***Special Fed Day Update – Powell & Company Wrong Again – Stocks Heading To New Highs***

After four crummy weather days, Mother Nature is apparently going to offer some sun and warmth in Southern CA, not that I have been outside since Sunday. The conference ends today and it’s been a tiring week so far, chairing the conference committee and keeping everything running smoothly and on time. I am looking forward to a half day free tomorrow morning before flying home.

It’s FOMC day for the Fed. The stock market model is plus or minus 0.50% until 2pm and then a rally. Given the last two days of decline, the model is further reinforced and has higher confidence of the post-2pm outcome.

Jay Powell & Company are going to stand pat today, another grossly wrong decision. The bogeyman they have been fighting has long been dead. Of course, that is inflation. Sure, we will see a warmer month here or month there, but the trend is beautifully lower. And as the economy continues to weaken, so will inflation. I am not in the stagflation camp. I am more concerned about mild deflation if GDP stay negative or hovers around the 0% line.

Again, as I have written about, the Fed should have cut rates 0.25% in March and then again in June. They are woefully and habitually late at almost every juncture. I would to think that replacing Jay Powell would solve the problem, but the next person isn’t likely to be much better. From Greenspan to Bernanke to Yellen to Powell, for the supposed smartest bankers on earth, they certainly do make a lot of really dumb decisions. Of that group, Ben Bernanke was definitely my favorite.

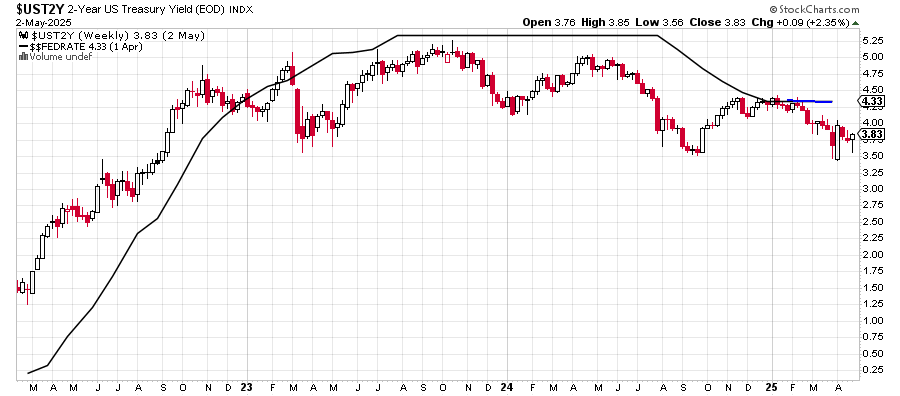

If the Fed just followed the 2-Year Treasury Note below with some smoothing constant, they would do a much better job of managing rates. Right now, the market is telling the Fed that 2 rate cuts are needed. I sense the 2-Year will ask for more as the year progresses. The longer the Fed remains behind the curve, the worse it will be for the economy.

The best outcome for today’s meeting is that Jay Powell floats the trial balloon about a possible rate cut in June. After announcing reductions in balance sheet sales, it’s probably too soon to eliminate them. Personally, I would rather cut rates more aggressively while still reducing the balance sheet, but that’s just me.

The stock market has been on a tear until the last two days, carrying further than I thought before a pullback. While some bears have thrown in the towel and now try to revise history, others have doubled and tripled down that the strength is just a bear market bounce and new lows are coming soon. From my seat, facts not in evidence.

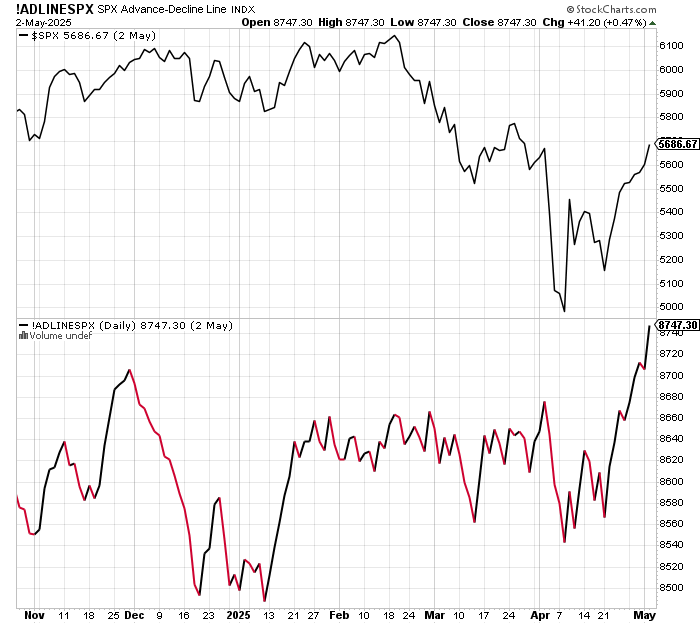

The first chart below is the cumulative advance/decline line of the S&P 500 which is just a fancy name for tallying all of the stocks going up and down on a daily basis and keeping a running total. The S&P 500 is in the upper chart in black. It is still well below its all-time high.

Notice anything about the lower chart, the S&P 500 A/D Line?

It is at an ALL-TIME HIGH. And the bears want to spin the narrative that this is a bear market? Um, tough one folks.

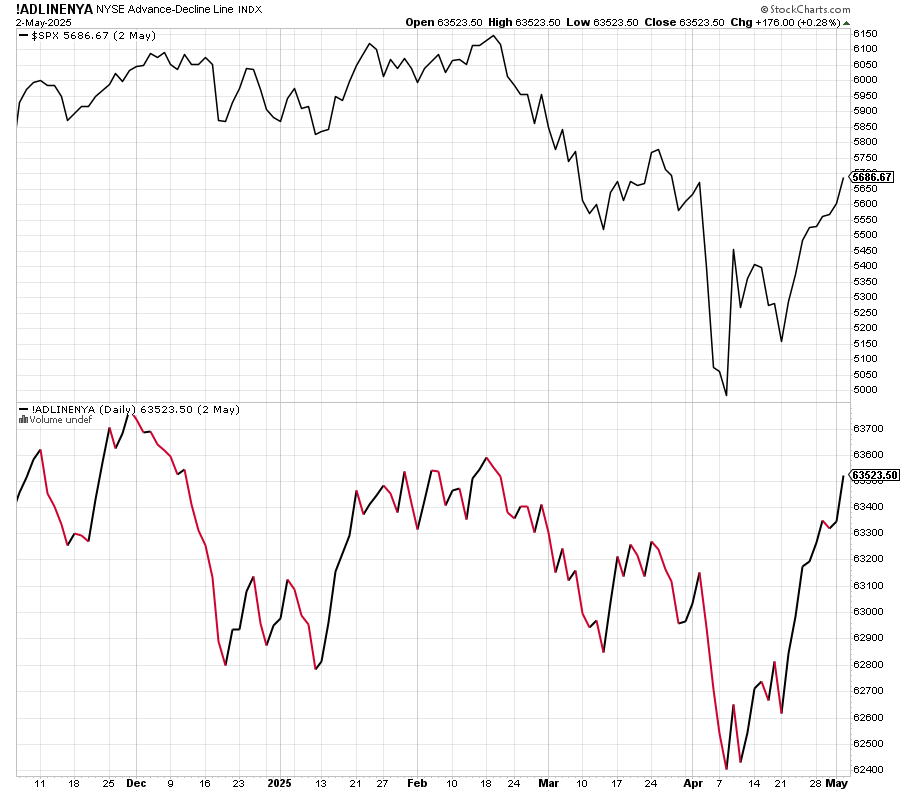

If I was playing the part of a bear stuck with a bad portfolio or narrative, I would point to the NYSE Advance/Decline Line below. While it’s stronger than the S&P 500 prices action, it is still not at new highs, at least not yet. I do think that’s coming as the weather warms.

Neither chart suggests an ongoing bear market, not that one could not develop. Again, as I have mentioned a number of times, the preponderance of our research suggests new highs in Q1 2026 with an S&P 500 in the mid 6000s.

On Monday we bought GDX and RAIL. We sold SDS. On Tuesday we bought QLD and more MQQQ. We sold QID.