***Special Fed Meeting Update – Still Asleep And Fighting Wrong Battle***

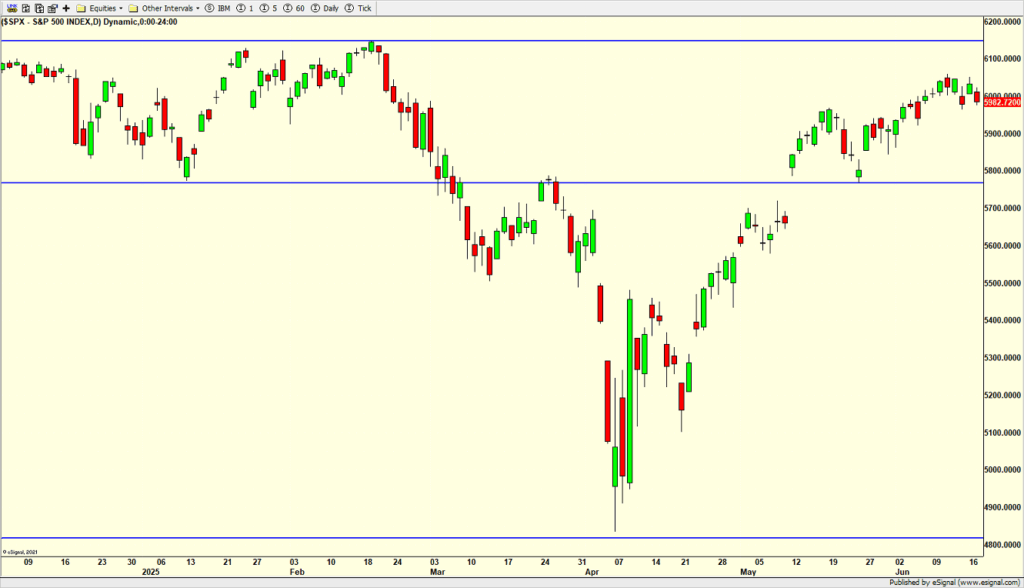

It’s FOMC (Fed) day. The stock market model calls for plus or minus 0.50% until 2pm and then a rally. The likelihood of success has risen because of the recent weakness. And there is also a potential set up for weakness depending on how stocks react.

Jay Powell and the FOMC should reduce interest rates by 1/4%. I said the same thing in March as well as May. Just like they were embarrassingly wrong in waiting to hike rates when the inflation Genie was out of the bottle in last 2020, the same is true today but in the opposite. Inflation is and has been dead.

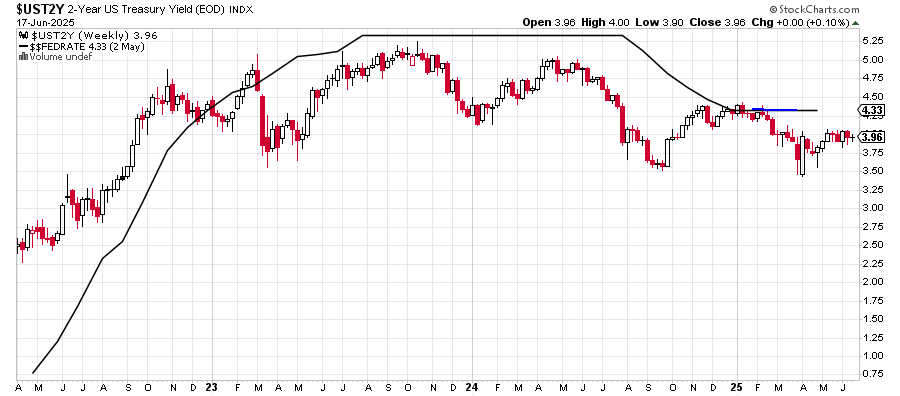

Frankly, we don’t even need the FOMC to set short-term interest rates. The 2-Year T Note does just fine and in many instances, a better job. The chart below is a familiar one. It’s the 2-Year in red, white and back versus the Fed Funds Rate in the solid, black line. The 2-Year says the market wants 1-2 rate cuts in the here and now. It is going to have to wait until the supposed brightest bankers on earth take their sweet time and watch the employment picture weaken.

Today, Jay Powell is going to leave rates as is and likely offer some dovish comments. That should be enough to ignite a little rally in the stocks. If that happens, bonds should firm and we should focus on how the cyclical versus defensive sectors behave.

The stock market has been digesting recent gains, but refusing to really pull back much against the exaggerated claims of WWIII having begun. I would like to see a 2-4% pullback, but the market may not cooperate. 2-4% should eliminate some of the froth of those who came to the party so late. You know the ones. Many sold right into the tariff tantrum plunge and have been in chase mode ever since, finally throwing in the bearish towel a few weeks ago.

Six month ago our 2025 Fearless Forecast called for a year with spiking volatility, a 10%+ correction by July 4th and a year that ended up mid-single digits. In April I added that fresh, all-time highs should be seen in late Q4. That’s likely going to occur in Q3. I am sticking with all that until proven otherwise.

On Monday we sold SSO, some ITA and some SPLV.