***Special Fed Meeting Update & The Continuous Loss of Credibility and Clue***

Six weeks later and it’s Groundhog Day all over again! Or is that deja vu all over again?!?! It matters not. I began my Fed day comments with this in April.

“The Federal Reserve Open Market Committee concludes their two day meeting with an announcement at 2 pm that interest rates will not change today. That’s what the markets are expecting. There has been all kinds of hot air coming from several Fed officials that rates need to rise now, but Chair Janet Yellen has been on the other side, sticking with her more accommodative stance. It would be very hard to believe that the majority of voting members would overtly vote against their chair.”

Before I get into the meat of this issue, I want to mention three independent studies surrounding FOMC meetings. All three short-term studies conclude that stocks are supposed to rally here. One is a one day trade. One is a two day trade and one is a three day trade. Their accuracy has been 70-90%.

They were out of their collective minds and the word “quack” now comes to mind.

With the blink of an eye, one weak employment report and a June rate hike is all but off the table. And almost as fast, those same pundits and analysts are now forecasting with certainty that the Fed will stand pat at 2 pm on Wednesday. Did they forget about the vote across the pond on June 23 for the UK to exit the Euro? There was no way Janet Yellen was going to raise interest rates before then.

How fast can you say, total lack of credibility???

This is not new news for you, my loyal readers, nor is it new for anyone paying even the slightest attention to the real world. For years, I was convinced that the economy and markets could not handle higher rates. I am still not convinced. However, over the past year and a half, a few new reasons became clear.

WHY???

Why does this matter?

Let’s say the Fed raised interest rates next month. Would you rather own the dollar where rates are increasing or the Euro where rates are becoming more and more negative each month? Where would your money be treated best?

You can make the same argument in Japan. The Japanese will continue to print and print and print, buy and own almost 100% of their government bond market and force rates well below 0%. Money flows where it’s treated best.

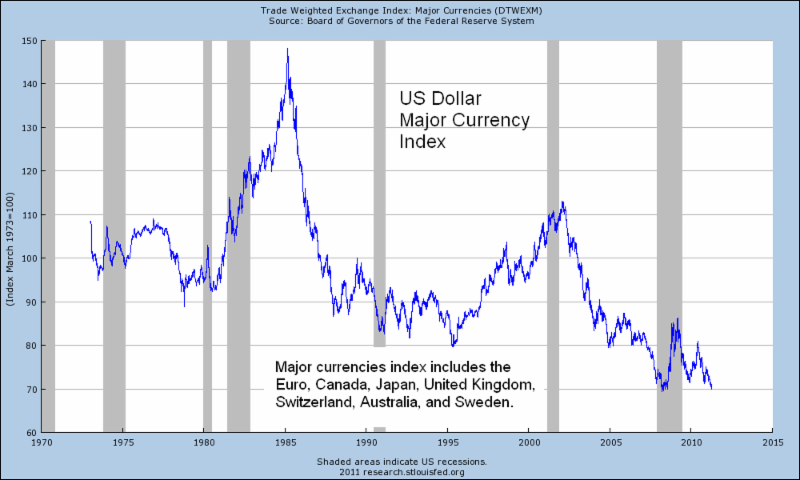

The real concern comes once the dollar scores fresh highs and stays there for at least a few weeks. The scenario would quickly turn to the playbook from the mid 1980s but on a much grander scale. I contend as I have since early 2008 that the U.S. Dollar is in a secular (long-term) bull market that will carry the index well above 100 with the Euro first falling below par (100) on the way to collapsing to all-time lows below 80.

Dow Above 20,000

If I am right, we will see massive capital flows from Europe and Asia into the dollar sometime in 2017 or 2018 that will feed on themselves. After dollars are bought, money will flow into treasury bills and notes for those seeking safety. However, similar to the 1980s, I see hundreds of billions and ultimately more than a trillion dollars making its way into blue chip stocks. That’s where my long standing forecast of Dow 20,000 and above come into play. Investors will be partying like it’s 1985 – 1986 again.

Ultimately, as with any and all gargantuan capital flows, severe global market dislocations will appear and we all know how poorly they end. The crash of 1987 was how the 80s dollar boom ended.

Besides the dollar and the upcoming vote by the UK to leave the Euro, few seem to be talking about China. Forgetting about their weakening economy and real estate woes, let’s not forget that the Bank of China responded very decisively to the Fed’s December rate hike by devaluing their currency several times in January and February, adding further stress to the global markets.

I am all the way to the end and it’s time to hit the send button without diving into stock market leadership which has been solidly defensive of late. Both utilities and consumer staples (for full disclosure we own them) recently hit all-time highs as bonds prices rallied. Dividend paying blue chip stocks are in high demand as replacements for “safer” fixed income.

As I write about all the time on www.investfortomorrowblog.com, I care much more about the markets’ reaction to the news over what the news actually is. Keep a close eye on what leads and lags from 2:30 to 4 pm today. For the shortest and most nimble traders, selling long-term bonds, utilities and staples on the Fed announcement may be a good play.

If you would like to be notified by email when a new post is made here, please sign up HERE.