SPECIAL Fed Day Update – Powell Has Cover to Cut

BREAKING NEWS: Fed Leaves Interest Rates Alone – No Change in Balance Sheet Reduction

Now you don’t have to wait until 2pm to learn the news that everyone knows already. Powell’s press conference may be a different story.

Let’s start with the model for the day which is plus or minus 0.50% for the S&P 500 and then a big move after 2pm. Pre-Powell, that move was higher. Jay hasn’t been as kind to the market as his predecessors. With pre-market action indicating a down opening, there may be opportunities for those who trade intra-day. Other than that, once again, the massive rally into the meeting has muted most of the tried and true trends and studies that I often look at every 6 weeks. Depending on the action this afternoon, there may be an opportunity for stocks to move lower in the days ahead.

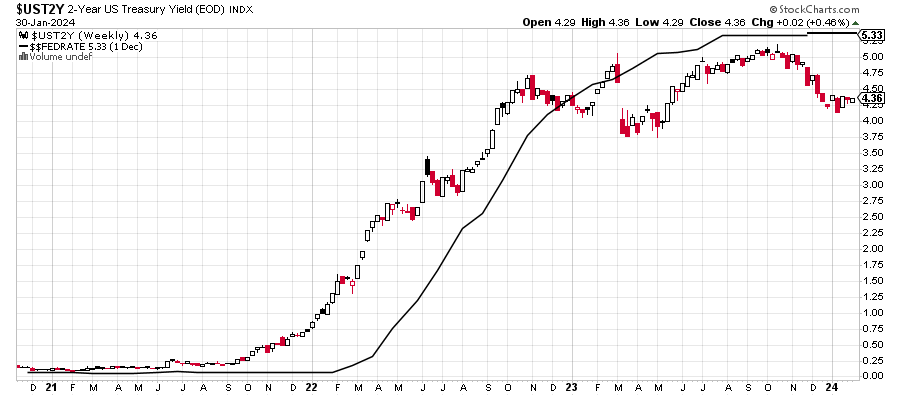

Turning to my favorite Fed related chart (with h/t to my friend Tom McClellan of Oscillator fame), we see that the solid black line continues to go sideways. That is the interest rate controlled by the Fed, otherwise known as the Fed Funds Rate. The current range remains 5.25% to 5.50%. The red, white and black chart is that of the 2-Year Treasury Note which the open market controls. The 2-Year has always done a much better job than the Fed and Jay Powell & Company have always been served best to follow that rate. But they haven’t, to their detriment.

A year ago, I discussed an important shift in the relationship when the 2-Year crossed below the Fed Funds. That was the warning shot across the bow that the Fed’s work should be coming to an end. Since then, we have largely seen sideways activity with the 2-Year in the same spot from Q4 2022. Today, we see the 2-Year a full 1% below where the Fed has set their rate. That doesn’t mean the Fed should cut rates by 1% immediately. It just means that in the here and now, the market is telling the Fed where to go over the coming months.

And they have the cover.

Below is a chart of crude oil. No one on earth could argue that it’s inflationary. The best bullish case you can make is that it has been consolidating for more than a year, preparing for its next bull market. That is a plausible scenario.

Finally, we have the U.S. Dollar Index. Similar to crude oil, the greenback has gone up and down over the past year without any upside headway. It’s hardly signaling inflation.

Personally, I would be fine if the Fed did a token 1/4% rate cut before summer and took a wait and see approach. While they have won the short-term battle on inflation, I sense that more may be coming in 2025 or 2026. I think it was completely idiotic for pundits to argue for 6-7 rate cuts in 2024 without an unfolding crisis. Folks, if Jay Powell cuts rates 6 times this year, there will be an emerging economic catastrophe.

Quickly on the stock market, last week I wrote about the greed, froth and giddiness in the market. I argued it was a good time to prune portfolios that have enjoyed the incredible Q4 run as well as 2023 surge. So far, we have only seen some indices, sectors and stocks pause with very minor downside. Lots of good earnings reports last night, but indications are that investors are selling the news. It is going to be a fun day and rest of the week. Buckle up!

On Monday we bought PCY and more levered NDX. On Tuesday we sold RYPMX, PMPIX and some levered NDX.