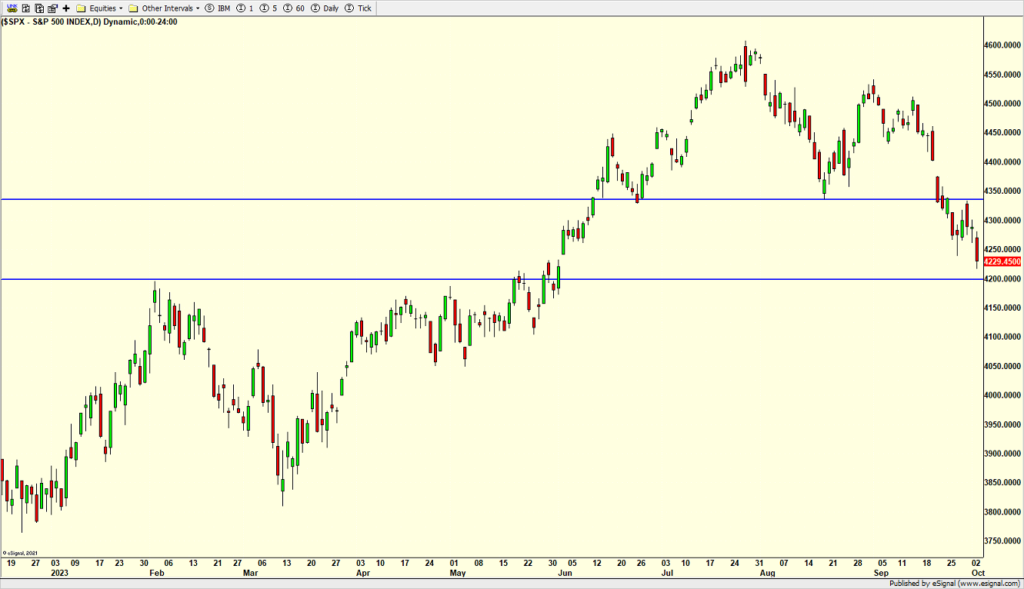

Something Breaking in The Markets – Still in The Zone & Getting Closer

Tuesday was not a pretty day in the markets, but it was really just more of the same. Bonds collapsed which means yields rose. Stocks fell. The dollar rallied. Rinse and repeat since mid-July. I can’t say it has been fun without many intervening rallies, but it also has not been disastrous, at least not yet. Stocks and risk assets remain under pressure to state the obvious. Both time and price are and have been in my zone for a low, but things are still lining up. And regardless, stocks are due to bounce, even after a putrid internal day like Tuesday where only 456 rallied while 2403 declines.

I am sure you’re tired of seeing the chart below which shows the price zone I have been looking for since August. Stocks are there. A bottom should be coming shortly.

Last week, I referenced the Volatility Index (VIX) needing to spike above 20. What did it do today? It calmly blipped above 20 and settled down. That is not the mini-panic I thought we would see with the S&P 500 under the most pressure since March when VIX was above 30.

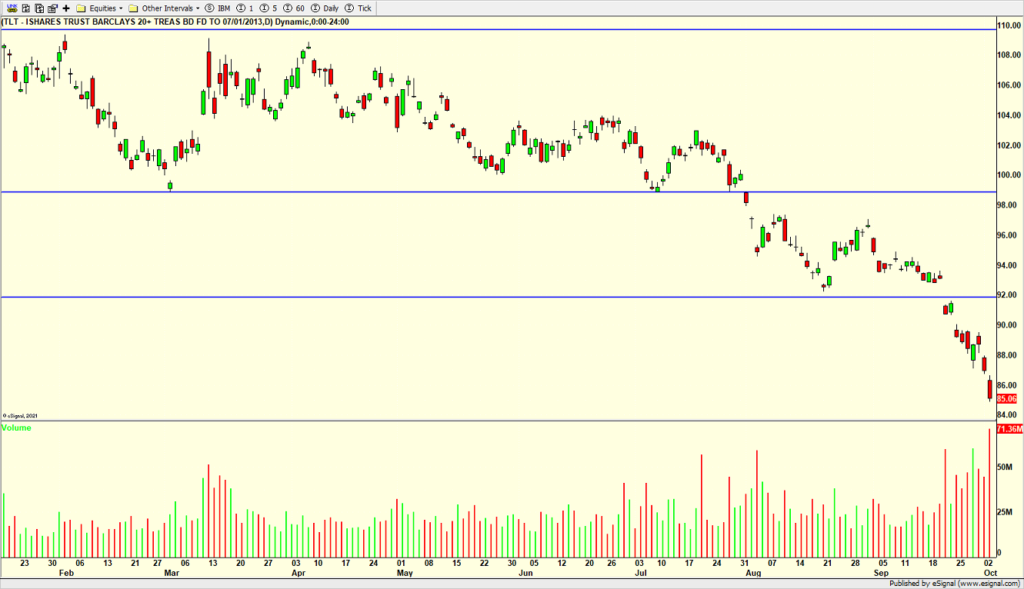

Let’s talk about the perceived culprit, bonds. Below is the popular TLT chart with volume at the bottom. Bonds have collapsed like we have seen only a few times in 100 years. That means long-term interest rates have risen. Look at the far left down below. 71 million shares of TLT traded today. That’s the most since the COVID Crash in March 2020. Bonds are in the zone for a low. It could today or tomorrow or next week, but it looks like it’s coming.

It also looks like something is breaking in the markets because of bonds.

Look what else is collapsing, utilities. Look at the volume in the most popular ETF, almost 58 million shares, the most since the COVID Crash. That, my friends, is panic is real time. Tuesday saw a reversal and I would not be surprised to see a vicious, short-term bounce in the utes to at least the $60 area.

And as we see during times of turmoil, investors are fleeing to the friendly confines of the U.S dollar.

Stocks should be very close to at least a strong bounce. Today and tomorrow are the most likely candidates to see the bulls attempt something. At the same time we should see bonds rally, utilities rally and the dollar decline.

On Monday we sold CYLRX and some levered NDX. On Tuesday we bought more ERX and more levered NDX. We sold ITA, ZEOIX and some IWF.