals. That trend looks likely to continue into the holiday weekend. The real star of the day was the Russell 2000 index of small cap companies which had generally been consolidating nicely before bursting higher. You can see the blue line below which shows a ceiling where price has stopped three times before, also known as a flat top. Once price breaks out above the flat top and closes above it, it is typically a very positive sign. Unless small caps fail right here and close back below the blue line next week, they should continue to move higher and lead.

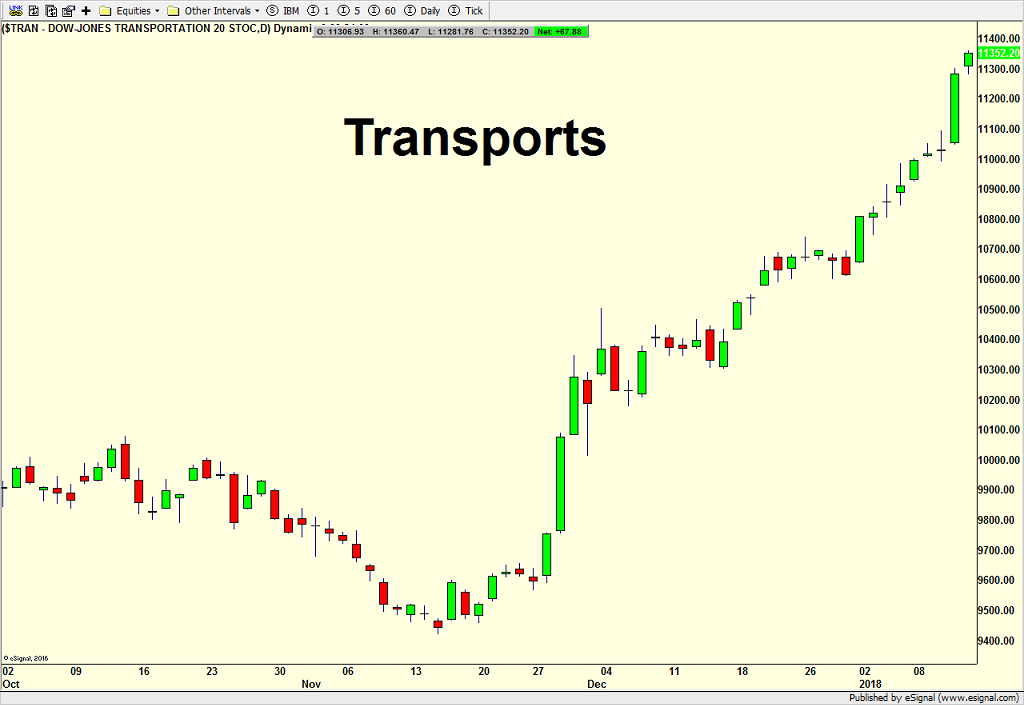

Looking like a Dotcom stock or Bitcoin, these two stodgy old sectors are in melt up phase. Both industrials and transports have been overpoweringly strong. I wrote about the bullish potential for transports near the bottom in November and they have exceeded my wildest upside projections so quickly.

Yes indeed. This is certainly a one of a kind bull market that won’t be repeated again anytime soon. I am just waiting to hear from folks that bear markets won’t happen again or stocks have a long way to go, although strategist Tom Lee did come out this morning and forecast another 300% to 500% left on the upside. SIGH…

If you would like to be notified by email when a new post is made here, please sign up HERE