Sometimes Markets Are Annoyingly Frustrating

The stock market blasted off this week. While Monday was a sizable down day, it turned out to be a trap for the bears. OUCH! Tuesday through Thursday were very strong, triggering a number of longer-term thrusts. Thrusts? Picture a rocket taking off. The first 1000, 10,000 and 100,000 feet see the strongest acceleration. Then the power continues without less energy.

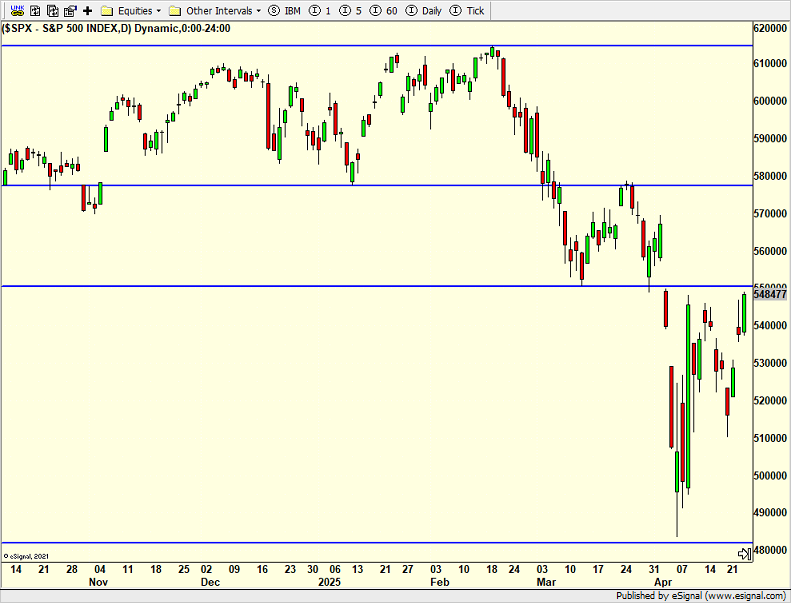

With stocks rallying so strongly, the bears seem to have disappeared. The same pundits who turned negative near the bottom have amnesia and believe they espoused buying at the lows. I thought the S&P 500 would bounce to the 5600 area before more selling came in. That’s still my take, but I am not arrogant enough nor dumb enough to believe I know better than the market. In any case, I still do not believe stocks are just going to race higher above 6000. The market needs more time to heal and rebuild.

And I am also watching our models give contradictory signals which is frustrating. Our non-leveraged strategies have all turned positive over the last three weeks. That was good timing. Our aggressive models have been all over the place with one being short the stock market during yesterday’s large rally. That was certainly not fun, but very much in line with how it behaved during bottom formations in 2022 and 2020.

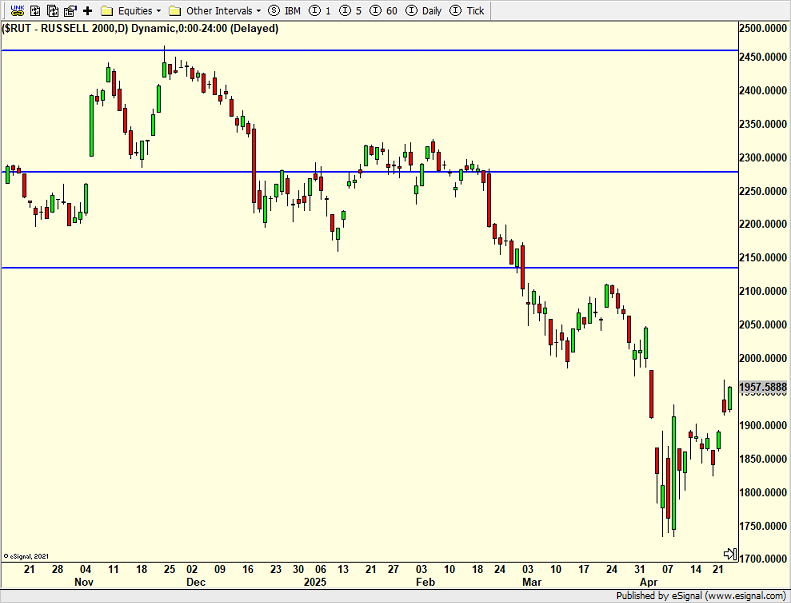

I wanted to throw up the Russell 2000 below. You can see how much weaker it looks over the past 6 months, right? However, it is also been the leading index since the April 7th low.

Our portfolios continue to rebalance. Lots of activity, some annoyingly frustrating when you watch hour to hour and day to day performance. But this is what happens as markets hammer in lows. That’s also why we invest for the long-term. Let me deal with the short-term machinations. Assuming there is a trading peak in the next week or so, I would expect emerging leadership to be apparent on the next pullback.

On Wednesday we bought EPOL, TWM, QID, PCY and OTIS. We sold EIS, UWM, QLD and SDS. On Thursday we bought EEM and more QQQ. We sold RYILX and some TLT.